- United States

- /

- Banks

- /

- NasdaqGS:OZK

Bank OZK (OZK) Is Up 5.2% After Fed Rate Cut Hopes Boost Banking Sector Sentiment

Reviewed by Sasha Jovanovic

- Earlier this week, comments from a key Federal Reserve official about the possibility of near-term interest rate cuts sparked renewed optimism among investors in the banking sector, including Bank OZK.

- This shift in monetary policy expectations is particularly relevant for Bank OZK given recent sector concerns about loan quality and the sensitivity of regional banks to interest rate changes.

- We will explore how rising expectations for a Fed rate cut could alter the risk and growth outlook in Bank OZK’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bank OZK Investment Narrative Recap

For investors to view Bank OZK as an attractive holding, confidence in the bank’s ability to manage credit quality, especially within its large commercial real estate portfolio, and navigate regional economic cycles is essential. The possibility of near-term rate cuts has boosted sentiment and could support short-term loan demand, yet it does not materially reduce the most pressing risk: exposure to commercial real estate, which remains sensitive to structural shifts or downturns in that sector.

The bank’s recent announcement of its 61st consecutive quarterly dividend increase, now at US$0.45 per share, reinforces its focus on returning value to shareholders. This steady pattern of raising dividends aligns with positive near-term catalysts like improved monetary policy expectations but does not directly address key sector-specific risks tied to commercial real estate lending concentrations.

However, while the outlook has brightened for some investors, potential issues in the RESG portfolio if commercial property trends worsen remain information that investors should be aware of...

Read the full narrative on Bank OZK (it's free!)

Bank OZK's narrative projects $2.1 billion in revenue and $815.7 million in earnings by 2028. This requires 10.6% yearly revenue growth and a $113.6 million earnings increase from current earnings of $702.1 million.

Uncover how Bank OZK's forecasts yield a $54.78 fair value, a 22% upside to its current price.

Exploring Other Perspectives

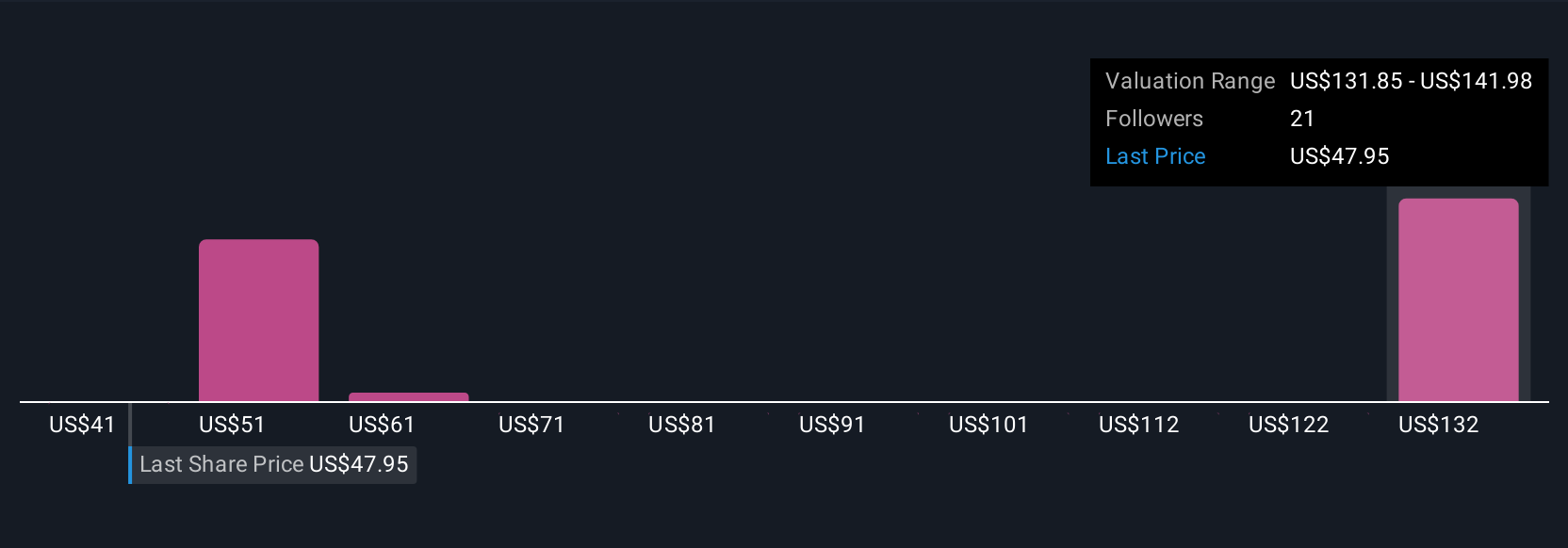

Fair value estimates from four Simply Wall St Community members span from US$54.78 to US$133.26 per share. With this diversity of views, remember that heavy concentration in commercial real estate lending continues to shape how different investors interpret opportunity and risk for Bank OZK.

Explore 4 other fair value estimates on Bank OZK - why the stock might be worth over 2x more than the current price!

Build Your Own Bank OZK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank OZK research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Bank OZK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank OZK's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank OZK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OZK

Bank OZK

Operates as a full-service Arkansas state-chartered bank that provides retail and commercial banking services in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success