- United States

- /

- Banks

- /

- NasdaqGS:TOWN

How Investors Are Reacting To TowneBank (TOWN) Surpassing Q2 Revenue Estimates and Advancing Growth Partnerships

Reviewed by Sasha Jovanovic

- TowneBank recently reported revenues of US$207.4 million for the second quarter, marking an 18.6% year-over-year increase and outperforming analyst expectations.

- The completed integration of Village Bank and the announcement of a forthcoming Old Point partnership underscore TowneBank’s ongoing focus on growth through collaborations.

- We'll explore how TowneBank's successful partnership integration and emphasis on expansion could shape its investment narrative going forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is TowneBank's Investment Narrative?

For anyone considering TowneBank as a potential investment, the big picture hinges on its ability to grow through strategic partnerships and consistent operational execution. The recent revenue beat and smooth Village Bank integration, coupled with a new tie-up with Old Point, have injected fresh momentum and could speed up short-term growth catalysts like earnings expansion and market share gains. This changes the conversation around risks: while TowneBank’s revenue acceleration and upbeat analyst sentiment were already drawing attention, the increased earnings consistency from these deals may help balance out softer net income and underperformance compared to both the market and broader banks sector this year. That said, elevated valuations based on traditional ratios and a Price-To-Earnings ratio above peers remain caution flags, especially if expected growth stalls or acquisition benefits take longer to materialize. However, expectations around the timing of Old Point’s impact are still up for debate.

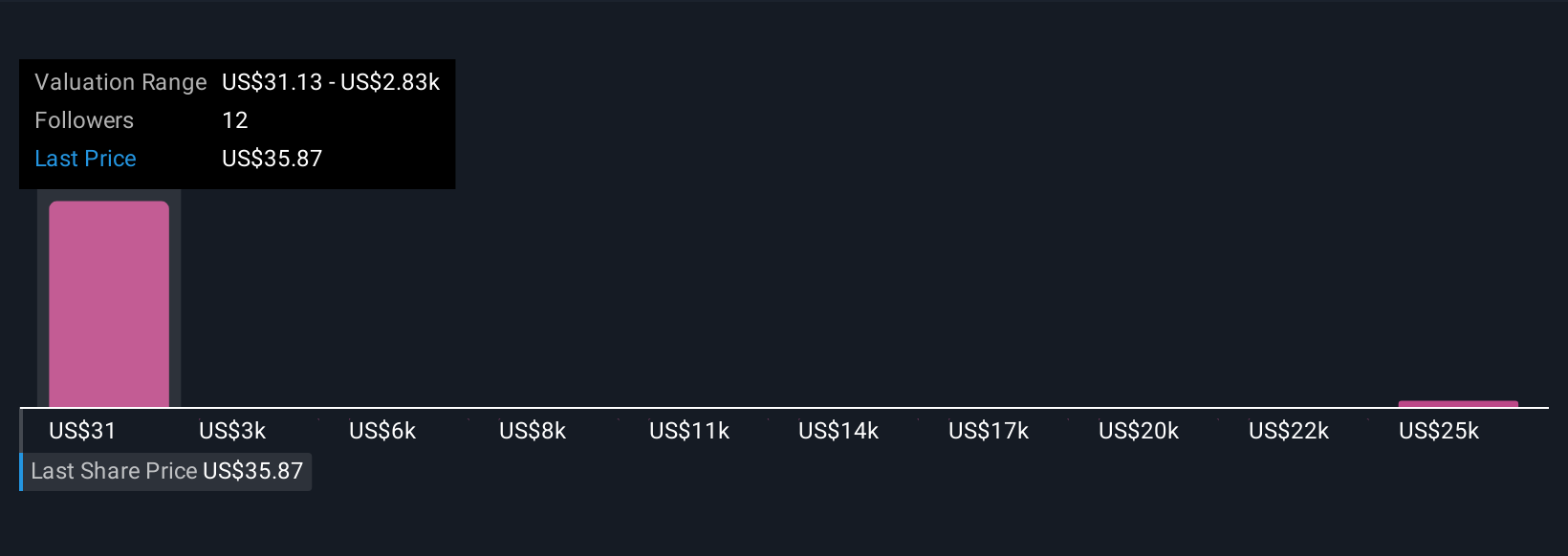

TowneBank's shares have been on the rise but are still potentially undervalued by 47%. Find out what it's worth.Exploring Other Perspectives

Explore 7 other fair value estimates on TowneBank - why the stock might be worth just $35.92!

Build Your Own TowneBank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TowneBank research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free TowneBank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TowneBank's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TowneBank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TOWN

TowneBank

Provides retail and commercial banking services for individuals, commercial enterprises, and professionals in Virginia and North Carolina.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives