- United States

- /

- Banks

- /

- NasdaqGM:QCRH

QCR Holdings (QCRH): Margin Expansion Reinforces Bullish Narratives Despite Slower Earnings Growth

Reviewed by Simply Wall St

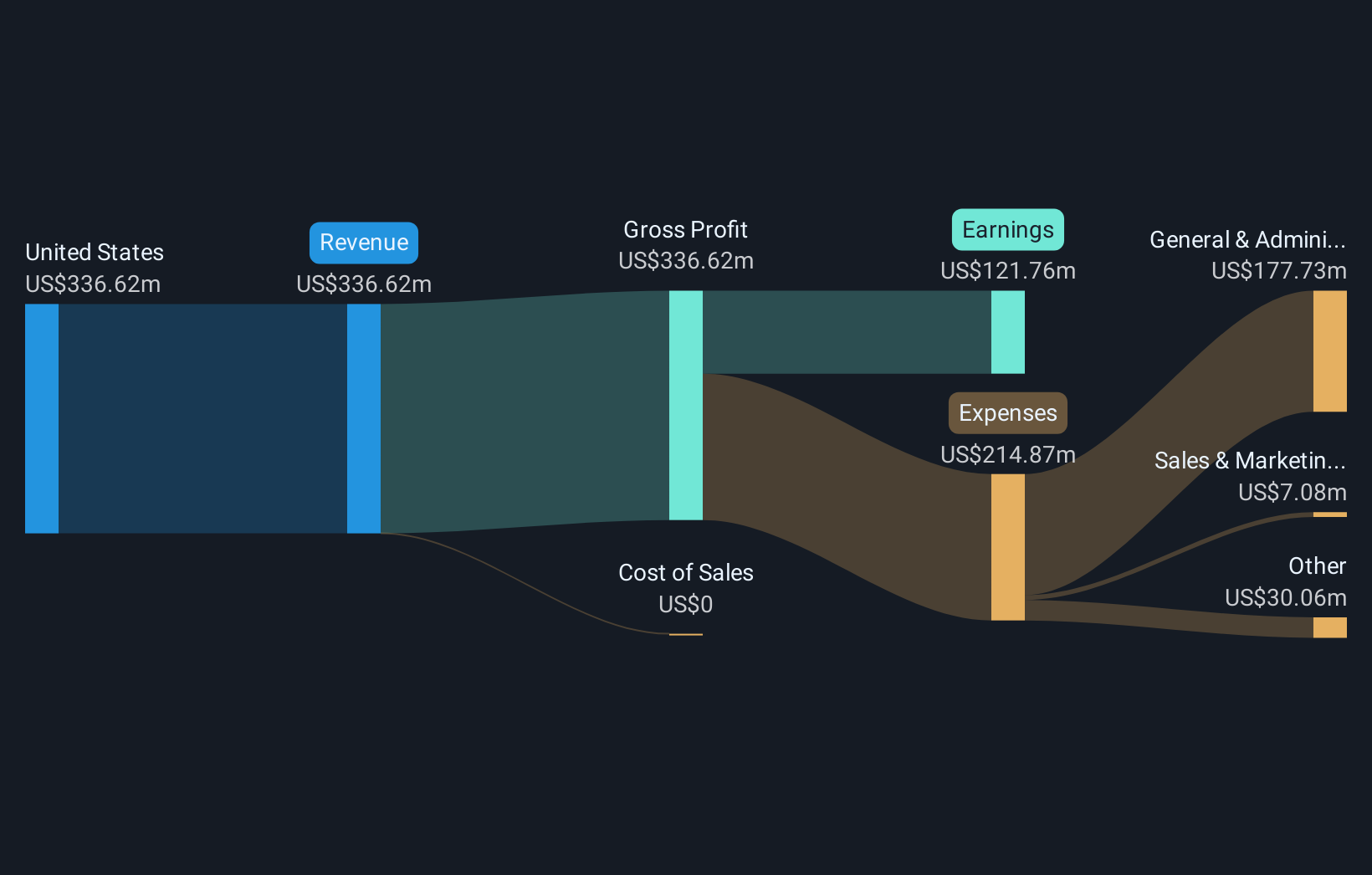

QCR Holdings (QCRH) delivered average annual earnings growth of 10.9% over the past five years. Most recently, earnings growth moderated to 4.5%. Net profit margins climbed to 36.2%, up from 34.1% a year ago. Looking ahead, revenue is forecast to grow at 12.2% per year, outpacing the broader US market. However, earnings growth is expected to lag the industry. Following these results, investors are likely to see a combination of margin improvement and robust top-line prospects, set against more modest earnings growth in the near term.

See our full analysis for QCR Holdings.The next section takes these numbers and weighs them against the most widely discussed market narratives, showing where the consensus view is confirmed and where surprises might emerge.

See what the community is saying about QCR Holdings

Margin Expansion Counters Slower Earnings Growth

- Net profit margins rose to 36.2%, up from 34.1% last year. This comes even as average annual earnings growth moderated to 4.5% compared to a 10.9% five-year average.

- The analysts' consensus view highlights that digital transformation and a pivot toward wealth management are expected to boost margins further and steady earnings in the long run.

- Consensus narrative notes ongoing investment in new banking technology could reduce expenses and lift margins over several years. This potentially offsets slowdowns in bottom-line growth.

- This expansion in net margin supports the thesis that operational improvements are taking root, contradicting concerns about deteriorating profitability as growth slows.

Revenue Projections Outpace Industry but Pressure on Margins Ahead

- Revenue is forecast to grow at 12.2% per year, which is ahead of the US market's 10% annual forecast. However, analysts predict profit margins will fall from 34.9% today to 24.4% in three years.

- Analysts' consensus view acknowledges that strong demand for affordable housing and favorable Midwest trends should sustain robust loan and noninterest income growth. Nevertheless, anticipated margin compression could limit how much of that revenue translates to earnings.

- Despite outsized revenue growth projections, consensus flags QCR's heavy reliance on LIHTC lending and the risk that political or regulatory shifts could disrupt the revenue pipeline.

- While top-line momentum is strong, profit conversion may be challenged if the company cannot maintain current net margin levels as forecasted.

Discounted Valuation Signals Market Skepticism

- QCR Holdings trades at a 10.2x PE ratio, which is below both the industry average (11.3x) and peer average (11x). It also remains well below its DCF fair value of $105.08, with a current share price at $73.76.

- According to the analysts' consensus, the stock’s valuation gap suggests that, while business fundamentals are solid, the market is pricing in concern about whether strong underlying revenue and margin trends will hold up under sector headwinds.

- With no major risk statements currently flagged, the main narrative tension centers on how much confidence investors place in management’s ability to execute on digital transformation and mitigate future regulatory cost pressures.

- This discount to fair value will draw interest from value-focused investors but also invites scrutiny of the sustainability of the company’s growth drivers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for QCR Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there’s another angle to these numbers? Take just a few minutes to create and share your unique take on QCR Holdings, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding QCR Holdings.

See What Else Is Out There

QCR Holdings faces pressure as profit margins are expected to contract significantly, which calls into question the sustainability of its earnings growth story.

Concerned about inconsistent profitability? Use stable growth stocks screener (2090 results) to discover companies delivering reliable revenue and earnings growth, backed by more predictable performance across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QCR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QCRH

QCR Holdings

A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives