- United States

- /

- Banks

- /

- NasdaqGS:STBA

A Fresh Look at S&T Bancorp (STBA) Valuation Following Recent Share Price Pullback

Reviewed by Simply Wall St

S&T Bancorp (STBA) shares have slipped a bit over the past week, giving investors a chance to consider whether recent price moves align with the bank’s long-term fundamentals. Let’s take a fresh look at what is driving its valuation.

See our latest analysis for S&T Bancorp.

S&T Bancorp’s share price pulled back more than 4% over the past week, despite gaining 5.7% in the previous month. This suggests shifting investor sentiment after a stretch of modest long-term growth. Notably, its five-year total shareholder return stands at an impressive 91%, even as the one-year total return has lagged at -9%.

If you’re weighing other ways to seize opportunity in today’s market, it could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

Given S&T Bancorp’s pullback and its steep discount to intrinsic value, the key question now is whether this is a clear value play that the market is overlooking, or if future growth is already priced in for investors.

Most Popular Narrative: 10.2% Undervalued

Compared to its last close price of $36.98, the most widely followed narrative places S&T Bancorp’s fair value at $41.17, reflecting meaningful upside driven by robust business fundamentals and future earnings expectations. The narrative draws on consensus analyst projections with a 6.4% discount rate.

The long-term trend towards greater regulatory scrutiny and compliance obligations is likely to drive up S&T's operating costs and put continued pressure on net margins, particularly as the company exceeds the $10 billion asset threshold and incurs the Durbin amendment impact.

What’s the engine beneath this valuation? Behind that attractive fair value lies an ambitious outlook for annual growth, future margins, and a premium profit multiple not often seen in regionals. Unpack the narrative to see what numbers could make or break this bullish target.

Result: Fair Value of $41.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, S&T Bancorp's strong asset quality and consistent deposit growth could help balance some of the competitive and regulatory pressures analysts highlight.

Find out about the key risks to this S&T Bancorp narrative.

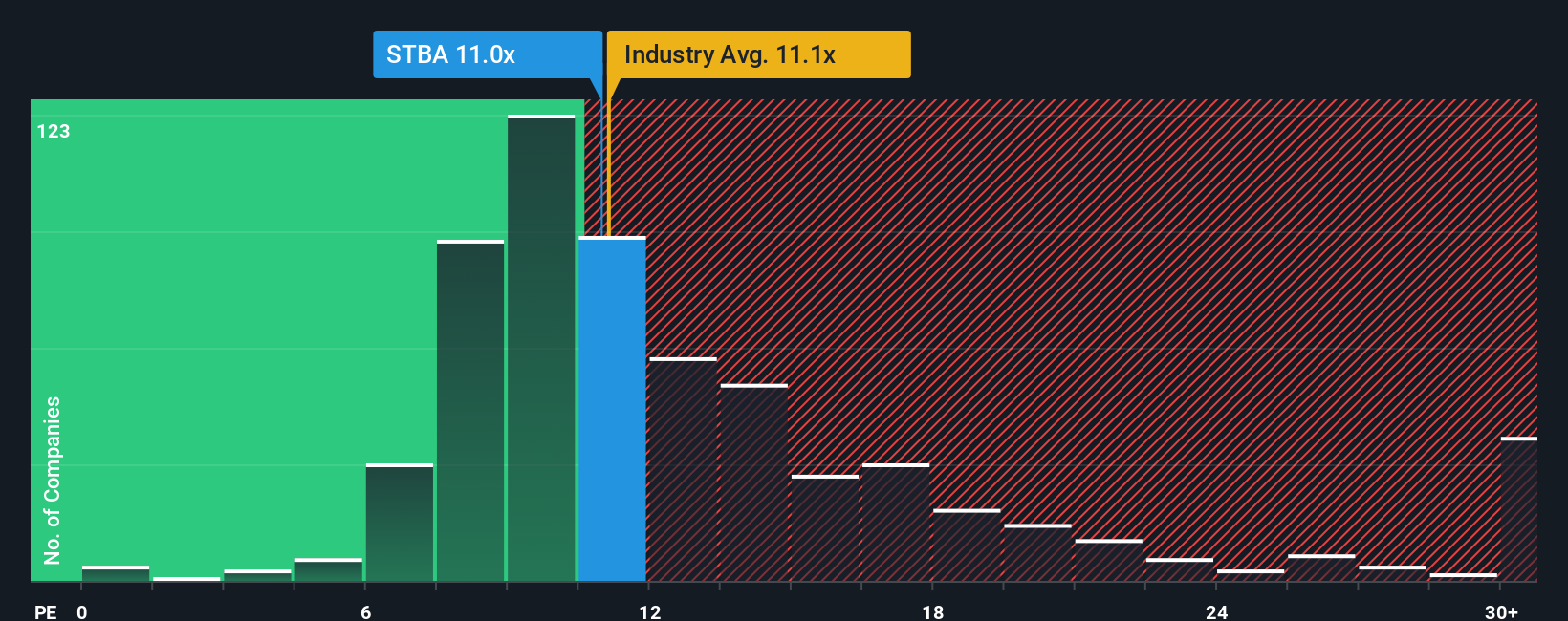

Another View: Examining Market Multiples

Setting aside the analyst-driven fair value, S&T Bancorp’s current price-to-earnings ratio of 10.6x is a bit lower than both the US Banks industry average of 11.2x and the peer average of 12.8x. However, it is slightly above its fair ratio of 9.9x, which is the level history suggests the market could move toward.

This suggests shares are a good value compared to industry peers, but only fair value when considering long-term trends. Should investors expect a rebound toward the averages, or could the real opportunity be elsewhere?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own S&T Bancorp Narrative

If the consensus view does not match your own perspective or you want to dig deeper, you can quickly explore the numbers yourself and shape your own story, often in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding S&T Bancorp.

Looking for More Smart Investment Ideas?

Expand your horizons and stay ahead of the market by checking out innovative companies and hidden gems that other investors might overlook. Don’t miss out on these compelling opportunities:

- Benefit from stable income streams with these 18 dividend stocks with yields > 3%, which offers yields above 3% backed by solid business fundamentals.

- Tap into the rising potential of next-generation healthcare by evaluating breakthroughs from these 31 healthcare AI stocks, which enhance diagnostics, drug discovery, and patient care.

- Capitalize on disruptive technology shifts by reviewing these 27 AI penny stocks, driving artificial intelligence advancements across multiple industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STBA

S&T Bancorp

Operates as the bank holding company for S&T Bank that provides retail and commercial banking products and services to consumer, commercial, and small business in Pennsylvania and Ohio.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives