- United States

- /

- Banks

- /

- NasdaqGS:TOWN

TowneBank (TOWN): Valuation Insights Following Q3 Earnings Dip and Old Point Acquisition Impact

Reviewed by Simply Wall St

TowneBank (TOWN) just posted its third-quarter earnings, and investors are digesting a mix of updates. Net income landed lower than last year, and the Old Point acquisition led to a sizable provision for credit losses.

See our latest analysis for TowneBank.

TowneBank’s third-quarter results followed a year where the share price has recovered ground, now sitting at $33.70. While momentum has cooled recently with a 5.3% 1-month share price decline, the bank’s 1-year total shareholder return of 4.9% and a robust 5-year total return of 114% remind investors of its longer-term compounding power and resilience through sector shifts.

If TowneBank’s steady track record has you rethinking your next move, step out of the ordinary and uncover fast growing stocks with high insider ownership

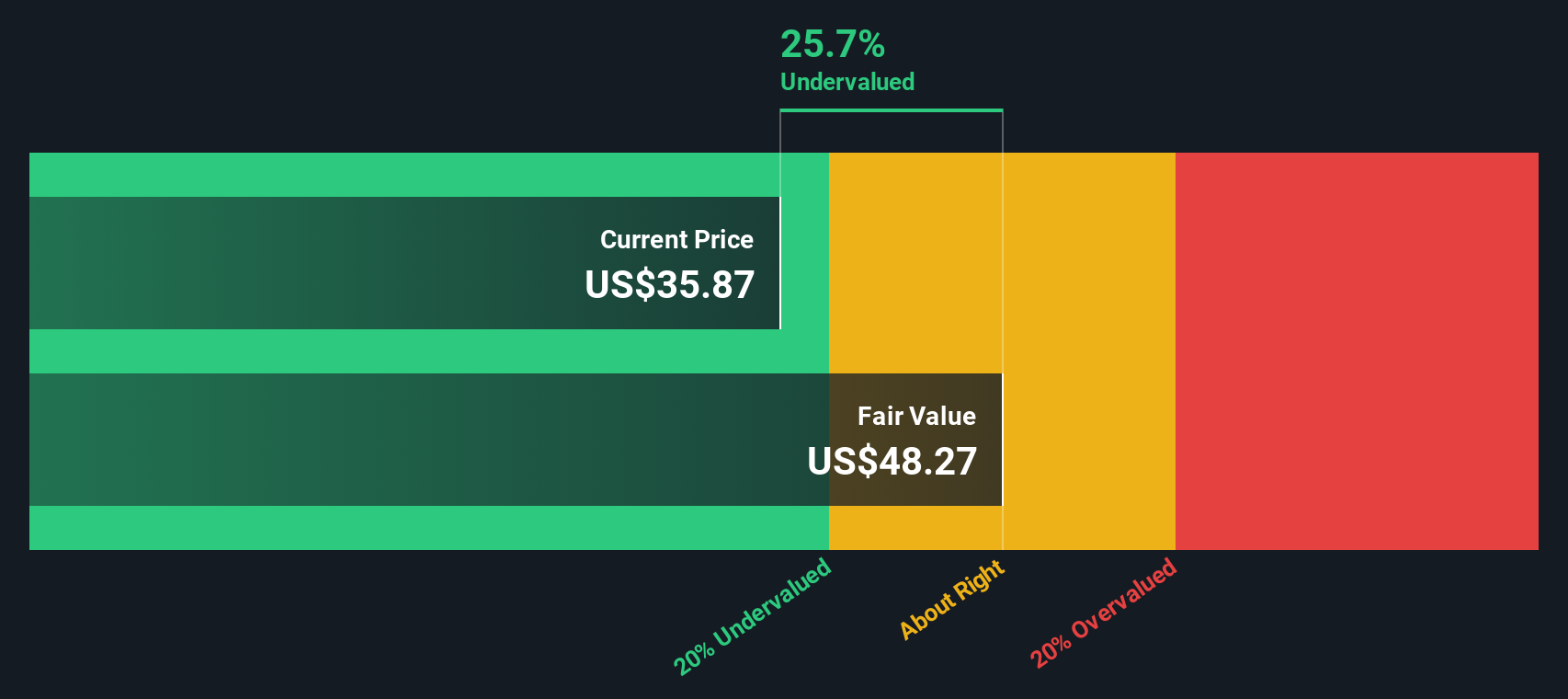

The current price sits well below the latest analyst target and intrinsic value estimates. However, recent results reveal softer profitability and sector headwinds. Does this create room for upside, or is the market already factoring in future growth?

Price-to-Earnings of 15.5x: Is it justified?

TowneBank's stock trades at a price-to-earnings (P/E) ratio of 15.5x, slightly above both its banking peers and the broader US banks sector benchmarks given the last close price of $33.70.

The P/E ratio shows how much investors are willing to pay for each dollar of annual earnings, making it a key yardstick for established banks. In TowneBank's case, this pricing suggests the market has some optimism about its growth prospects or resilience. It is more expensive than many competitors.

Compared to the US banks industry average P/E of 11.2x and peer average of 13.4x, TowneBank looks relatively pricey. However, regression analysis indicates its fair P/E ratio stands at 18x. This shows upside potential if earnings play out as projected and investor sentiment turns more bullish.

Explore the SWS fair ratio for TowneBank

Result: Price-to-Earnings of 15.5x (ABOUT RIGHT)

However, softer profitability and ongoing sector headwinds could limit TowneBank’s upside, especially if economic pressures persist or if loan quality trends worsen.

Find out about the key risks to this TowneBank narrative.

Another View: Discounted Cash Flow Model

While TowneBank may look pricey based on earnings multiples, our DCF model points in the opposite direction. The SWS DCF model estimates fair value at $71.64, which suggests shares might be deeply undervalued at current prices. Could the real opportunity be hiding beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TowneBank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TowneBank Narrative

If you want to see things from a different angle or trust your own research, you can get started on a fresh view in just minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding TowneBank.

Looking for more investment ideas?

Smart investors never settle for just one play when markets offer a world of potential. Give yourself an edge by tapping opportunities others might overlook.

- Tap into breakthrough healthcare innovation and harness the power of medical technology by checking out these 33 healthcare AI stocks.

- Boost your income stream and target reliable payouts through these 17 dividend stocks with yields > 3% with attractive yields and steady performance histories.

- Seize tomorrow’s tech trends now and get ahead of the crowd by searching these 27 AI penny stocks poised to redefine entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives