- United States

- /

- Banks

- /

- NasdaqGS:WSBC

Should WesBanco’s (WSBC) Preferred Stock Shift Reshape Its Capital Strategy?

Reviewed by Sasha Jovanovic

- WesBanco, Inc. announced it redeemed all 150,000 shares of its 6.75% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series A, and the 6,000,000 related depositary shares on November 15, 2025, for a redemption price of US$1,000 per Series A share or US$25.00 per depositary share.

- This redemption, funded by the recent Series B preferred stock offering, marks a significant change in WesBanco's capital structure and preferred shareholder base.

- We'll examine how replacing Series A with higher-yielding Series B preferred stock may influence WesBanco's future earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WesBanco Investment Narrative Recap

WesBanco’s investment case centers on steady loan and deposit growth in attractive regional markets, disciplined credit management, and robust expansion into fee-based products. The redemption of Series A preferred shares, funded by a higher-yielding Series B offering, adjusts the company’s capital structure but does not materially affect the key short-term catalyst, organic growth from new markets, or the primary risk of exposure to commercial real estate payoff and refinancing challenges.

Of the recent announcements, WesBanco’s entry into Tennessee via new loan production offices is most relevant to the ongoing organic growth catalyst. This move expands the bank’s footprint into higher-growth areas, which could support the sustained loan and revenue growth that underpin positive earnings expectations, independent of the recent preferred stock redemption.

However, investors should also be aware that despite these steps, market softness or elevated payoff rates in commercial real estate could still...

Read the full narrative on WesBanco (it's free!)

WesBanco's outlook anticipates $1.7 billion in revenue and $821.3 million in earnings by 2028. This requires a 35.2% annual revenue growth rate and an increase in earnings of $696.1 million from the current $125.2 million.

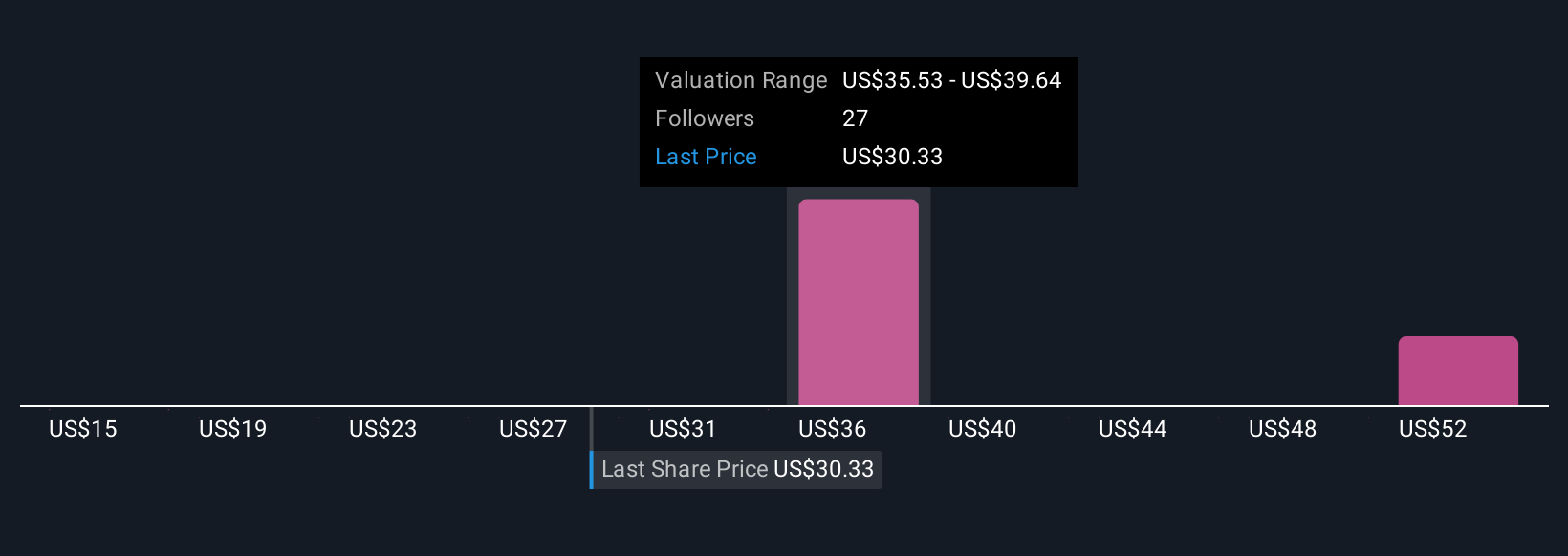

Uncover how WesBanco's forecasts yield a $37.43 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided five fair value estimates for WesBanco, ranging from US$14.98 to US$56.24 per share. While opinions differ widely, the outlook for expanding into faster-growing regions remains a key theme for understanding potential performance.

Explore 5 other fair value estimates on WesBanco - why the stock might be worth less than half the current price!

Build Your Own WesBanco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WesBanco research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WesBanco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WesBanco's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WesBanco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WSBC

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives