- United States

- /

- Banks

- /

- NasdaqGS:ONB

Old National Bancorp (ONB): Exploring Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Old National Bancorp (ONB) shares edged higher recently, continuing a steady upward trend this month. Investors may be taking notice of the company's improving revenue and net income growth, as well as its long-term performance.

See our latest analysis for Old National Bancorp.

Old National Bancorp's latest share price movement adds to a constructive multi-month trend, with shares now at $20.99. While the year-to-date share price return remains slightly negative, long-term investors have enjoyed a total shareholder return of more than 52% over the past five years, reflecting sustained growth momentum and renewed market confidence.

If recent gains have you looking beyond banks, now is a great moment to widen your perspective and discover fast growing stocks with high insider ownership

With solid earnings growth but shares already rebounding, is Old National Bancorp still trading below its true value? Or has the market already priced in its future prospects and potential upside?

Most Popular Narrative: 18.5% Undervalued

Compared to its last close at $20.99, the most widely followed narrative sees Old National Bancorp’s fair value much higher, suggesting real upside potential if projections materialize. The market may be underestimating the company’s operational strength and growth levers, given this valuation gap.

Successful integration and synergy realization from acquisitions (specifically, the Bremer merger and retention of CRE loans previously planned for sale) is unlocking operational efficiencies and margin expansion, contributing to improved return on equity and tangible book value per share. These metrics may be underappreciated in the current valuation.

Want to know why analysts are betting big on Old National Bancorp? The narrative’s valuation hinges on bold growth assumptions, margin gains, and an ambitious earnings leap. Curious about the specific financial leaps projected, and how they might justify such a premium? Dive in to uncover the details that could shift the market view.

Result: Fair Value of $25.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in commercial lending and ongoing exposure to regional CRE markets could quickly challenge Old National Bancorp’s growth outlook and valuation story.

Find out about the key risks to this Old National Bancorp narrative.

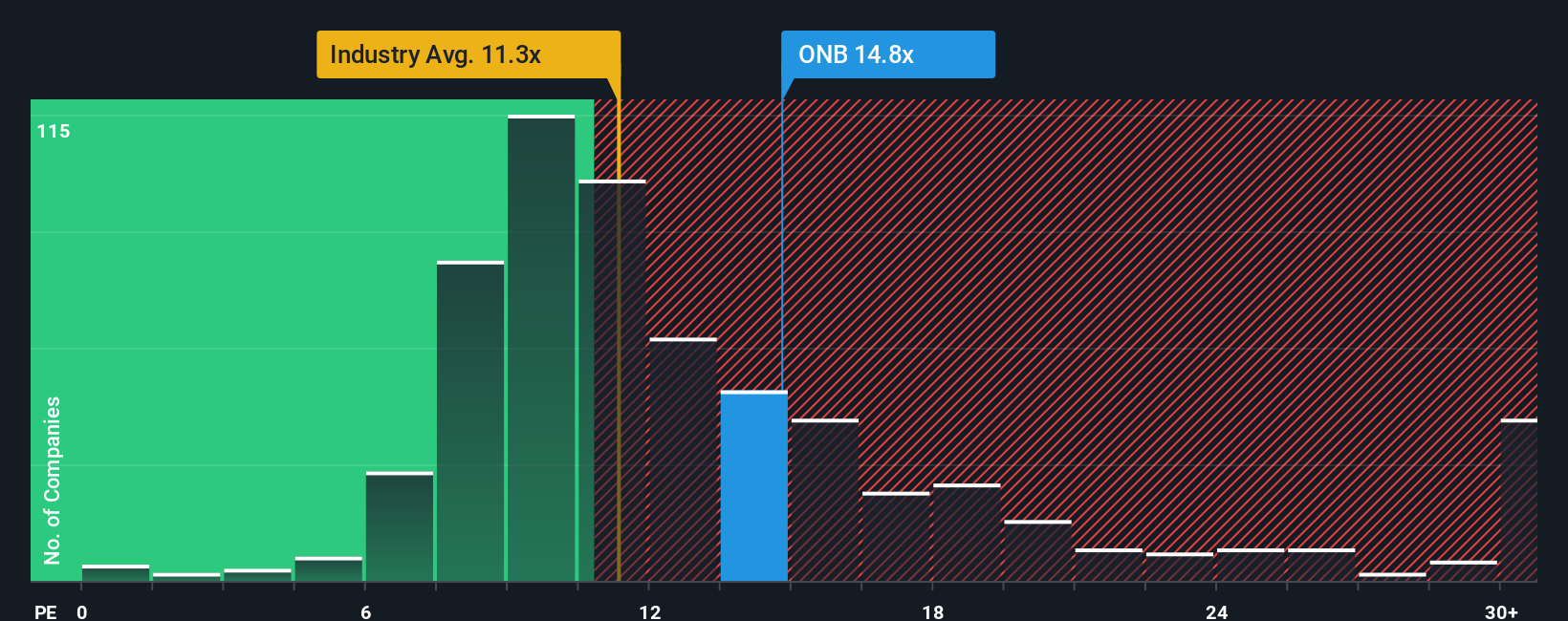

Another View: Market Ratios Tell a Different Story

Looking at the company’s price-to-earnings ratio, Old National Bancorp trades at 13.9x, which is higher than both industry peers (11.1x) and its peer average (12.1x), but still below its fair ratio of 16.7x. This premium signals optimism; however, it also suggests the market expects more. Could this gap close or is there a risk of correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old National Bancorp Narrative

If you see the story differently or want to investigate the numbers first-hand, it’s easy to build a personal perspective in just a few minutes. Do it your way

A great starting point for your Old National Bancorp research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities never wait, and neither should you. Uncover companies that match your goals by tapping into focused stock screens designed to reveal true standouts.

- Capitalize on yield potential and secure steady returns with these 16 dividend stocks with yields > 3%, which showcases robust companies offering attractive dividend yields above 3%.

- Boost your portfolio’s edge and embrace technological shifts by checking out these 25 AI penny stocks, covering everything from automation to AI-driven innovation.

- Target exceptional value opportunities by starting with these 874 undervalued stocks based on cash flows, featuring businesses trading at compelling discounts based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONB

Old National Bancorp

Operates as the bank holding company for Old National Bank that provides consumer and commercial banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives