- United States

- /

- Banks

- /

- NasdaqGS:VLY

Can New VLY Leadership Hires Reveal the Depth of Valley National's Long-Term Commercial Banking Ambitions?

Reviewed by Sasha Jovanovic

- In November 2025, Valley National Bancorp announced several executive appointments, including Curt Lang as chief banking officer for New Jersey, Mark Glasky as California Market President, and Matthew Verney as chief banking officer for Philadelphia and South Jersey, each tasked with leading commercial banking expansion in their respective territories.

- These leadership changes underscore the company's intent to strengthen its commercial banking capabilities and accelerate regional growth by leveraging experienced industry professionals.

- We'll examine how Valley National Bancorp's targeted leadership hires support its investment narrative around geographic expansion and commercial banking growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Valley National Bancorp Investment Narrative Recap

For shareholders of Valley National Bancorp, the investment story hinges on whether the company's leadership and expansion efforts can capture new commercial banking opportunities in faster-growing markets while keeping asset quality concerns and regional risks in check. The recent executive appointments add relevant experience and local expertise across key territories, but they do not materially alter the most immediate risk, which remains Valley’s exposure to commercial real estate and potential regional economic downturns.

Of particular note is the hiring of Mark Glasky as California Market President, given California’s size and potential to diversify Valley’s footprint beyond the Northeast. With a strong track record in commercial banking, Glasky’s appointment could support loan growth and mitigate concentration risk, though the benefits may take time to materialize alongside the company’s continued commercial real estate exposure.

By contrast, investors should be aware that the company’s long-term reliance on commercial real estate lending still leaves its earnings and margins sensitive to shifts in local property markets, especially if ...

Read the full narrative on Valley National Bancorp (it's free!)

Valley National Bancorp's outlook anticipates $2.5 billion in revenue and $807.5 million in earnings by 2028. This scenario requires a 16.6% annual revenue growth rate and a $381.8 million increase in earnings from the current $425.7 million.

Uncover how Valley National Bancorp's forecasts yield a $13.46 fair value, a 28% upside to its current price.

Exploring Other Perspectives

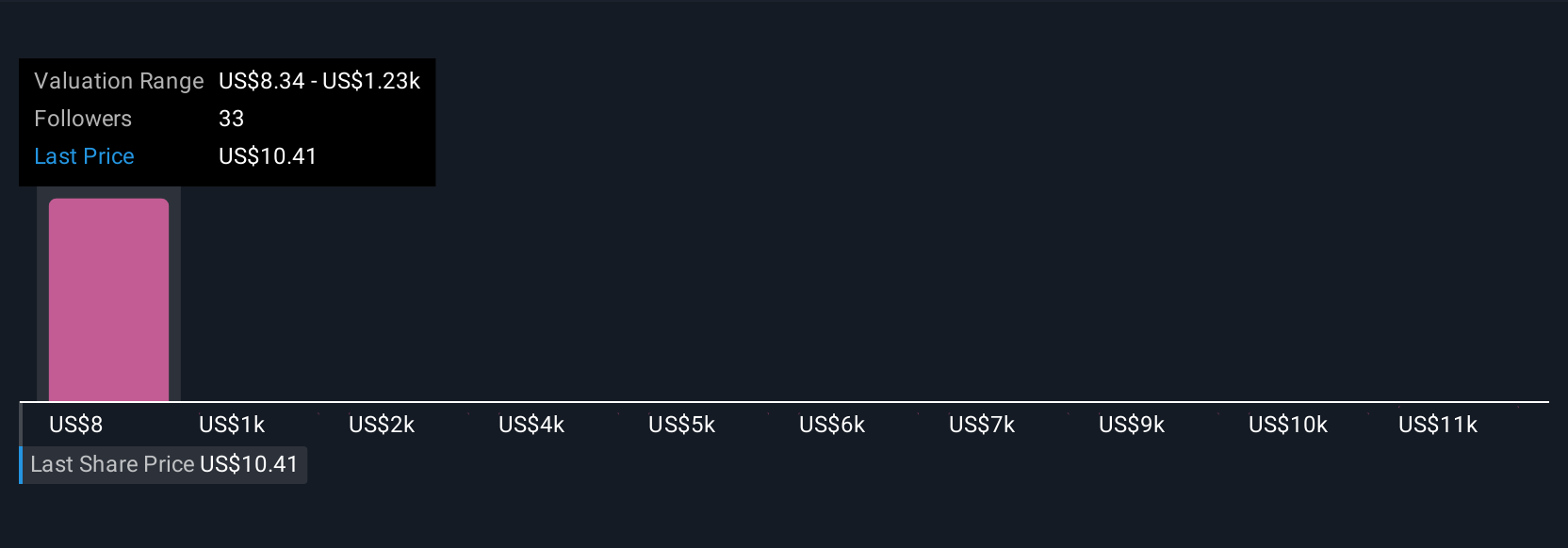

Simply Wall St Community members generated two fair value estimates for Valley National Bancorp ranging from US$13.46 to US$19.62 per share. While management focuses on expansion into new markets, many participants remain mindful of risks from regional loan concentrations that could affect profitability in the coming years.

Explore 2 other fair value estimates on Valley National Bancorp - why the stock might be worth as much as 87% more than the current price!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives