- United States

- /

- Banks

- /

- NasdaqGM:QCRH

Will a Fresh Dividend and Rate Cut Hopes Shift QCR Holdings' (QCRH) Investment Narrative?

Reviewed by Sasha Jovanovic

- On November 19, 2025, QCR Holdings, Inc. announced its Board of Directors had declared a US$0.06 per share cash dividend, payable January 7, 2026, to shareholders of record as of December 23, 2025.

- This move coincided with market optimism for an interest rate cut, which particularly boosted regional banks like QCR Holdings due to expectations of improved lending margins.

- Now, we'll examine how rising rate cut hopes and QCR's new dividend shape the company's forward-looking investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

QCR Holdings Investment Narrative Recap

To be a QCR Holdings shareholder right now means believing the company will leverage its strong Midwest presence, efficient core banking systems, and specialty lending platforms, especially LIHTC lending, to foster resilient earnings even as industry competition and regulatory thresholds loom. The new US$0.06 per share dividend, while reaffirming management’s focus on shareholder returns, does not fundamentally shift the short-term catalyst of interest rate policy, which continues to be the most meaningful near-term driver, nor does it offset substantial risks tied to regulatory changes and sector-specific lending exposures.

Among recent announcements, QCR Holdings' third quarter 2025 earnings report best aligns with investors’ near-term focus. This update showed increased net interest income and improving net charge-offs following declines in the M2 equipment finance portfolio, providing context for both the dividend’s sustainability and how credit trends could amplify or buffer the stock’s reaction to macroeconomic shifts.

However, while investor optimism around interest rate cuts may provide short-term support, the company’s outsized dependence on LIHTC lending means any adverse regulatory or funding surprise in this area is a material risk investors should be mindful of...

Read the full narrative on QCR Holdings (it's free!)

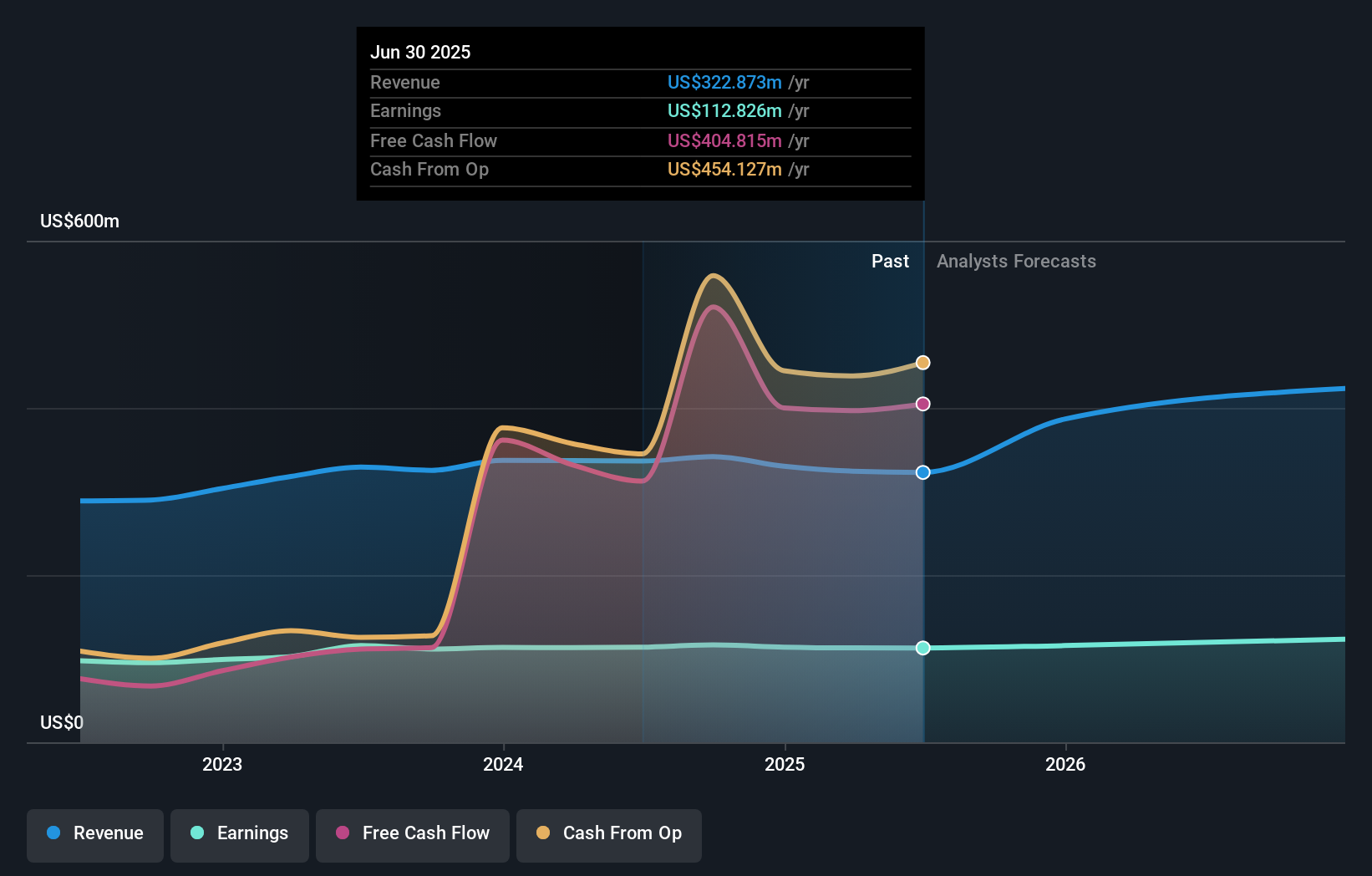

QCR Holdings' narrative projects $549.9 million revenue and $134.4 million earnings by 2028. This requires 19.4% yearly revenue growth and an increase of $21.6 million in earnings from $112.8 million.

Uncover how QCR Holdings' forecasts yield a $89.30 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate QCR Holdings’ fair value in a single band at US$89.30 based on one viewpoint. This contrasts with analyst concerns about heavy reliance on LIHTC lending, highlighting why it’s worth comparing several perspectives when evaluating risk and upside.

Explore another fair value estimate on QCR Holdings - why the stock might be worth just $89.30!

Build Your Own QCR Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QCR Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free QCR Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QCR Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QCR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QCRH

QCR Holdings

A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success