- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Texas Capital Bancshares (TCBI): Evaluating Valuation After Strong Q3 Results and Renewed Investor Interest

Reviewed by Simply Wall St

Texas Capital Bancshares (TCBI) recently turned heads with its latest Q3 results, highlighted by a 13% jump in net interest income and stable credit quality across its commercial lending portfolio.

See our latest analysis for Texas Capital Bancshares.

After those impressive Q3 numbers, Texas Capital Bancshares has seen some renewed investor interest. Despite a minor dip last week, the stock’s year-to-date share price return of 9.13% hints at steady momentum. However, the 1-year total shareholder return is down slightly by 2.42%. Long-term investors have fared better, with a 44% total return over three years and nearly 47% over five. This underscores resilience even as short-term sentiment shifts with each earnings update and event such as this month’s industry conference.

If you’re drawn to companies with a track record of resilience and want to broaden your search, it’s a great moment to discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and a track record of earnings growth, the question now is whether Texas Capital Bancshares is truly undervalued or if the market is already anticipating its next chapter of growth.

Most Popular Narrative: 8.9% Undervalued

Compared to its last closing price of $83.82, the narrative consensus fair value of $92.00 points to meaningful upside. The difference raises the stakes as investors weigh whether strong fundamentals can keep moving the share price closer to this target.

Texas Capital Bancshares is positioned to benefit from robust commercial loan growth and ongoing population and economic expansion in Texas and the broader Sunbelt. These factors drive higher lending and deposit opportunities and directly support revenue and earnings expansion.

Curious what future scenario gets the stock to that target? The secret sauce in this narrative is a unique financial mix, combining powerful revenue growth, notable margin improvements, and a significant shift in earnings. Want the insider details on what numbers drive this valuation? Find out what really underpins the analysts’ optimism.

Result: Fair Value of $92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to the Texas economy and the high costs of digital transformation could pose challenges to Texas Capital Bancshares' expected growth trajectory.

Find out about the key risks to this Texas Capital Bancshares narrative.

Another View: The Multiples Perspective

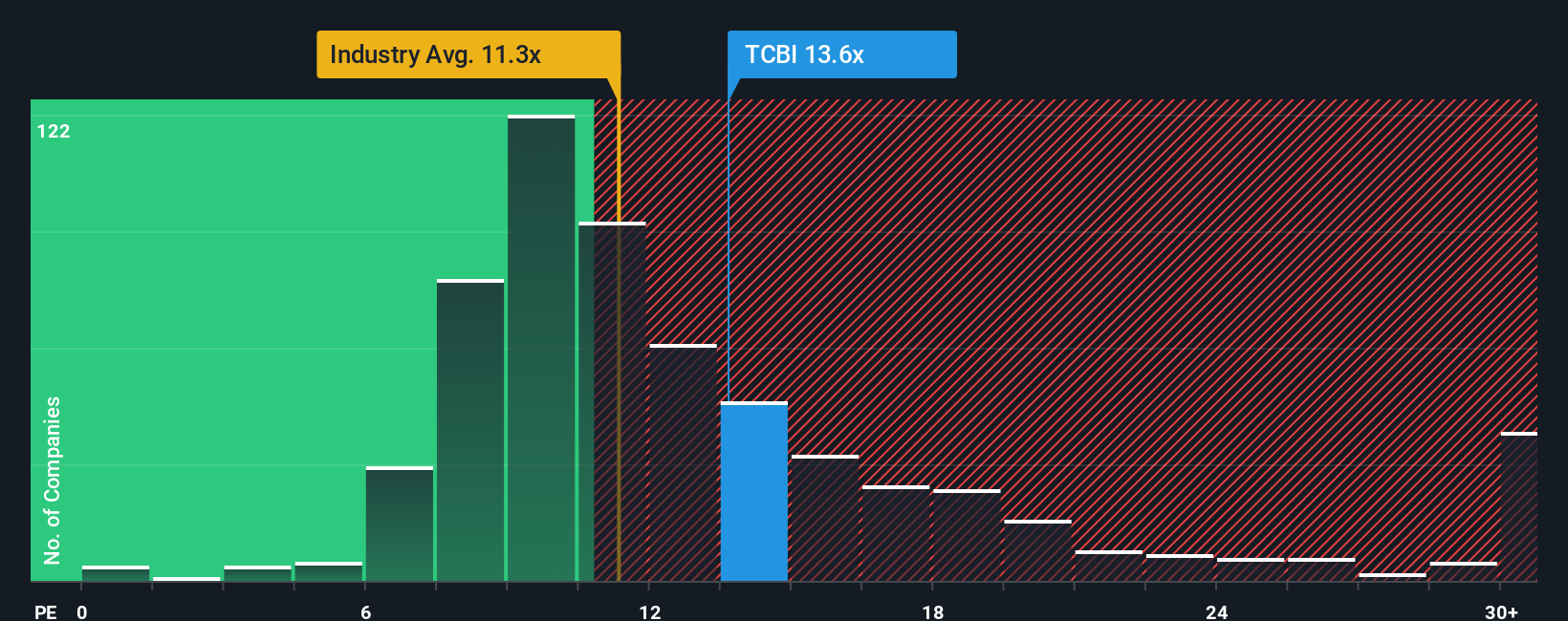

Looking from a different angle, Texas Capital Bancshares currently trades at a price-to-earnings ratio of 13.5x. This is above both the industry average of 10.9x and its peer group at 24.7x, but still higher than its estimated fair ratio of 11.8x. This gap suggests the market is pricing in more optimism than fundamentals alone, which means valuation risk could be higher if expectations are not met. Is the market right to expect more, or is caution the smarter play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Capital Bancshares Narrative

If you’d rather draw your own conclusions or want a hands-on look at the numbers, building a personal Texas Capital Bancshares narrative is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Texas Capital Bancshares.

Looking for More Investment Ideas?

Don’t miss your chance to get ahead by finding stock opportunities others overlook. Simply Wall Street’s tools make it easy to identify untapped trends and strong performers.

- Supercharge your portfolio with reliable cash flow by checking out these 18 dividend stocks with yields > 3% that offer attractive yields above 3%.

- Step into tomorrow’s healthcare breakthroughs and see which innovators are transforming medicine through these 31 healthcare AI stocks and leading the next wave in patient care.

- Capture potential upside with overlooked value by starting your search among these 906 undervalued stocks based on cash flows packed with strong fundamentals and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives