- United States

- /

- Banks

- /

- NasdaqCM:OVLY

Oak Valley Bancorp (OVLY) Margin Miss Reinforces Cautious Sentiment Despite Value and Dividend Appeal

Reviewed by Simply Wall St

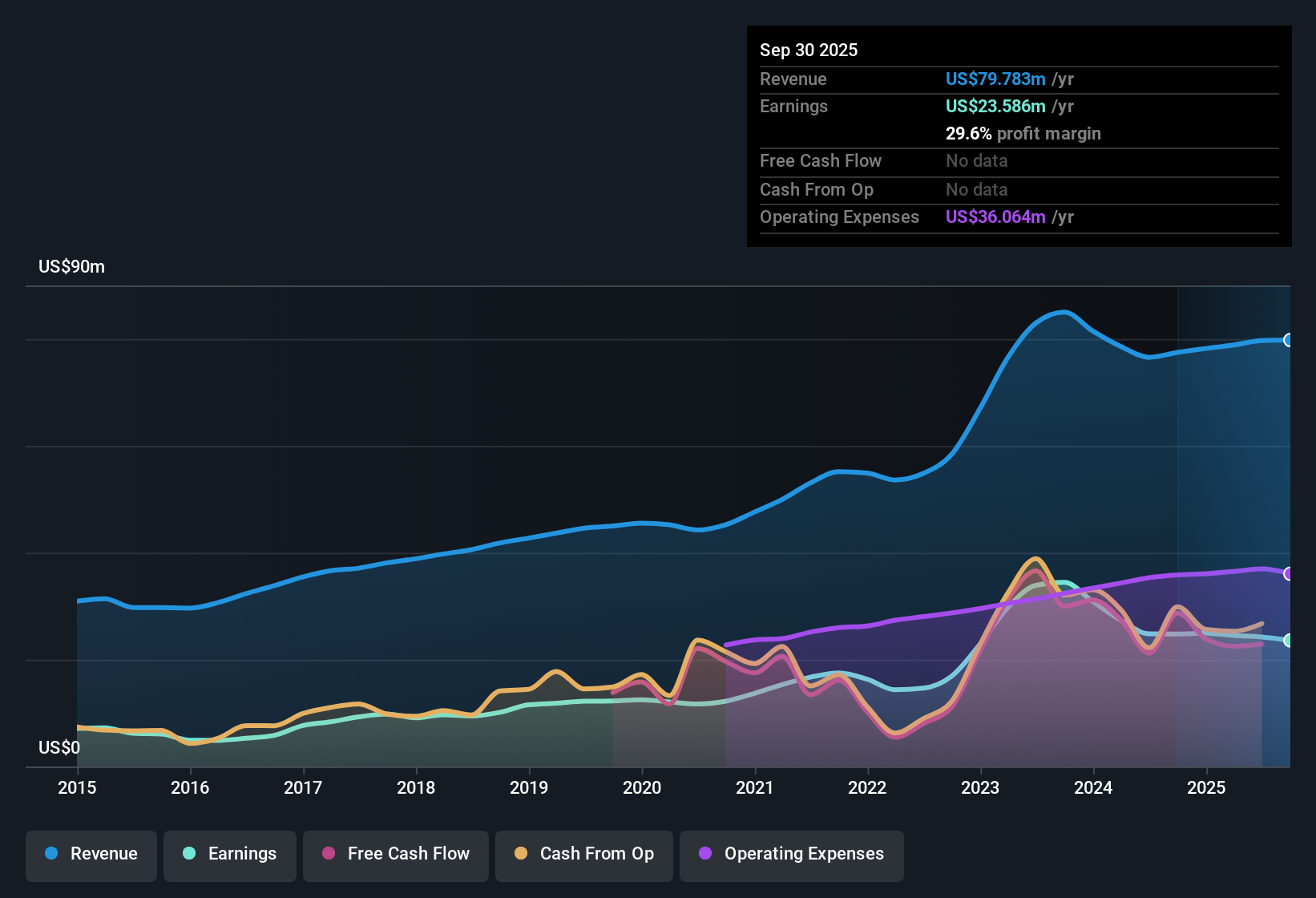

Oak Valley Bancorp (OVLY) posted a net profit margin of 29.6%, down from last year’s 32%, with annual earnings growth averaging 13.5% over the last five years. However, earnings declined in the most recent period, even as the company maintains a reputation for high quality earnings and offers an attractive dividend. Investors may take note of the company’s relatively low price-to-earnings ratio of 9.7x and share price of $27.75, both of which suggest appealing value and income characteristics despite the softening margin trend.

See our full analysis for Oak Valley Bancorp.Let’s take a closer look at how these results compare with the major narratives shaping expectations for Oak Valley Bancorp and see where the numbers provide support or raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Tightens, but Durability Shows

- Net profit margin came in at 29.6%, down from 32% last year. This reinforces that current profitability has dipped but remains robust for a community bank even as sector-wide margin pressure persists.

- Despite the margin slipping, the prevailing view emphasizes Oak Valley Bancorp's reputation for high quality earnings, which helps differentiate it from riskier peers.

- This reputation is supported by a five-year earnings growth average of 13.5%, suggesting the recent dip in profitability may be more cyclical than structural.

- The company's ability to maintain a margin close to 30% underlines resilience in operations, even as earnings decline in the latest period.

Price-to-Earnings Undercuts Industry Peers

- Oak Valley Bancorp trades at a price-to-earnings ratio of 9.7x, noticeably below both the US banks industry average (11.2x) and peer group (12.2x). This highlights a discount that value-oriented investors may seize upon.

- Conversations often center on the company’s status as a potential "defensive pick," strengthened by its lower valuation and supportive dividend.

- Compared to industry peers, the below-average multiple tempers downside risk for investors wary of overpaying in a sector known for volatility.

- This valuation gap reinforces the draw for income-seeking buyers, particularly given Oak Valley Bancorp’s history of steady profitability and dividend payments.

Trading Well Below DCF Fair Value Estimate

- The latest share price of $27.75 stands far under the company's DCF fair value of $64.76. This spotlights an unusually wide gap between market pricing and estimated intrinsic worth.

- Prevailing analysis points to a setup where investors may be rewarded for patience if mean reversion to fair value occurs.

- The presence of an attractive dividend and good value credentials further support this potential, especially as sector headwinds subside or catalysts materialize.

- While there are no flagged risk statements in disclosures, the primary tension lies in whether the market will recognize and correct the current valuation disconnect.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Oak Valley Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Oak Valley Bancorp’s declining profit margin and recent earnings drop highlight that its growth trajectory is vulnerable to market and sector headwinds.

If you want greater consistency and less downside in your portfolio, use stable growth stocks screener (2098 results) to discover companies with steadier earnings and resilience through economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OVLY

Oak Valley Bancorp

Operates as the bank holding company for Oak Valley Community Bank that provides a range of commercial banking services to individuals and small to medium-sized businesses in the Central Valley and the Eastern Sierras.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives