- United States

- /

- Banks

- /

- NasdaqGS:TOWN

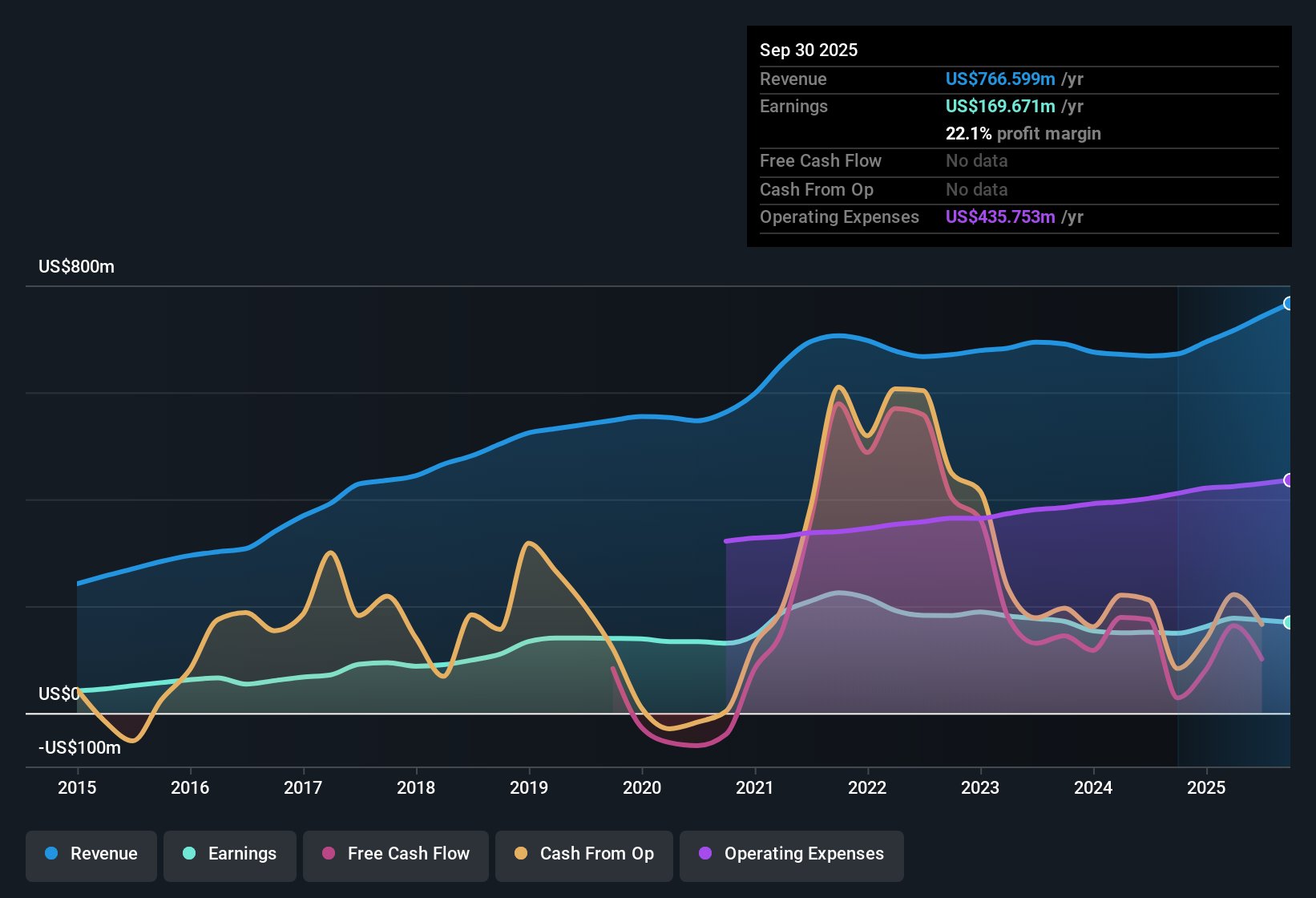

TowneBank (TOWN) Earnings Growth Tops Narrative as Profit Margin Holds Firm at 22.1%

Reviewed by Simply Wall St

TowneBank (TOWN) delivered a notable 13.6% earnings growth over the past year, reversing a previous 5-year annual decline of 2.5%. Net profit margin remained steady at 22.1% compared to last year’s 22.2%. Looking ahead, analysts expect revenue to climb 21.3% per year, while earnings are forecast to surge at 38.7% annually. Both of these figures outpace the broader US market. With earnings described as high quality and no specific risks flagged, the results present an attractive setup for investors seeking both growth and value opportunities.

See our full analysis for TowneBank.Now let’s see how these headline numbers hold up when we place them next to the dominant market narratives. This is where stories get tested against the data.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Holds Strong at 22.1%

- Net profit margin sits at 22.1%, nearly identical to last year's 22.2%, demonstrating TowneBank's ability to keep a firm grip on profitability even as it accelerates growth.

- While the prevailing market view highlights TowneBank’s stable regional banking model and conservative approach, margin consistency stands out,

- maintaining relative insulation from the sector’s volatility, as the bank avoids sharp sentiment swings caused by unpredictable earnings.

- supporting the idea that community banking resilience and prudent cost management give TowneBank a durable edge.

Trading Below Analyst Target Despite Premium P/E

- The current share price of $32.80 is not only below the analyst price target of $40.50, but also below estimated DCF fair value of $62.93, even though the bank trades at a 15x Price-To-Earnings ratio, which is a clear premium to the US Banks industry average of 11.3x and peer average of 12.5x.

- The prevailing market view questions how a premium P/E multiple can persist while the market leaves the stock priced well below targets,

- as bulls may point to the high-quality earnings profile and attractive dividend potential, using consistent profit margins and above-market growth forecasts as ammunition.

- at the same time, the premium valuation relative to peers could invite skepticism unless future growth and margin stability are sustained.

Growth Forecasts Outpace Sector and Market

- Looking ahead, consensus expects TowneBank’s revenue to grow at 21.3% per year versus the US market’s average of 10%, and earnings to surge at 38.7% annually, well above the market’s 15.5% pace.

- This reinforces the prevailing view that the bank is positioned as a “safe haven” regional,

- attracting yield-focused investors with forecasts that dramatically outpace both sector and broader market norms.

- with the caveat that a positive sector turn or local economic rebound would be needed to fully unlock this upside.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TowneBank's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While TowneBank maintains steady profit margins and growth forecasts, its persistent premium valuation compared to peers could become hard to justify if growth slows or beats disappoint.

If you want to sidestep valuation concerns, use our these 875 undervalued stocks based on cash flows to discover stocks trading at more attractive prices with upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives