- United States

- /

- Banks

- /

- NasdaqGS:STBA

How S&T Bancorp (STBA) Dividend Hike and Board Addition May Shape Shareholder Value

Reviewed by Sasha Jovanovic

- On October 30, 2025, S&T Bancorp, Inc. announced that Stephanie N. Doliveira, a seasoned executive with more than 25 years of people-centric leadership and risk oversight at Sheetz, Inc., has joined its board of directors and was also appointed to the board of S&T Bank.

- This move supplements the Board’s expertise in compliance, employee development, and enterprise risk, while coinciding with a 5.88% increase in S&T Bancorp’s quarterly dividend to US$0.36 per share.

- We'll explore how the dividend increase signals management's confidence in S&T Bancorp’s financial position and commitment to shareholder returns.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

S&T Bancorp Investment Narrative Recap

To be a shareholder in S&T Bancorp, you need to have confidence in the bank's disciplined credit risk management, reliable asset quality, and consistent deposit growth as key drivers for long-term stability. The recent board appointment of Stephanie N. Doliveira adds expertise in risk and people management, but does not materially alter the main short-term catalyst, which remains the company’s ability to defend net interest margins in a competitive and changing regional market; nor does it shift the principal risk arising from increased compliance costs as the bank expands.

Of the recent developments, the 5.88% quarterly dividend increase stands out, highlighting management’s confidence in S&T Bancorp's balance sheet and its commitment to returning capital to shareholders. This action could reinforce the bank’s reputation for prudent capital management, but it leaves underlying structural challenges in the operating environment unaddressed.

But with competition from digital-first fintechs intensifying, investors should be aware that...

Read the full narrative on S&T Bancorp (it's free!)

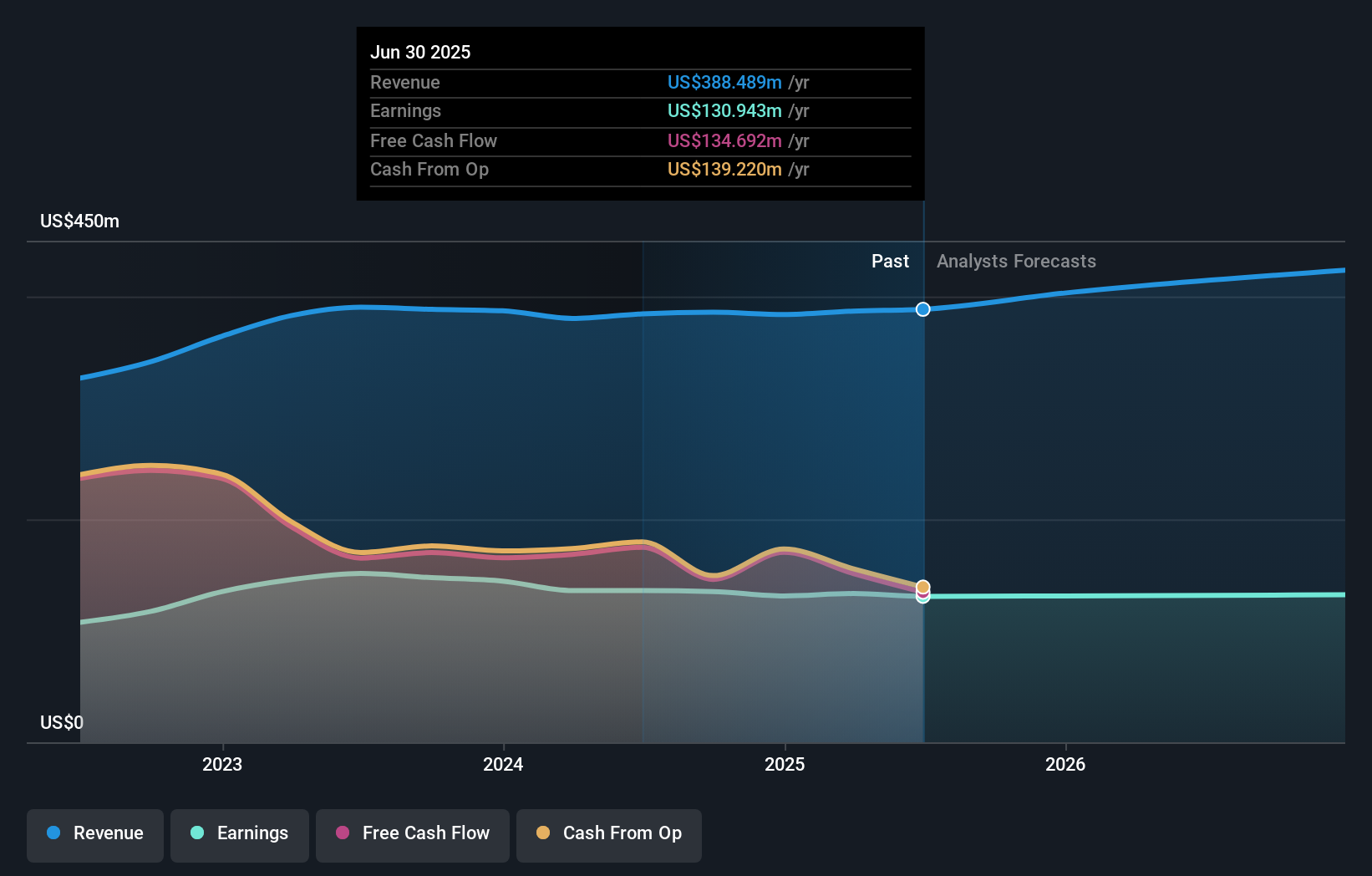

S&T Bancorp's outlook anticipates $457.8 million in revenue and $131.6 million in earnings by 2028. This projection is based on annual revenue growth of 5.6% and an increase in earnings of $0.7 million from the current $130.9 million.

Uncover how S&T Bancorp's forecasts yield a $41.17 fair value, a 8% upside to its current price.

Exploring Other Perspectives

All fair value estimates from the Simply Wall St Community cluster at US$41.17 per share across 1 submission. While these single-point views suggest consensus, risks from increased regulatory pressures could impact the bank’s cost structure and return profile, shaping future shareholder outcomes. Explore the range of viewpoints shared by fellow investors.

Explore another fair value estimate on S&T Bancorp - why the stock might be worth just $41.17!

Build Your Own S&T Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&T Bancorp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free S&T Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&T Bancorp's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STBA

S&T Bancorp

Operates as the bank holding company for S&T Bank that provides retail and commercial banking products and services to consumer, commercial, and small business in Pennsylvania and Ohio.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives