- United States

- /

- Banks

- /

- NasdaqGS:SHBI

Shore Bancshares (SHBI) Margin Expansion Reinforces Bullish Narratives Despite Growth Slowdown Forecast

Reviewed by Simply Wall St

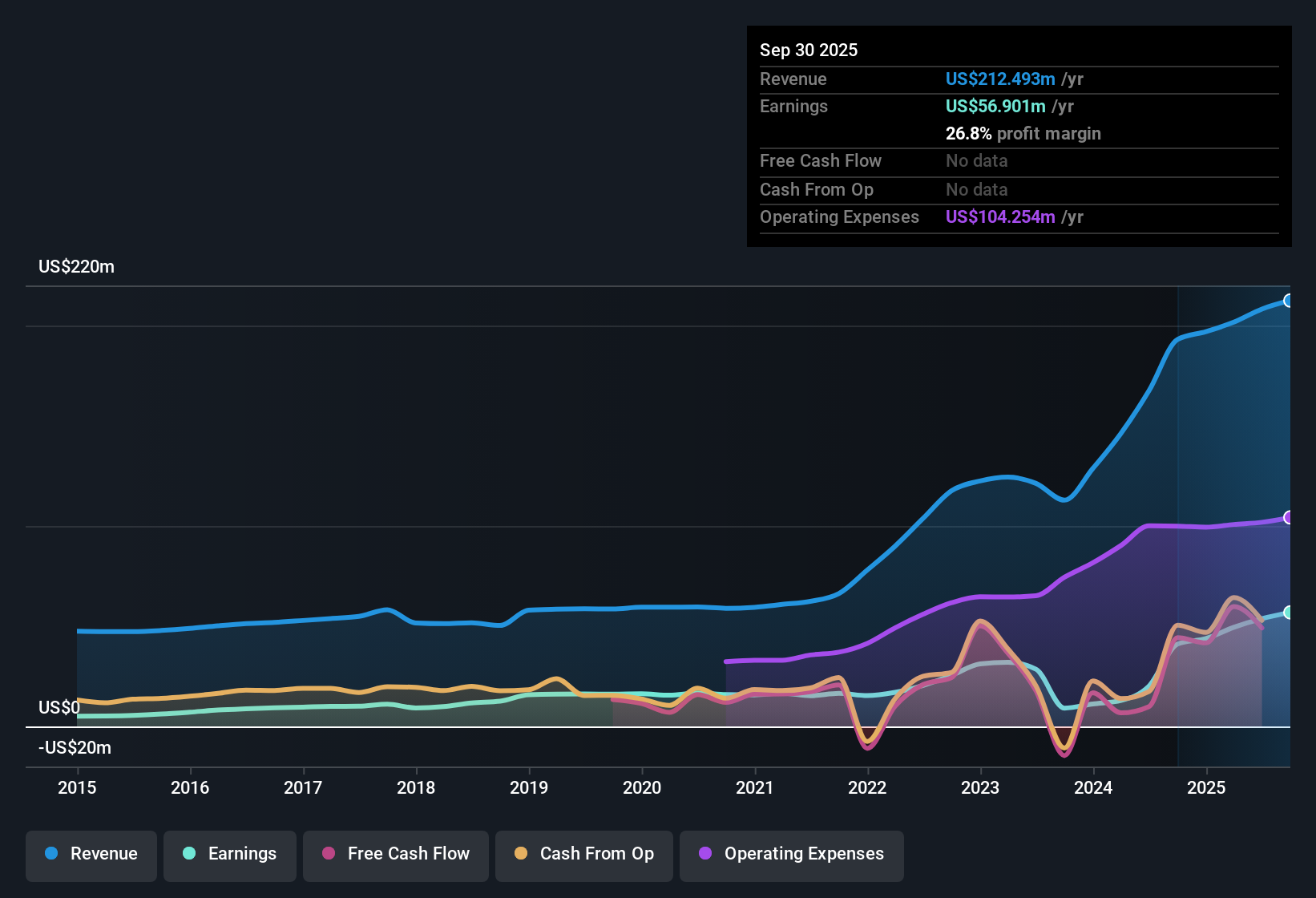

Shore Bancshares (SHBI) posted net profit margins of 26.8%, up from last year’s 21.3%, with earnings growth of 38.5% over the past year. This performance is well ahead of its five-year average of 26% per year. With a Price-to-Earnings Ratio of just 9.3x, notably lower than both peer and US bank industry averages, and dividends that remain attractive, the company’s results highlight continued profit and revenue growth for investors. However, forecasts show earnings growth slowing to 5.8% annually, signaling that while profitability remains strong, momentum could moderate going forward.

See our full analysis for Shore Bancshares.Next, we’ll see how these figures compare to the most-watched narratives about SHBI and what that means for the path ahead. Some expectations may be confirmed, while others might be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Peers

- Net profit margins reached 26.8%, now standing above last year’s 21.3% and comfortably outpacing typical industry and peer benchmarks.

- Sustained margin performance heavily supports optimism around the company's resilient profit model, even as its five-year average earnings growth of 26% per year slows.

- Analysts tracking recent filings point to these strong margins and 38.5% annual earnings growth as evidence that SHBI has capitalized on scale and banking efficiency, reinforcing bullish claims about its high-quality earnings base.

- Surprisingly for investors, this margin improvement comes even as the company prepares for slower forecasted growth of 5.8% per year. This raises questions about whether such profitability can be consistently sustained if top-line growth moderates.

Valuation Gap Drives Attention

- The Price-to-Earnings Ratio sits at just 9.3x, well below both the peer group average of 16.3x and the broader US banks industry at 11.2x, signaling a notable discount despite recent share gains to $15.75.

- This relative undervaluation highlights a tension noted in prevailing analysis, as investors weigh whether the discounted multiple reflects misunderstood strengths or simply factors in a projected growth slowdown.

- Consensus narrative notes that, although forward earnings growth is expected to taper to 5.8% per year, which is significantly lower than the US market average of 15.5%, the company’s valuation may already reflect caution. This leaves room for upside if profit quality holds up.

- Notably, even with the stock trading above its internally estimated DCF fair value of $14.69, there is little evidence of excessive exuberance. This suggests investors remain focused on margin stability rather than chasing momentum.

Dividends Stay Attractive Amid Slower Growth

- Dividend attractiveness remains a standout, as the company continues to emphasize payout quality in the absence of flagged material risks.

- Bullish arguments lean on the combination of historically robust earnings and reliable dividends to justify continued interest.

- Supporters highlight how the company’s improved margin and earnings base enable it to maintain attractive dividends as a core pillar of value, even as growth rates moderate in forecasts.

- The positive risk-reward balance, with ongoing revenue and profit growth, gives bulls conviction that SHBI’s income stream and valuation discount could draw renewed investor attention moving forward.

See our latest analysis for Shore Bancshares.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shore Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Shore Bancshares maintains solid profit margins and dividends, its sharply slowing earnings growth could make long-term returns less predictable for investors.

If you want to focus on consistent expansion, use our stable growth stocks screener (2099 results) to discover companies delivering steady earnings and revenue growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHBI

Shore Bancshares

Operates as a bank holding company for the Shore United Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives