- United States

- /

- Banks

- /

- NasdaqGS:WABC

How Investors May Respond To Westamerica Bancorporation (WABC) Q3 Earnings Decline and Ongoing Headwinds

Reviewed by Sasha Jovanovic

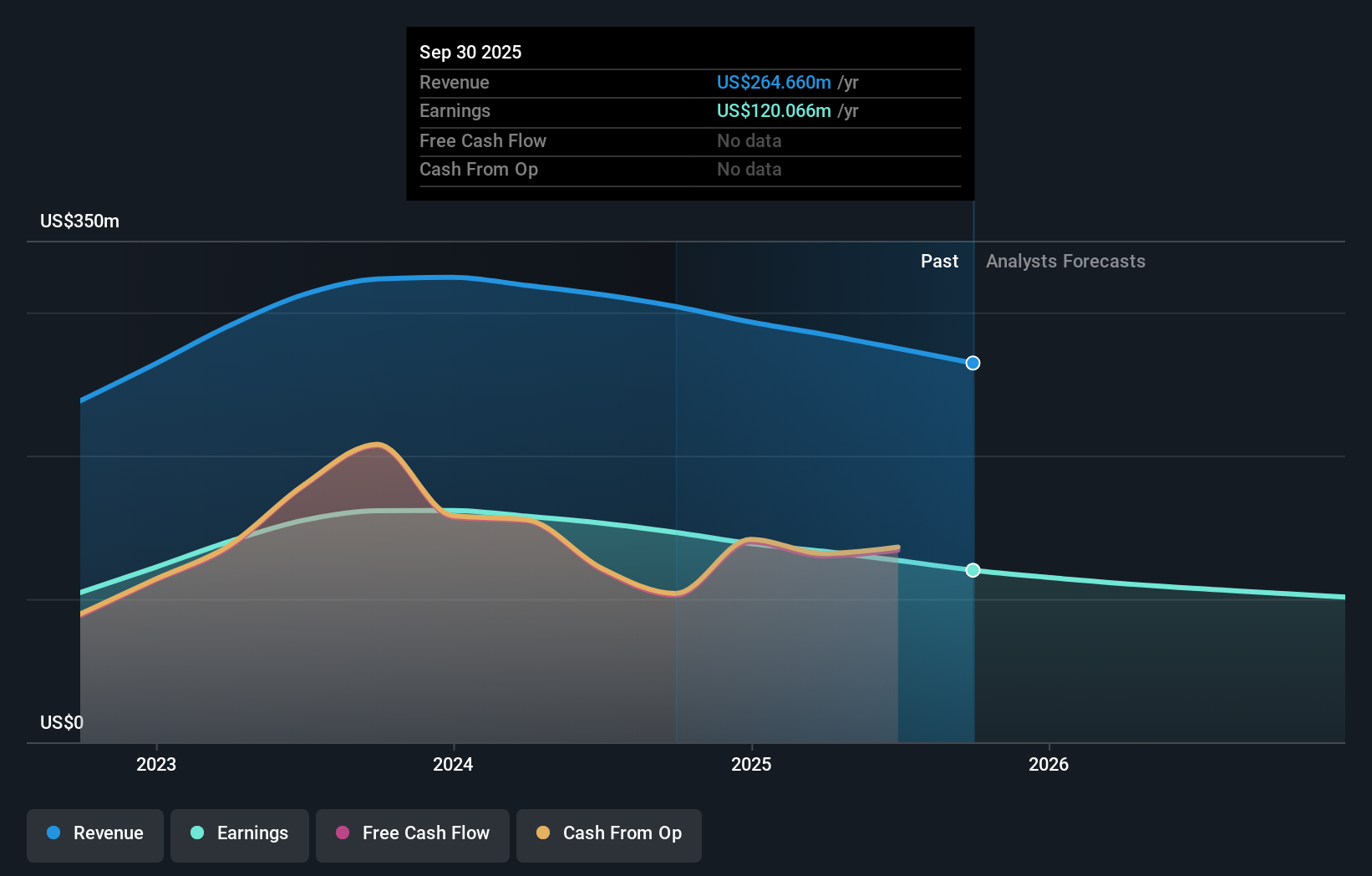

- Westamerica Bancorporation recently released its third quarter 2025 financial report, revealing declines in interest and loan fee income, net income, and earnings per share compared to the previous year.

- Management highlighted ongoing challenges from inflation, Federal Reserve policy, and industry-wide concerns like liquidity and deposit outflows as factors affecting its outlook.

- We'll examine how these operational headwinds, particularly the decline in net interest income, shape Westamerica Bancorporation's current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Westamerica Bancorporation's Investment Narrative?

For anyone considering Westamerica Bancorporation, the real crux is belief in the bank’s ability to adapt and preserve value in a challenging California banking environment. The latest quarterly report, which revealed declines in both net interest income and earnings, reinforces immediate concerns about core banking profitability. Previously, catalysts like the steady share buybacks and consistent dividend increases suggested management’s ongoing confidence, but sharper metrics like net interest margin erosion and expected earnings declines now loom larger. The recent news, a dip in financial results and management warnings about inflation, deposit outflows, and policy headwinds, spotlights the volatility facing regional banks. In the short term, these factors could blunt the impact of the dividend as a steadying force and shift attention to liquidity and competitive risks, making operational resilience rather than shareholder returns the critical near-term focus for investors.

But behind the dividends, investors should watch for signs of deeper profitability pressure.

Exploring Other Perspectives

Explore another fair value estimate on Westamerica Bancorporation - why the stock might be worth as much as $42.00!

Build Your Own Westamerica Bancorporation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westamerica Bancorporation research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westamerica Bancorporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westamerica Bancorporation's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives