- United States

- /

- Banks

- /

- NasdaqGS:UMBF

Is UMB Financial a Bargain After a 10% Slide and Regulatory Shifts in 2025?

Reviewed by Bailey Pemberton

- Curious whether UMB Financial is currently trading at a bargain or a premium? You're not alone, as finding value in the banking sector can be a real challenge.

- The stock has seen some bumps recently, dipping 5.9% over the past week and nearly 10% over the last month. However, it has managed to hold flat for the year and boasts an 89.3% gain over the past five years.

- Recent shifts in the broader banking industry and regulatory landscape have provided important context for these price moves. Headlines have centered on changes to capital requirements for regional banks and increased focus on risk management after industry-wide volatility in the sector.

- Based on our current measures, UMB Financial scores a 4 out of 6 on key valuation checks. As we dive into different ways to assess value, you'll see there's an even more insightful perspective waiting at the end.

Find out why UMB Financial's 0.1% return over the last year is lagging behind its peers.

Approach 1: UMB Financial Excess Returns Analysis

The Excess Returns approach is a widely used valuation method that focuses on how much return a company generates on its equity, above the cost of that equity. In other words, it looks at whether UMB Financial is putting shareholders’ money to work in a way that meaningfully exceeds what it costs the company to obtain that capital.

Based on analyst projections, UMB Financial has a book value of $94.13 per share and a stable earnings per share figure of $12.06. These estimates are derived from future return on equity expectations compiled from eight analysts. The cost of equity sits at $7.32 per share. After deducting this from earnings, the excess return per share is $4.74. On average, the company’s anticipated return on equity is 11.28%. Looking ahead, the stable book value is expected to reach $106.97 per share, based on projections from nine analysts. These figures help highlight the company’s capacity to earn returns above its cost of capital over time.

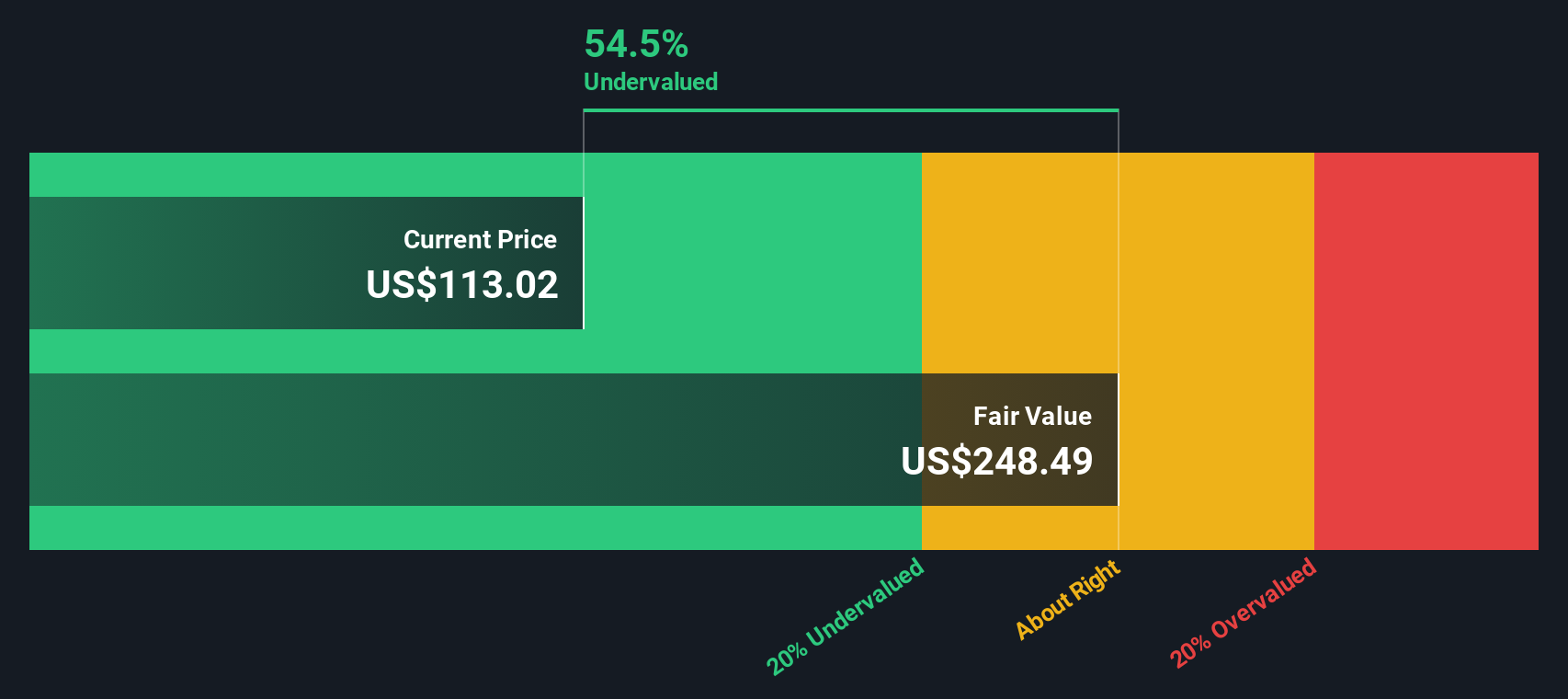

With these metrics, the Excess Returns model estimates an intrinsic value that is 54.1% higher than the current share price. This suggests UMB Financial stock is significantly undervalued at today’s levels.

Result: UNDERVALUED

Our Excess Returns analysis suggests UMB Financial is undervalued by 54.1%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: UMB Financial Price vs Earnings

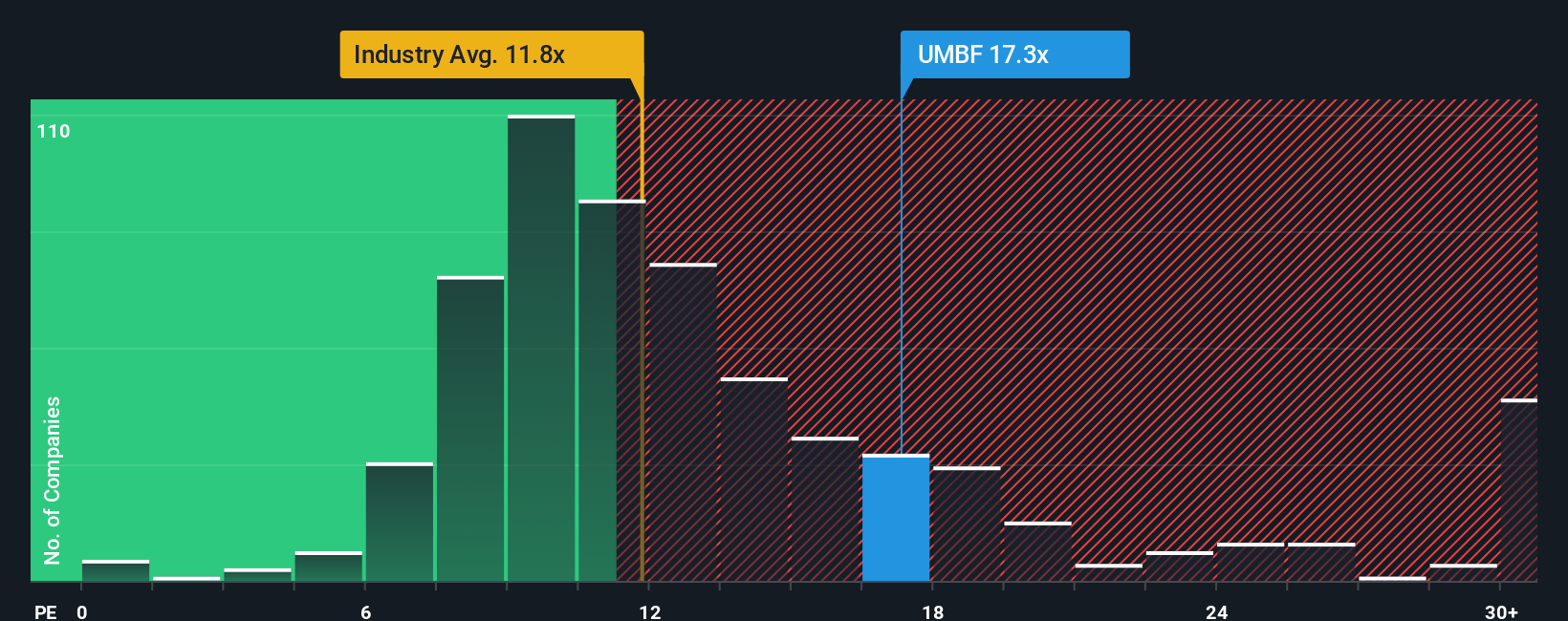

For profitable companies like UMB Financial, the price-to-earnings (PE) ratio is a widely used valuation metric. It allows investors to quickly gauge how much they are paying for each dollar of earnings, making it an essential tool for comparing profitability across banks and industry peers.

What constitutes a “fair” PE ratio can shift depending on expected growth rates and perceived risk. Companies with stronger earnings growth or lower risk profiles often command higher PE multiples, while those facing uncertainty tend to trade at discounted multiples. Context is vital when interpreting whether a stock’s PE is high or low.

Currently, UMB Financial trades on a PE ratio of 13.6x. This is above the banking industry average of 11.1x and also higher than a typical peer at 11.9x. However, Simply Wall St’s proprietary Fair Ratio, which accounts for UMB Financial’s unique mix of earnings growth, profit margin, risk profile, industry position and market cap, sits at 16.2x. This comprehensive metric offers a more nuanced lens than a simple peer or industry comparison, as it weighs the company’s specific strengths and risks rather than relying on broad benchmarks.

Given that UMB Financial’s current PE multiple of 13.6x is meaningfully below its Fair Ratio of 16.2x, the stock appears undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UMB Financial Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind the numbers, where you connect what you believe about a company, its prospects, strengths, challenges, and future, directly to your financial forecast and fair value estimate.

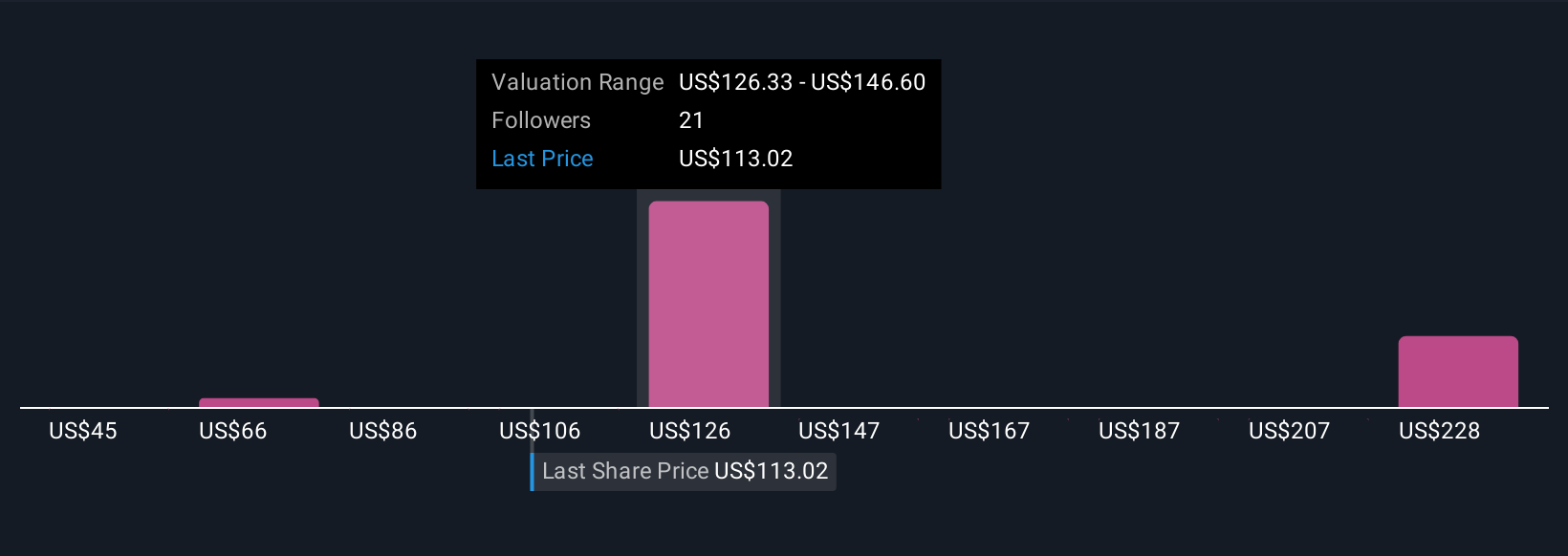

Narratives take your view of UMB Financial, whether shaped by optimism about its successful Heartland integration and digital upgrades or caution about regional risks and competition, and tie it to projected revenues, earnings, and margins. This bridges your opinion with real-world data, making it far easier to act confidently on your investment convictions.

On Simply Wall St's Community page, millions of investors use Narratives as an accessible tool. Enter your story, update your assumptions anytime, and instantly see your Fair Value compared to the current share price. If new earnings or headlines appear, your Narrative updates automatically, making sure your decisions are always based on the latest information.

For example, right now, the most bullish UMB Financial Narrative on the platform sees fair value at $150, driven by high-margin growth and tech-led efficiency, while the most cautious assigns just $120, emphasizing integration risk and competitive threats. Which story best fits what you believe? Let your Narrative guide your next move.

Do you think there's more to the story for UMB Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives