- United States

- /

- Banks

- /

- NasdaqGM:TSBK

We Think The Compensation For Timberland Bancorp, Inc.'s (NASDAQ:TSBK) CEO Looks About Right

Under the guidance of CEO Mike Sand, Timberland Bancorp, Inc. (NASDAQ:TSBK) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 25 January 2022. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for Timberland Bancorp

Comparing Timberland Bancorp, Inc.'s CEO Compensation With the industry

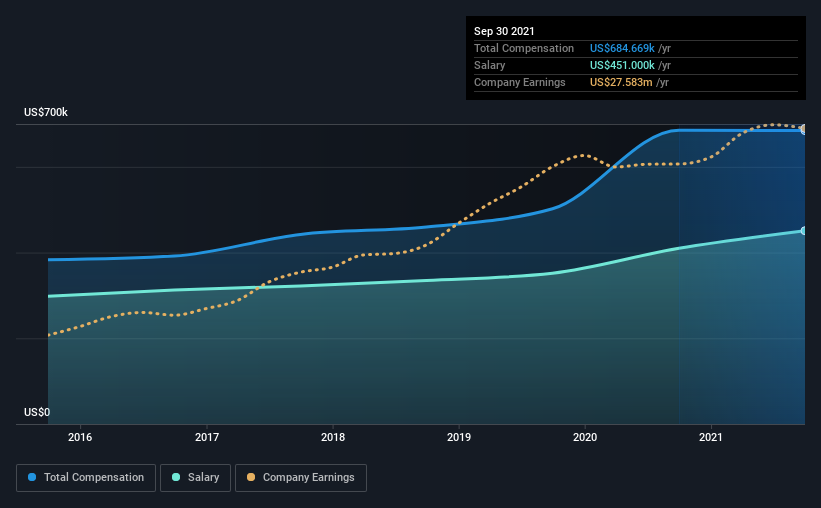

According to our data, Timberland Bancorp, Inc. has a market capitalization of US$244m, and paid its CEO total annual compensation worth US$685k over the year to September 2021. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at US$451.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$874k. This suggests that Timberland Bancorp remunerates its CEO largely in line with the industry average. Furthermore, Mike Sand directly owns US$4.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$451k | US$410k | 66% |

| Other | US$234k | US$275k | 34% |

| Total Compensation | US$685k | US$685k | 100% |

Speaking on an industry level, nearly 51% of total compensation represents salary, while the remainder of 49% is other remuneration. Timberland Bancorp is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Timberland Bancorp, Inc.'s Growth

Timberland Bancorp, Inc. has seen its earnings per share (EPS) increase by 13% a year over the past three years. Its revenue is up 7.1% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Timberland Bancorp, Inc. Been A Good Investment?

With a total shareholder return of 21% over three years, Timberland Bancorp, Inc. shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Timberland Bancorp that you should be aware of before investing.

Important note: Timberland Bancorp is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Timberland Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TSBK

Timberland Bancorp

Operates as the bank holding company for Timberland Bank that provides various community banking services in Washington.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success