- United States

- /

- Banks

- /

- NasdaqGS:SYBT

Stock Yards Bancorp (SYBT): Evaluating Valuation as Fed Rate Cut Hopes Lift Regional Bank Sentiment

Reviewed by Simply Wall St

Stock Yards Bancorp (SYBT) is seeing its shares react alongside other regional banks after a softer inflation report renewed optimism for possible Federal Reserve rate cuts. This could potentially ease funding costs and improve loan demand for the sector.

See our latest analysis for Stock Yards Bancorp.

Stock Yards Bancorp’s share price has edged down in recent weeks, reflecting some of the cautious sentiment that has lingered across regional banks, but its 1-year total shareholder return of 3.5% shows that long-term holders are still ahead, especially considering an impressive 85% total return over five years. Recent moves are part of a sector-wide reaction as shifting expectations for interest rates and better loan demand drive investor narratives, with attention focused on any signs of improving fundamentals as macro conditions evolve.

If this latest rate-cut optimism has you watching banks more closely, now might be the perfect time to see what’s happening beyond the headlines. Broaden your search and uncover fast growing stocks with high insider ownership

With Stock Yards Bancorp trading at a discount to analyst targets and showing steady growth, the key question remains: is this an undervalued entry point, or has the market already priced in the anticipated turnaround?

Price-to-Earnings of 15.4x: Is it justified?

Stock Yards Bancorp trades at a price-to-earnings (P/E) ratio of 15.4x, putting it above the US Banks industry average of 11.2x and the estimated fair P/E of 11.5x. Despite a recent pullback, this suggests investors are paying a premium for future growth or quality compared to the broader sector.

The P/E ratio measures how much investors are willing to pay for each dollar of the company’s current earnings. For banks, it is a quick way to compare valuations across the industry and shows how expectations stack up.

Currently, Stock Yards Bancorp’s premium multiple may reflect confidence in its earnings growth, robust profit margin, and history of steady performance. However, with the P/E above both the industry and its fair regression-based level, there is limited margin of safety and the stock could be vulnerable if growth slows or sector sentiment turns.

In particular, the market could re-rate the shares closer to the 11.5x level implied by historical relationships, which could compress the premium now embedded in the price.

Explore the SWS fair ratio for Stock Yards Bancorp

Result: Price-to-Earnings of 15.4x (OVERVALUED)

However, if interest rates remain elevated for an extended period or if loan growth slows, Stock Yards Bancorp may struggle to justify its current premium valuation.

Find out about the key risks to this Stock Yards Bancorp narrative.

Another View: Discounted Cash Flow Says Undervalued

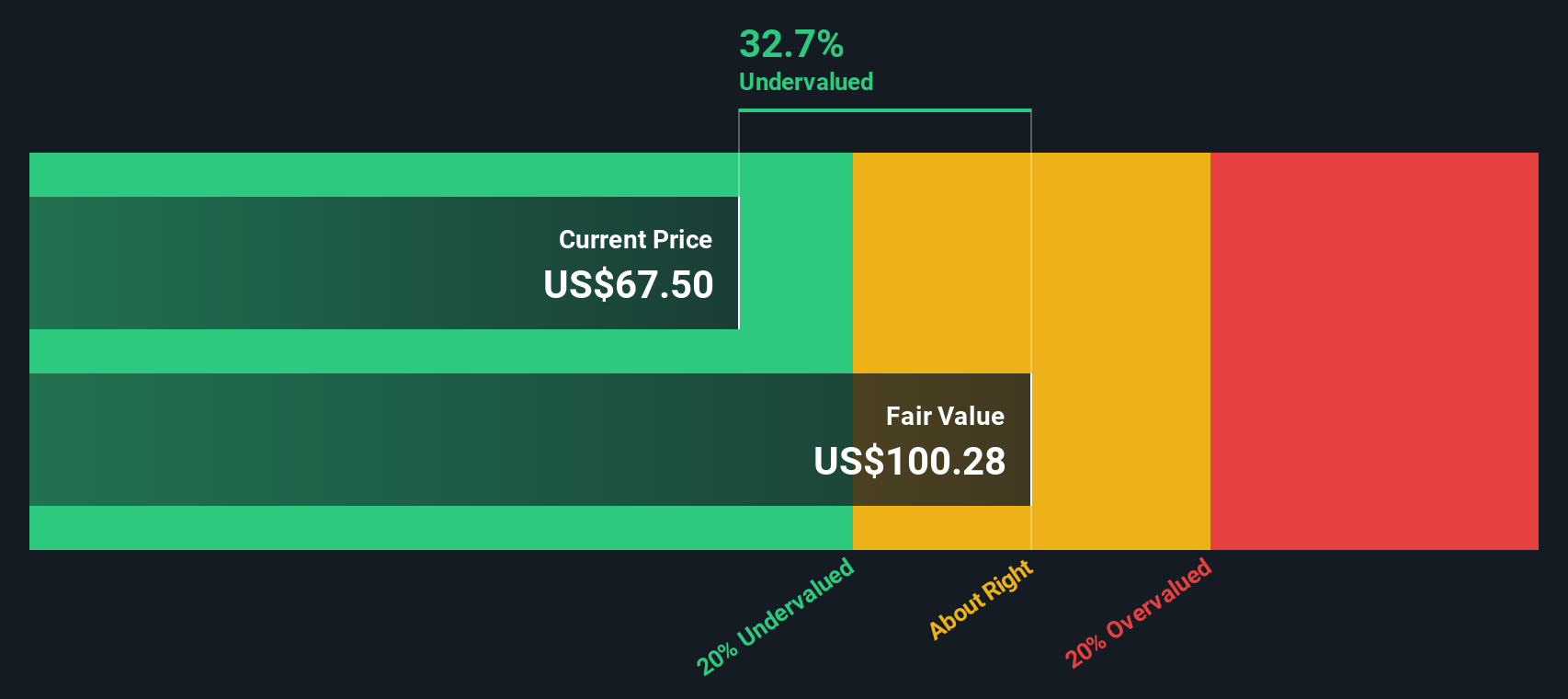

Looking from a different angle, our DCF model suggests Stock Yards Bancorp is trading about 33% below its estimated fair value of $100.28 per share. This places the current price firmly in undervalued territory. Could the market be underestimating its earnings potential, or is there more risk than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stock Yards Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stock Yards Bancorp Narrative

If you want to see different angles or draw your own conclusions, it’s quick and easy to dig into the numbers and shape a narrative yourself. Do it your way

A great starting point for your Stock Yards Bancorp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investment Opportunities?

Smart investors always keep an eye on what’s ahead, and the best gains often come from acting before the crowd. Don’t miss your edge; expand your horizon with these powerful, hand-picked screeners.

- Tap into future-shaping breakthroughs in artificial intelligence by exploring these 26 AI penny stocks, which are revolutionizing entire industries with innovative technology and automation.

- Secure more consistent income with these 21 dividend stocks with yields > 3%, where you’ll find stocks boasting strong yields and robust fundamentals to boost your portfolio.

- Catalyze your returns with these 3575 penny stocks with strong financials, which have the financial health and potential to become market standouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYBT

Stock Yards Bancorp

Operates as a holding company for Stock Yards Bank & Trust Company that provides various financial services for individuals, corporations, and others in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives