- United States

- /

- Banks

- /

- NasdaqGS:VLY

Valley National Bancorp (VLY): Exploring Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Valley National Bancorp.

Momentum for Valley National Bancorp has been steady, with recent share price gains building on a strong start to the year. While the past week saw a modest pullback, VLY’s share price is still up over 17% in 2024 and its total shareholder return over the past year stands at nearly 8%. This confirms ongoing confidence despite occasional market jitters.

If you're weighing similar moves across the market, it could be the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With robust share price gains and upbeat financials, the question remains: is Valley National Bancorp currently undervalued, or has the recent momentum already captured all its growth prospects, leaving little room for further upside?

Most Popular Narrative: 22% Undervalued

With Valley National Bancorp closing at $10.46 and the most popular narrative placing fair value at $13.46, recent momentum is only part of the story. The widely tracked narrative synthesizes shifting fundamentals and a dynamic lending landscape.

Valley's accelerating growth in commercial & specialty deposit accounts, driven by technology investments and targeted market penetration, is likely to yield structurally lower funding costs and enhanced net interest margin as legacy brokered deposits are replaced with lower-cost core deposits, directly supporting revenue and margin expansion.

Curious about the catalyst behind such a premium fair value? It all comes down to a rapid transformation in revenue, margin expansion, and ambitious future earnings projections. The big question is: what are the financial assumptions powering this bold valuation target?

Result: Fair Value of $13.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Valley’s concentrated exposure to regional markets and ongoing reliance on commercial real estate loans. These factors could test earnings resilience ahead.

Find out about the key risks to this Valley National Bancorp narrative.

Another View: Looking at Earnings Ratios

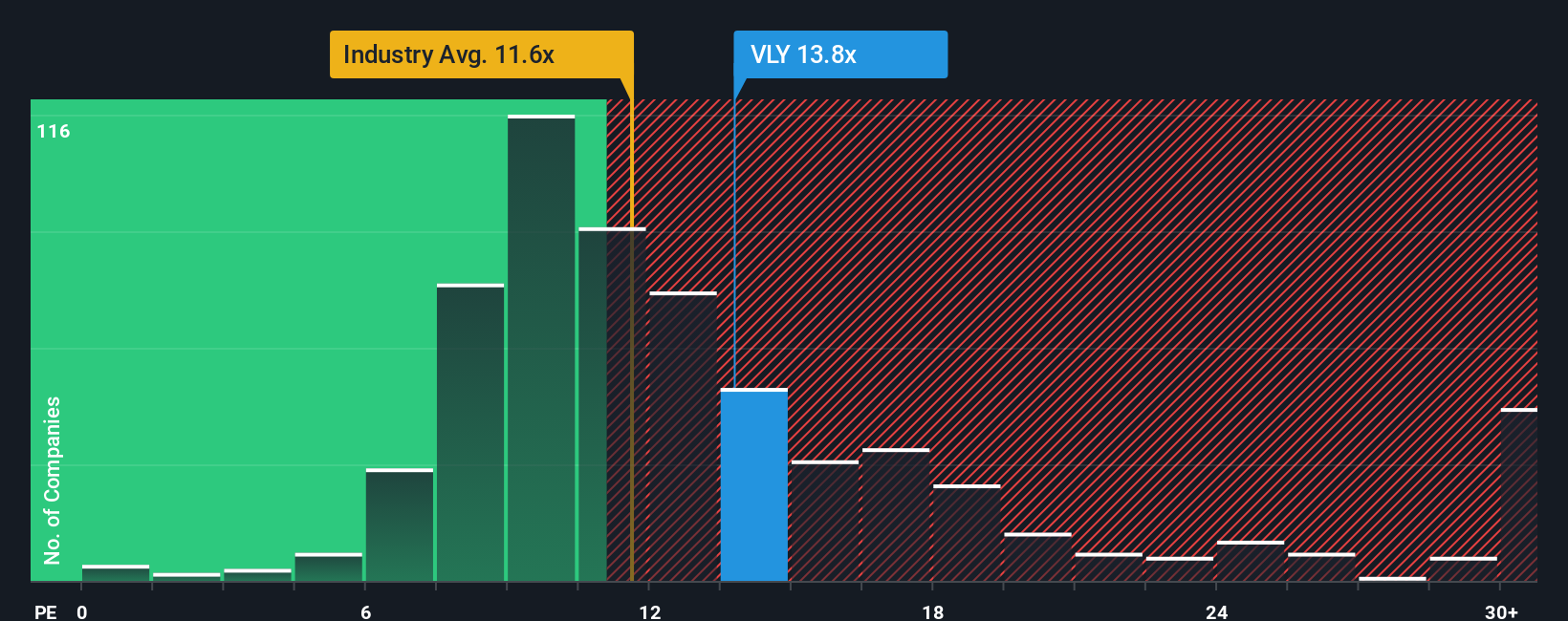

While the fair value narrative sees Valley National Bancorp as undervalued, a closer look at its price-to-earnings ratio tells a different story. At 11.9x, VLY is pricier than the US Banks industry average of 10.9x. However, it is cheaper than the peer average of 13.2x. Compared to a fair ratio of 14.5x, there remains upside potential, but the current premium signals that the market already prices in some optimism. Is the market ahead of itself, or is upside still left on the table?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valley National Bancorp Narrative

If you have your own take or want to dig deeper into the numbers, it’s quick and easy to craft your own perspective using our tools. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Valley National Bancorp.

Looking for More Investment Ideas?

Expand your portfolio and spot unique opportunities that others might miss. Don’t wait until trends become obvious; get ahead by checking out these powerful ideas now:

- Unlock steady income potential through reliable companies offering impressive yields by checking out these 18 dividend stocks with yields > 3%.

- Tap into the future of medicine with breakthrough innovators using artificial intelligence in healthcare. Start with these 31 healthcare AI stocks.

- Seize undervalued opportunities before the crowd does and find tomorrow’s winners among these 901 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives