- United States

- /

- Banks

- /

- NasdaqGS:RBCA.A

Republic Bancorp (RBCA.A): Assessing Valuation as Net Interest Income Forecasts Pressure Investor Sentiment

Reviewed by Simply Wall St

Republic Bancorp (RBCA.A) has come under increased market scrutiny following forecasts that its net interest income could dip by 2% over the next year. This signals potential challenges for near-term growth.

See our latest analysis for Republic Bancorp.

While Republic Bancorp’s recent outlook has prompted some investor caution, the share price tells a broader story. The stock is down 7.6% over the past month and 4.8% year-to-date, and its total shareholder return for the past year sits at -11.7%. Looking further back, long-term holders have still doubled their money over five years, with a total shareholder return of 109% that outpaces typical industry peers. This suggests that recent volatility is weighing on short-term sentiment, even as the company’s multi-year performance remains robust.

If you’re curious about other compelling ideas beyond the usual suspects, this is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

The key question for investors now is whether Republic Bancorp’s recent dip makes it an undervalued opportunity, or if the market has already factored in the expected downturn and future growth prospects.

Price-to-Earnings of 10.1x: Is it justified?

Republic Bancorp’s shares are currently trading at a price-to-earnings (P/E) ratio of 10.1x, which is lower than the average for its closest listed peers. With a last close price of $65.67, the stock appears relatively undervalued on this measure compared to the sector.

The price-to-earnings ratio tells investors how much they are paying for each dollar of company earnings. For banks, a lower P/E may suggest lower market expectations for growth or quality, or it can hint at a discount opportunity if future prospects improve.

Republic Bancorp is trading below both the peer average P/E of 12.3x and the broader US banks industry average of 11x. The market is assigning a more conservative multiple than most direct competitors. However, when benchmarked against the estimated fair price-to-earnings ratio of 8.9x, Republic Bancorp’s current valuation looks somewhat rich. This suggests the market could adjust to a lower multiple if fundamentals falter further.

Explore the SWS fair ratio for Republic Bancorp

Result: Price-to-Earnings of 10.1x (UNDERVALUED)

However, persistent declines in annual net income growth and recent negative shareholder returns could suggest that market caution around Republic Bancorp is not unfounded.

Find out about the key risks to this Republic Bancorp narrative.

Another View: SWS DCF Model Shows Major Discount

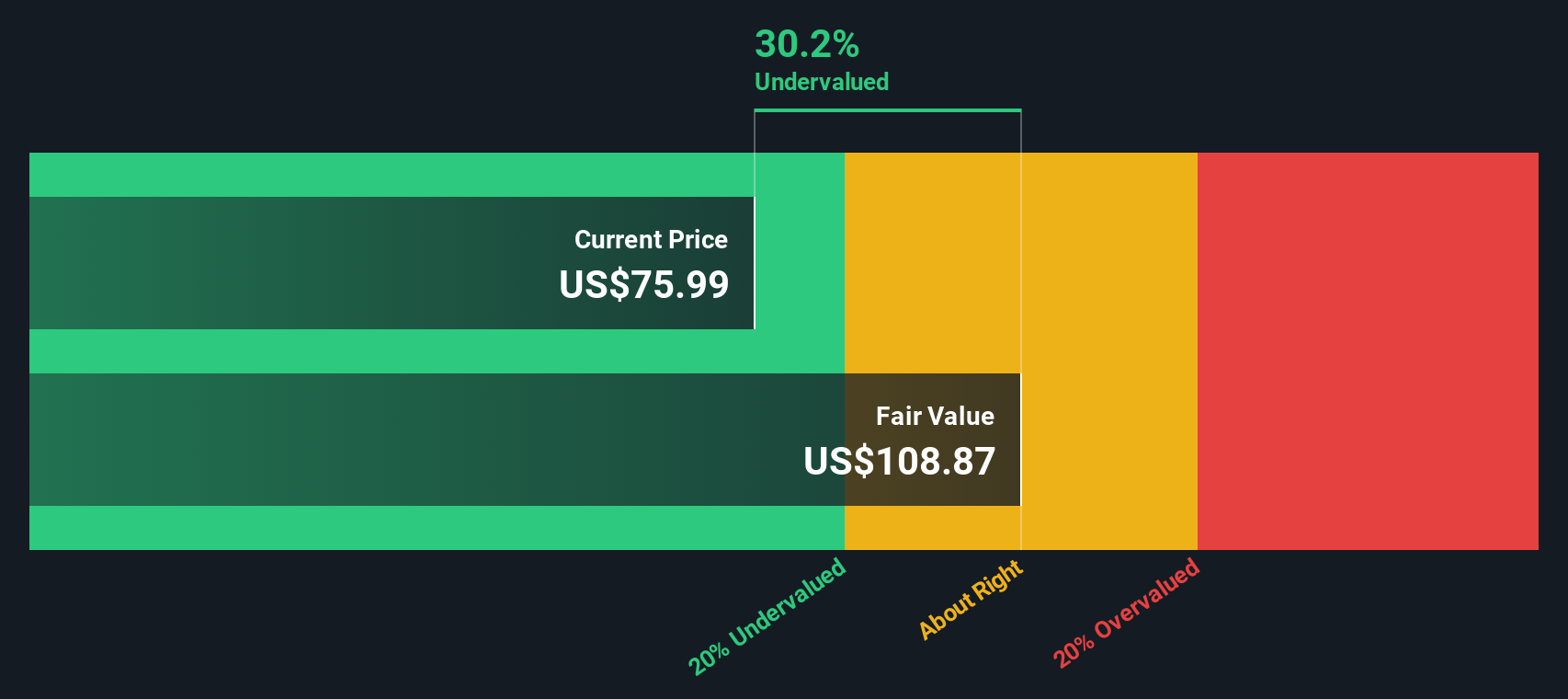

Looking at Republic Bancorp through the lens of our SWS DCF model provides a strikingly different perspective. The DCF suggests shares are trading around 40% below fair value, which implies a significant undervaluation if our cash flow projections prove accurate. Such a wide gap creates both upside potential and uncomfortable questions: which story should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Republic Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Republic Bancorp Narrative

If you’re interested in drawing your own conclusions or want to dig deeper into the company’s numbers, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your Republic Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment opportunities?

Smart investors are always seeking fresh ideas. Don’t let great opportunities pass you by. Simply Wall Street’s powerful screener makes it easy to find exciting stocks suited to your goals.

- Capitalize on undervalued potential by screening for companies trading below their intrinsic value through these 870 undervalued stocks based on cash flows.

- Harness growing demand for healthcare innovation by targeting trailblazers in medical artificial intelligence with these 32 healthcare AI stocks.

- Secure reliable income streams by finding top picks among those delivering generous yields using these 16 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBCA.A

Republic Bancorp

Operates as a bank holding company for Republic Bank & Trust Company that provides various banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives