- United States

- /

- Banks

- /

- NasdaqGS:WAFD

Is WaFd’s (WAFD) Dividend Policy a Sign of Strategic Strength—or Missed Growth Potential?

Reviewed by Sasha Jovanovic

- On November 11, 2025, WaFd, Inc.'s Board of Directors declared a cash dividend of US$12.19 per share on its 4.875% Fixed Rate Series A Non-Cumulative Perpetual Preferred Stock, payable January 15, 2026, to shareholders as of December 31, 2025.

- This announcement highlights WaFd's continued focus on rewarding shareholders through preferred and common stock dividends with a consistent history of increases.

- We'll explore how WaFd's commitment to ongoing dividend growth shapes its investment narrative for income-focused investors.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is WaFd's Investment Narrative?

For anyone considering WaFd as a potential holding, the overarching belief centers on the consistency and reliability of its shareholder returns, especially via dividends. The most recent preferred dividend announcement, alongside a continuing common dividend streak, reaffirms WaFd’s focus on rewarding both income-seeking and preferred shareholders. Short-term catalysts still largely hinge on earnings stabilization and margin management, as recent quarters show some swings in net interest income and net income. While the latest dividend news is encouraging and in line with prior practice, it is unlikely to significantly shift near-term catalysts or risks, given that payout stability was expected and already reflected in WaFd’s steady pricing and analyst valuations. For now, the main risks remain slower forecasted earnings and revenue growth compared to the wider banking sector, as well as underperforming total returns over the past year. The new announcement simply maintains the existing risk-reward picture that investors have come to expect from the business. On the flip side, slower-than-market growth is still something you’ll want to keep an eye on.

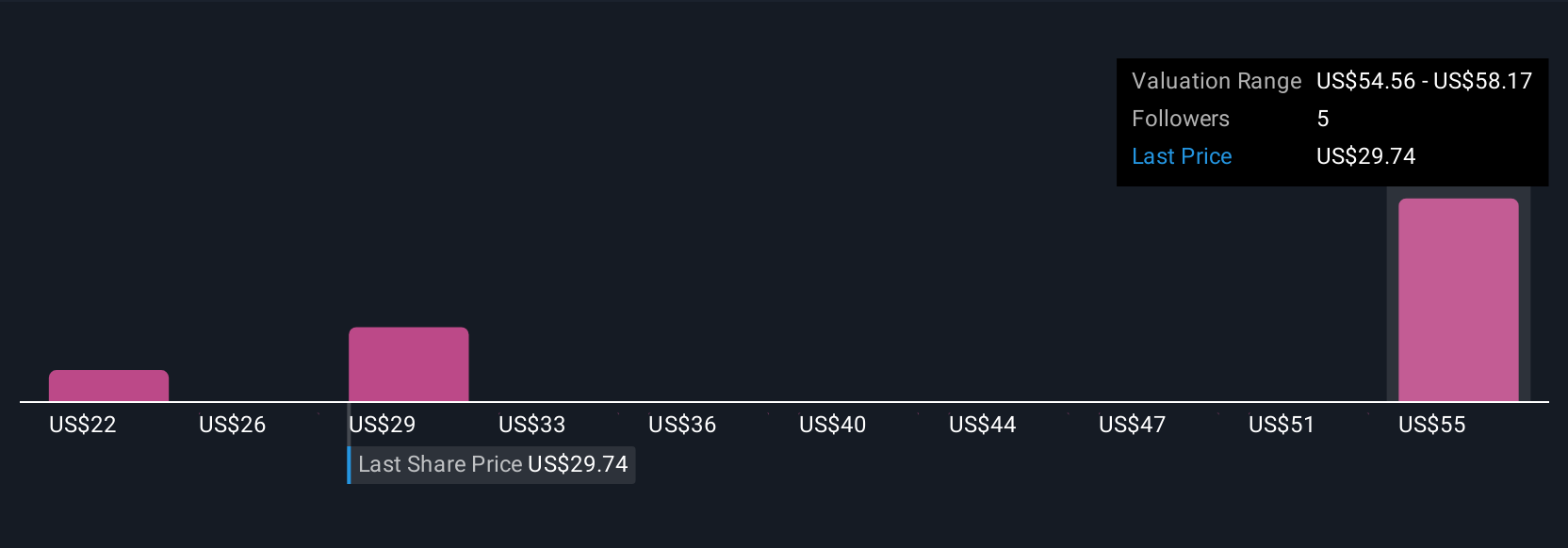

WaFd's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on WaFd - why the stock might be worth 32% less than the current price!

Build Your Own WaFd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WaFd research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free WaFd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WaFd's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion