- United States

- /

- Banks

- /

- NasdaqGS:UMBF

Assessing UMB Financial (UMBF) Valuation After Recent Pullback and Acquisition Integration

Reviewed by Simply Wall St

UMB Financial (UMBF) shares have edged lower over the past month, continuing a modest downward trend that began earlier this year. Investors are weighing recent performance in relation to the company’s longer-term returns and ongoing annual growth.

See our latest analysis for UMB Financial.

Shares have pulled back by 4.46% over the past month and are trading at $103.99, reflecting fading near-term momentum. However, UMB Financial’s 1-year total shareholder return stands at -13.01%. Its three- and five-year total returns, at 31.2% and 62.3% respectively, indicate that the longer-term growth story remains very much alive.

If you’re interested in expanding your horizons beyond the banking sector, now is a great time to check out fast growing stocks with high insider ownership.

Given these mixed signals, investors are left to consider whether UMB Financial is truly undervalued, offering a potential entry point, or if its current price already reflects all foreseeable growth prospects.

Most Popular Narrative: 24.5% Undervalued

The most widely followed narrative suggests that UMB Financial’s intrinsic value sits well above its last close price of $103.99. The narrative’s fair value estimate provides a clear contrast to current trading levels and sets the stage for a closer look at what drives this optimism.

The successful integration of the Heartland (HTLF) acquisition, including vendor consolidation and conversion to the UMB platform, is expected to unlock substantial cost savings ($124 million targeted, most of which will be realized by early 2026). This is projected to materially improve operating leverage and expand net margins.

Want to know the story behind the valuation? Analysts are betting on powerful cost savings, a significant profit margin increase, and an ambitious bottom line target. The underlying bold multiple is central to these expectations. What is driving these standout projections? The numbers may surprise you.

Result: Fair Value of $137.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regional economic slowdowns or setbacks integrating Heartland could limit UMB Financial’s ability to deliver the projected margin and revenue gains.

Find out about the key risks to this UMB Financial narrative.

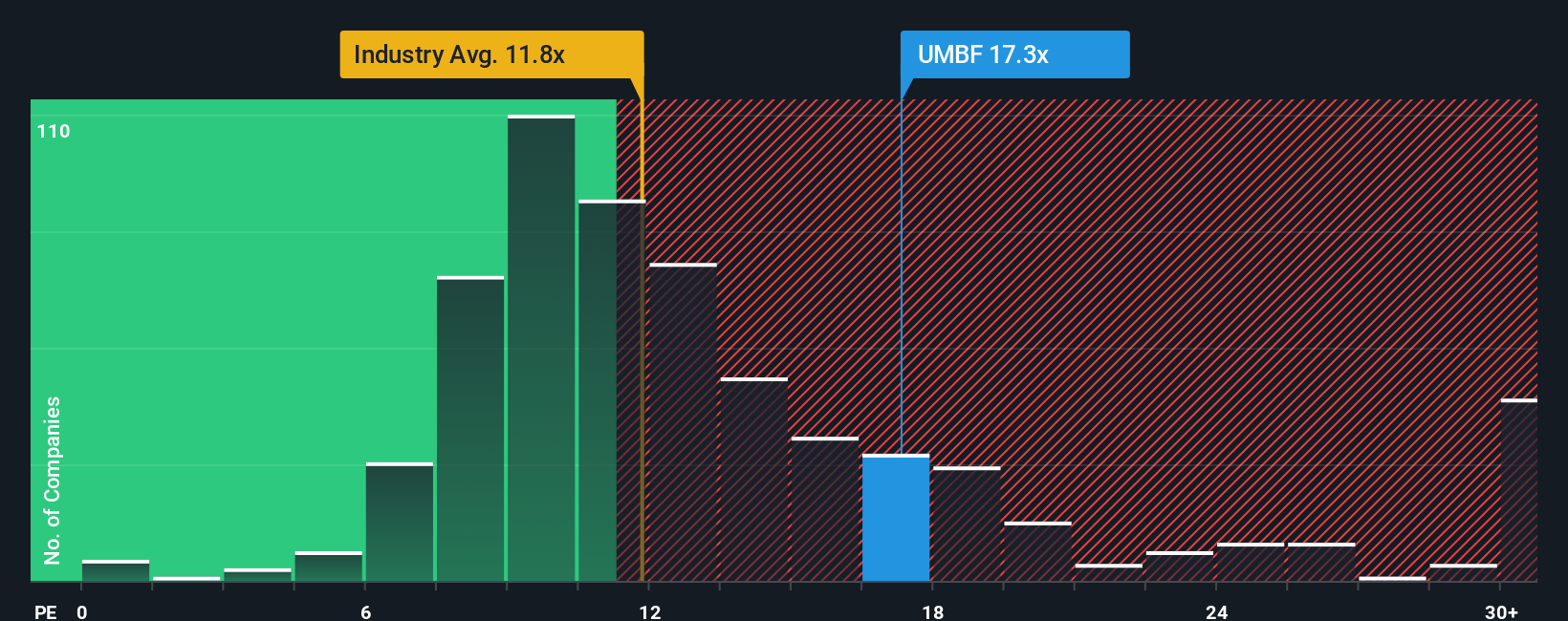

Another View: Market Multiples Paint a Pricier Picture

While the fair value estimate points to UMB Financial being undervalued, a look at the price-to-earnings ratio shows a different angle. UMB Financial trades at 13.3x earnings, ahead of both the industry average (11.2x) and its peer group (12.2x). Compared to the market-driven fair ratio of 15.1x, there is still some room to move higher, but the current premium versus sector rivals could signal more limited upside unless strong growth comes through. Is the gap justified, or does it highlight valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMB Financial Narrative

If you see things differently or want a hands-on look at the numbers, you can piece together your own view of UMB Financial quickly: Do it your way.

A great starting point for your UMB Financial research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn your attention to new markets and emerging sectors that could reshape your investment outlook. Find promising opportunities before they move beyond reach.

- Capture consistent income by evaluating these 18 dividend stocks with yields > 3% yielding above 3 percent. This can enhance your long-term portfolio stability.

- Fuel your portfolio’s growth by targeting these 27 AI penny stocks that may benefit from breakthroughs in artificial intelligence and automation.

- Capitalize on rapidly evolving trends with these 82 cryptocurrency and blockchain stocks, driving innovation in digital assets and the next wave of financial technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UMBF

UMB Financial

Operates as the bank holding company that provides banking services and asset servicing in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives