- United States

- /

- Banks

- /

- NasdaqGM:QCRH

QCR Holdings (QCRH) Is Up 6.1% After Record Q3 Results and New Buyback Plan – What’s Changed

Reviewed by Sasha Jovanovic

- QCR Holdings, Inc. recently reported record third-quarter results for the period ended September 30, 2025, with net interest income rising to US$64.8 million and net income climbing to US$36.71 million, while also announcing a new share repurchase program of up to 1.7 million shares.

- Management highlighted substantial growth in capital markets revenue and the continued progress of its digital transformation, backed by disciplined credit performance and strong loan growth.

- Let's explore how QCR Holdings' record earnings growth and new buyback plan reshape the company's investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

QCR Holdings Investment Narrative Recap

For investors considering QCR Holdings, the core story is about the company’s ability to sustain revenue growth through its digital transformation and its strong position in LIHTC lending, while maintaining disciplined credit performance. The recent record third-quarter earnings reinforce the primary short-term catalyst: robust loan growth and improved capital markets revenue. However, the biggest current risk, persistent challenges or setbacks in completing its digital transformation relative to faster-moving fintech peers, remains largely unchanged by this quarter’s results.

Of the recent company announcements, the launch of a new share buyback program for up to 1.7 million shares stands out, underscoring QCR Holdings' focus on shareholder returns. This move aligns with the positive momentum from the latest earnings, yet the long-term success of their capital allocation will still hinge on their execution of digital investments and core business expansion strategies.

On the other hand, investors should be aware of the ongoing risk that QCR Holdings is only "halfway through" its digital transformation and...

Read the full narrative on QCR Holdings (it's free!)

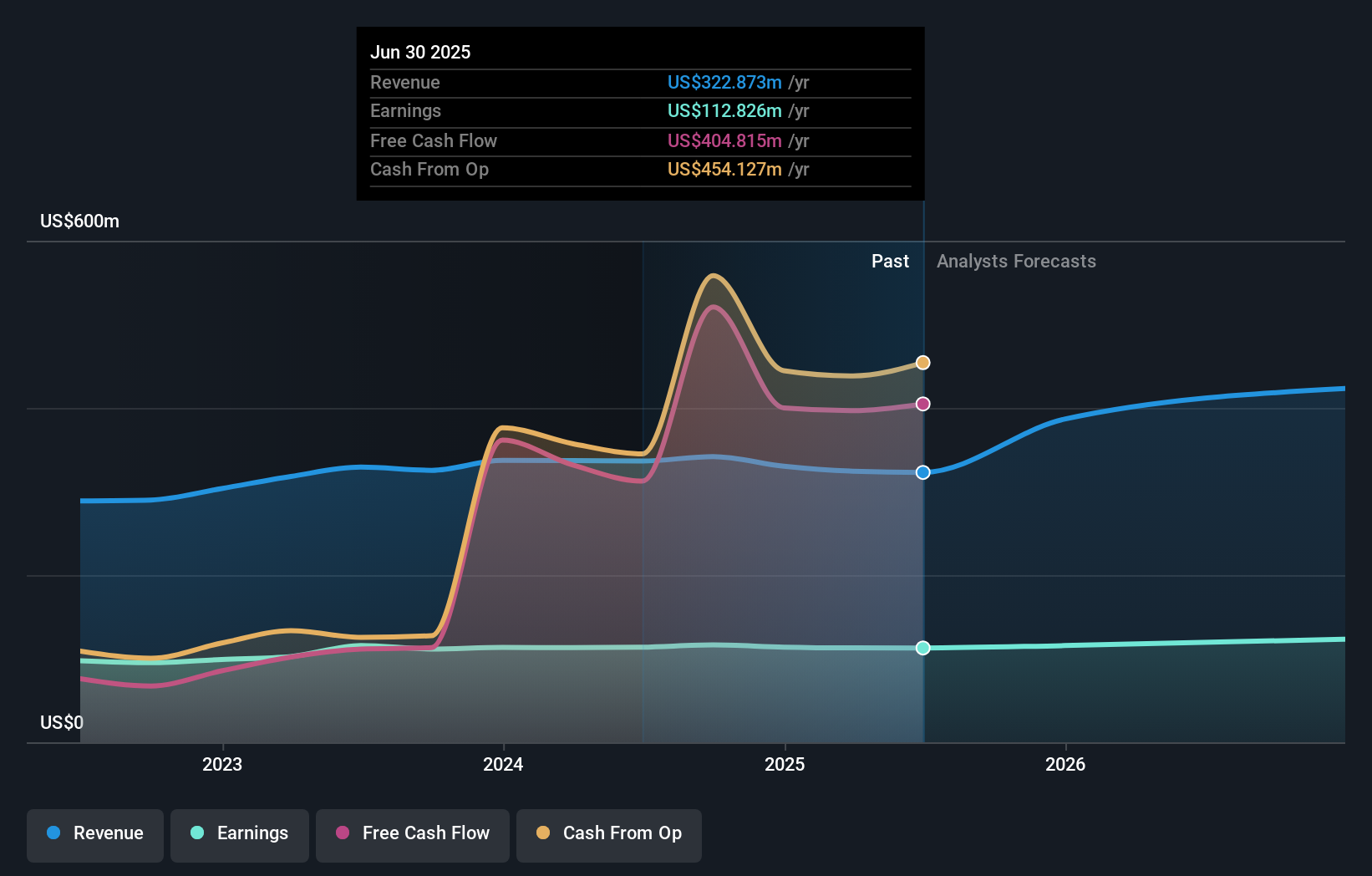

QCR Holdings' narrative projects $549.9 million revenue and $134.4 million earnings by 2028. This requires 19.4% yearly revenue growth and an increase of $21.6 million in earnings from $112.8 million currently.

Uncover how QCR Holdings' forecasts yield a $89.30 fair value, a 18% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community currently provides just one fair value estimate for QCR Holdings at US$89.30, with no spread across other opinions. While recent earnings growth highlights a positive catalyst, remember that the pace of digital transformation could shape QCR’s longer-term prospects. Check out other viewpoints within the community to see how opinions may evolve.

Explore another fair value estimate on QCR Holdings - why the stock might be worth as much as 18% more than the current price!

Build Your Own QCR Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QCR Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free QCR Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QCR Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QCR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:QCRH

QCR Holdings

A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

Flawless balance sheet and good value.

Market Insights

Community Narratives