- United States

- /

- Banks

- /

- NasdaqGS:STBA

A Fresh Look at S&T Bancorp (STBA) Valuation Following Earnings Beat and Dividend Increase

Reviewed by Simply Wall St

S&T Bancorp (STBA) has gained attention after announcing its third quarter earnings. The company reported steady revenue growth along with a boost in its quarterly dividend. These latest results and the dividend increase present some intriguing signals for shareholders.

See our latest analysis for S&T Bancorp.

S&T Bancorp shares have seen modest movement lately, with the stock closing at $36.64 and a 1-year total shareholder return just above breakeven. Despite market ups and downs, the company’s steady operational progress is reflected in a strong five-year total return of nearly 130%. This indicates that long-term investors have been rewarded even as short-term momentum shifts with each earnings cycle and leadership update.

If a bank’s combination of resilience and opportunity appeals to you, now might be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading at a discount to analyst price targets and fundamentals trending up, the real question is whether S&T Bancorp is currently undervalued or if the market has already factored in the company’s future growth prospects.

Most Popular Narrative: 11% Undervalued

The most widely followed narrative values S&T Bancorp notably above the latest closing price, suggesting that current market sentiment may not fully reflect projected future fundamentals. This view sets the stage for a closer look at the factors supporting such a premium fair value.

*Investors may be overlooking the threat posed by digital-first fintech competitors, which are rapidly gaining market share and could erode S&T Bancorp's customer acquisition rates and fee income growth, ultimately putting downward pressure on future revenue and margins.*

Curious why analysts expect profit margins to shrink while projecting earnings stability? The narrative is built around a balancing act between rising competition and a foundation of steady asset quality. Dive in to discover the surprising assumptions behind this valuation and see what numbers drive their fair value projection.

Result: Fair Value of $41.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, S&T Bancorp’s strong asset quality and robust loan growth could offset competitive threats. These factors may support earnings and resilience even if risks materialize.

Find out about the key risks to this S&T Bancorp narrative.

Another View: What Do Market Ratios Say?

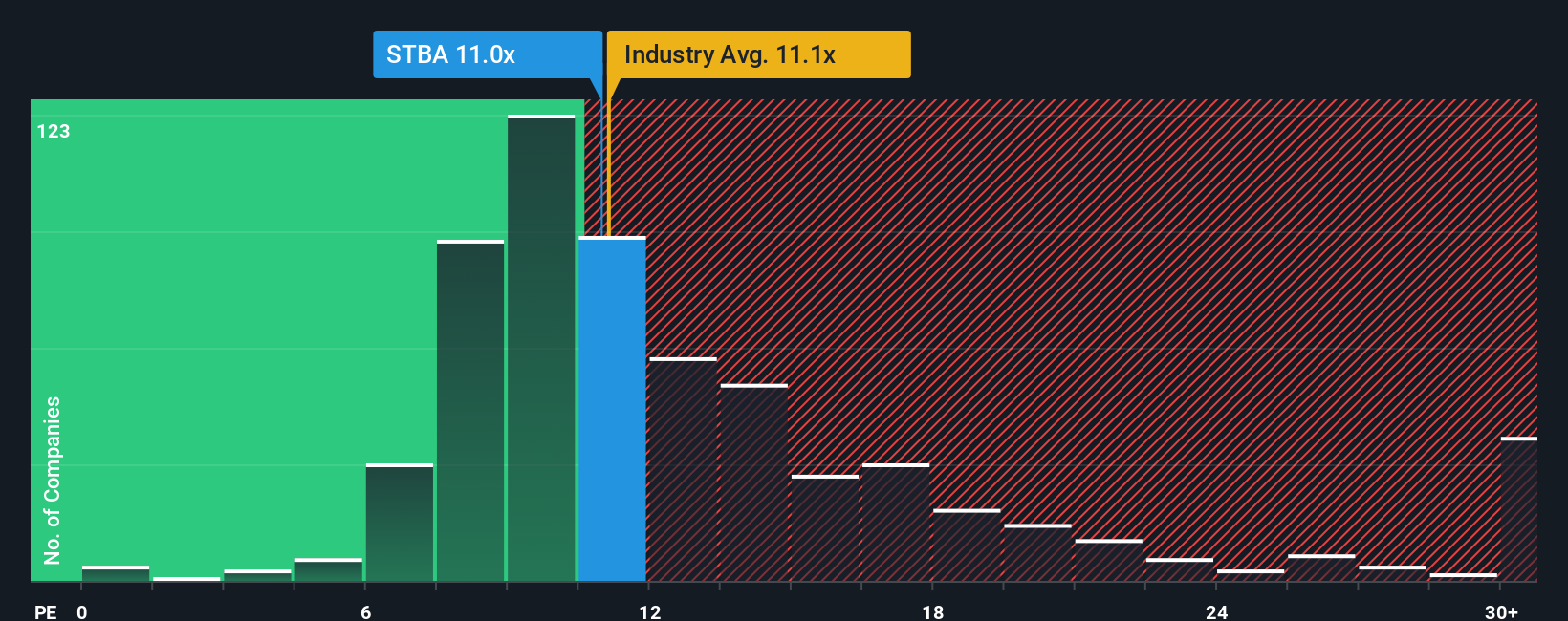

Setting aside analyst forecasts, the company’s price-to-earnings ratio stands at 10.5x, which is slightly lower than the US Banks industry average of 11x and well below the peer average of 12.9x. However, it sits above the fair ratio of 9.9x. This suggests investors may already be factoring in some future gains, as well as a possible premium for stability. Does this more cautious view highlight hidden risks, or does it miss longer-term upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own S&T Bancorp Narrative

If you see the story differently or want to examine the numbers firsthand, you can shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding S&T Bancorp.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Stay ahead by tracking sectors positioned to spark the next wave of returns. Start now to avoid missing out.

- Capitalize on high-yield opportunities and secure income with these 22 dividend stocks with yields > 3% that consistently offer attractive payouts exceeding typical market returns.

- Ride the future of finance and see how these 81 cryptocurrency and blockchain stocks are influencing innovations in digital assets and modern payment platforms.

- Spot tomorrow’s tech trailblazers by searching these 26 AI penny stocks blending artificial intelligence with real-world advantages and industry-changing solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STBA

S&T Bancorp

Operates as the bank holding company for S&T Bank that provides retail and commercial banking products and services to consumer, commercial, and small business in Pennsylvania and Ohio.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives