- United States

- /

- Banks

- /

- NasdaqCM:VABK

Virginia National Bankshares (VABK) Profit Margins Rise as Quality Narrative Gains Support

Reviewed by Simply Wall St

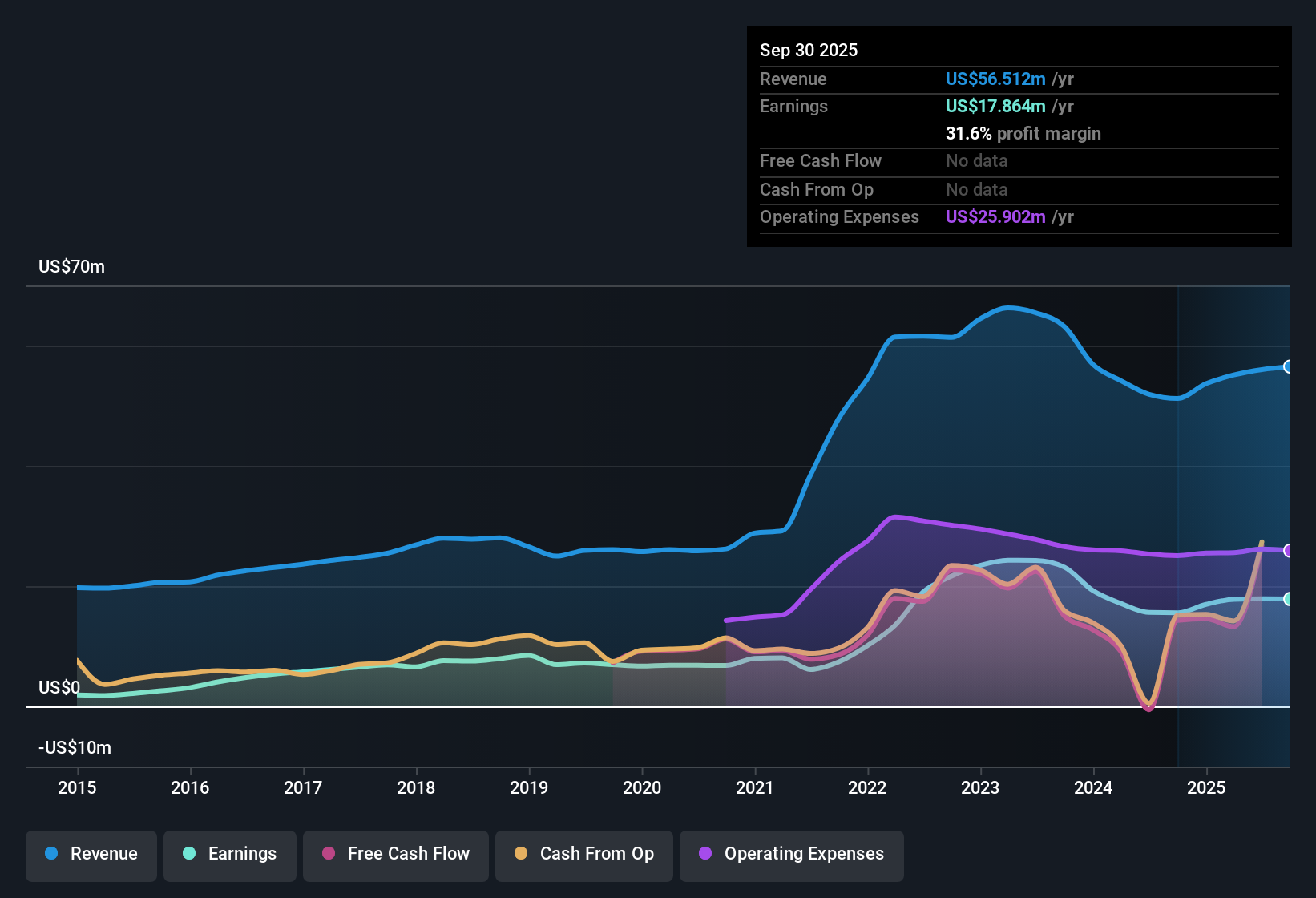

Virginia National Bankshares (VABK) posted a net profit margin of 31.8% this year, up from 30.4% the prior year, with annual earnings growth reaching 14.7% both this year and on a five-year average. The bank trades at a price below its estimated fair value, but its price-to-earnings ratio of 12.1x is just above both its peers and the overall US banks sector. Investors will be watching the attractive dividend and the recent track record of steady earnings growth, even as the valuation premium compared to industry benchmarks may temper enthusiasm for some.

See our full analysis for Virginia National Bankshares.Let’s see how these headline results compare with the dominant narratives. Some long-held views may be reinforced, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Last Year’s Levels

- Net profit margin rose to 31.8%, topping last year’s 30.4%, indicating that Virginia National Bankshares managed to convert more revenue into bottom-line profit despite a competitive operating environment.

- What stands out is how this higher margin supports market commentary that banks with steady profits command attention when sector risks run high.

- Investors tend to seek out institutions with stable profitability as a signal of underlying portfolio strength, especially with recent sector turbulence following bank failures elsewhere.

- Margins near 32% are notable for a regional bank and lend weight to arguments that steady profitability can drive a “flight to quality” effect among risk-averse investors.

Five-Year Earnings Growth Holds Firm

- Annual earnings growth averaged 14.7% over the last five years and matched that rate again this year, revealing not just a one-off result but persistent growth through varying economic cycles.

- The prevailing analysis suggests that consistent growth like this attracts investors prioritizing income and resilience even if headline excitement is muted.

- Sustained double-digit earnings expansion, especially when paired with a reputation for conservative management, is a draw for those targeting long-term, steady performers in the banking sector.

- While larger banks often see more volatility, this consistent pace shows Virginia National Bankshares has avoided dramatic swings, which can be a plus for conservative portfolios.

Valuation Premium vs. Peers Remains

- Trading at a price-to-earnings ratio of 12.1x, Virginia National Bankshares is priced above its peer median of 12x and the broader US banks sector at 11.2x, despite a share price ($40.24) below the internally estimated DCF fair value ($66.43).

- The current perspective highlights how the valuation premium signals investor willingness to pay up for perceived quality, but it also sets the bar higher for future performance.

- This pricing premium, when compared to the sector, suggests the market is factoring in enduring profitability and robust margins.

- However, history shows valuation gaps can narrow quickly if future growth expectations are not met. The premium adds both credibility and pressure to deliver.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Virginia National Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Virginia National Bankshares shows steady earnings, its valuation premium over peers raises the risk that future results may not justify the higher price.

If that concerns you, use our these 878 undervalued stocks based on cash flows to quickly find alternatives with attractive pricing based on robust cash flow and less potential downside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VABK

Virginia National Bankshares

Operates as the holding company for Virginia National Bank that provides a range of commercial and retail banking products and services in Virginia.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives