- United States

- /

- Banks

- /

- NasdaqGS:OCFC

OceanFirst Financial (OCFC) Margin Decline Contrasts with Strong Growth Forecasts

Reviewed by Simply Wall St

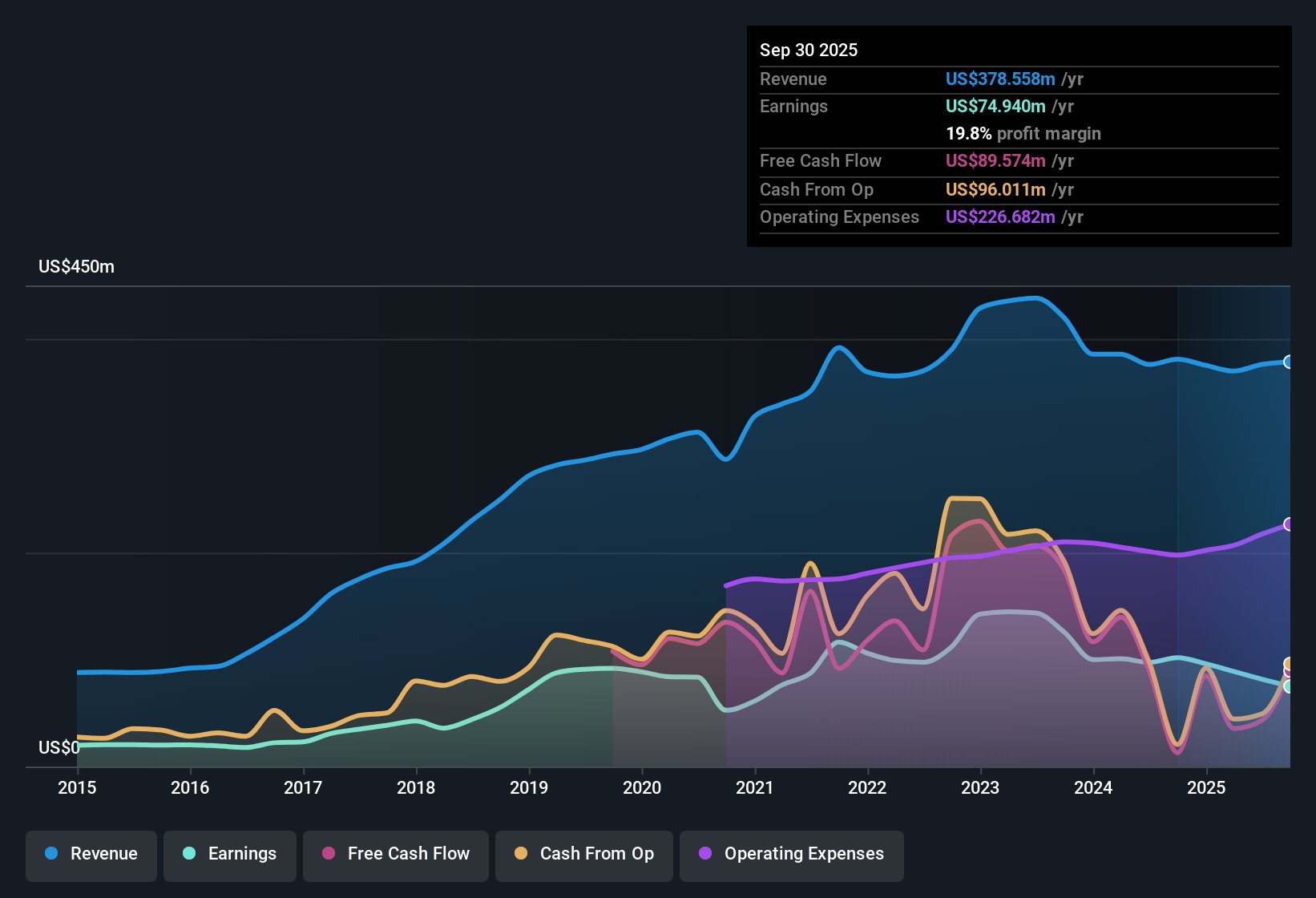

OceanFirst Financial (OCFC) has posted consistent annual earnings growth of 2.5% over the past five years and is forecasting a sharp acceleration, with EPS expected to jump 24.3% per year over the next three years. Revenue is projected to grow at 11.7% annually, outpacing the US market. The net profit margin sits at 19.8%, down from 26.7% last year, signaling some recent margin pressure for investors to watch.

See our full analysis for OceanFirst Financial.Next, we will see how these headline figures measure up to the popular market narratives and community views for OceanFirst Financial.

See what the community is saying about OceanFirst Financial

Profit Margins Off Recent Peak

- Net profit margin dropped to 19.8%, down from last year's 26.7%, marking a notable dip in efficiency despite ongoing revenue growth.

- Consensus narrative spotlights the rollout of new deposit teams aiming to boost margins and stability,

- but admits that margin compression and outsized expansion costs may weigh on profits if new business lags targets.

- Analysts see margin improvement as possible if commercial loan and deposit ramp-up meets or exceeds expectations in OceanFirst's growing regional markets.

Valuation Above Peers Despite Growth

- The current Price-to-Earnings ratio of 13.9x is higher than both the US Banks industry average (11.9x) and OceanFirst’s peer group, signaling a premium is baked into the share price.

- Consensus narrative notes robust forecasted earnings, with analysts expecting earnings to reach $124.4 million and revenue topping $536.1 million by 2028,

- yet the analyst price target of 21.20 is just 5.4% above the current price of $18.19, suggesting that strong fundamentals may already be priced in.

- To justify upside, consensus expects OceanFirst's PE ratio to compress to 11.1x, below the current industry average, assuming growth targets are achieved.

No Material Risks Flagged in Filings

- The latest data reports no major or minor risks cited by management or flagged in regulatory filings, which is uncommon for a regional bank.

- Consensus narrative sees this absence of identified risks as supportive of a stable long-term earnings outlook,

- but cautions that future risks could arise if new markets prove less profitable than anticipated or if digital investment lags behind competitors.

- Analysts remain focused on cost structures and changing competitive dynamics as OceanFirst scales its expansion strategy.

Consensus expects OceanFirst’s expanding strategies and margin outlook to play a critical role in shaping near-term market perception. See the full range of investor perspectives in the narrative deep dive below. 📊 Read the full OceanFirst Financial Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OceanFirst Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the results? In just a few minutes, you can build your personalized view and share your perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding OceanFirst Financial.

See What Else Is Out There

Despite OceanFirst Financial’s earnings growth, its elevated valuation and declining profit margins suggest limited upside compared to industry peers.

If you’re looking for stocks with more attractive pricing and future potential, unlock opportunities with these 877 undervalued stocks based on cash flows that may offer stronger value relative to their growth outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OCFC

OceanFirst Financial

Operates as the bank holding company for OceanFirst Bank N.A.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives