Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqCM:NVEC

Exploring NVE And Two Other Undiscovered Gem Stocks

Reviewed by Simply Wall St

Despite a recent 2.1% drop over the last seven days, the United States stock market has shown robust growth with a 19% increase over the past year and earnings expected to grow by 15% annually. In this dynamic environment, identifying stocks like NVE that are not yet widely recognized can offer unique opportunities for investors looking for potential growth in underexploited areas of the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jiayin Group | NA | 23.46% | 30.79% | ★★★★★★ |

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

NVE (NasdaqCM:NVEC)

Simply Wall St Value Rating: ★★★★★★

Overview: NVE Corporation is a technology firm specializing in the development and sale of spintronic devices, which utilize electron spin for information processing, across both domestic and international markets, with a market capitalization of $391.38 million.

Operations: The company operates in the electronic components and parts sector, generating revenue through sales of these products. It consistently achieves a high gross profit margin, averaging around 78.77% over recent quarters, indicating efficient cost management relative to its revenue generation from these sales.

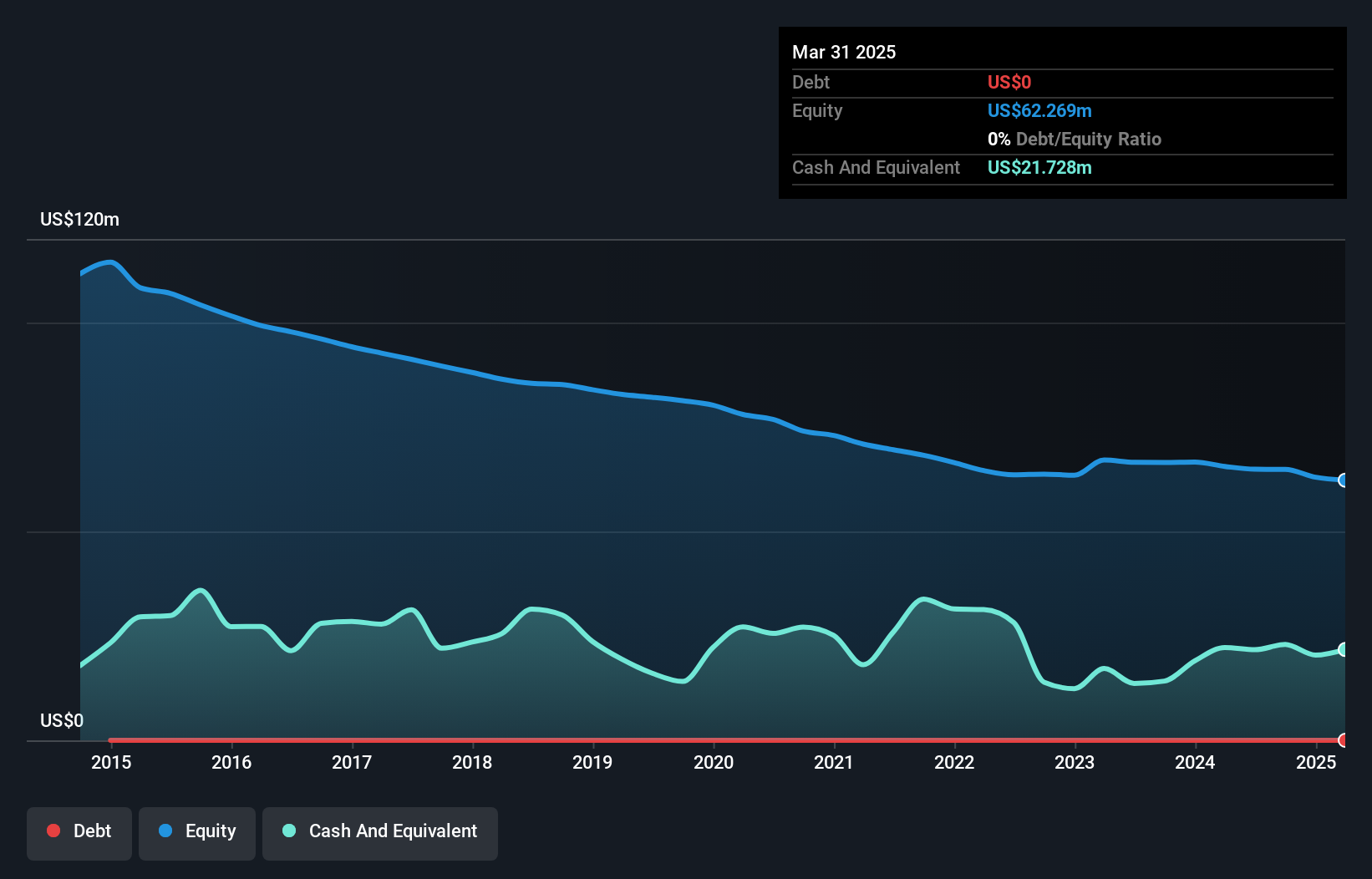

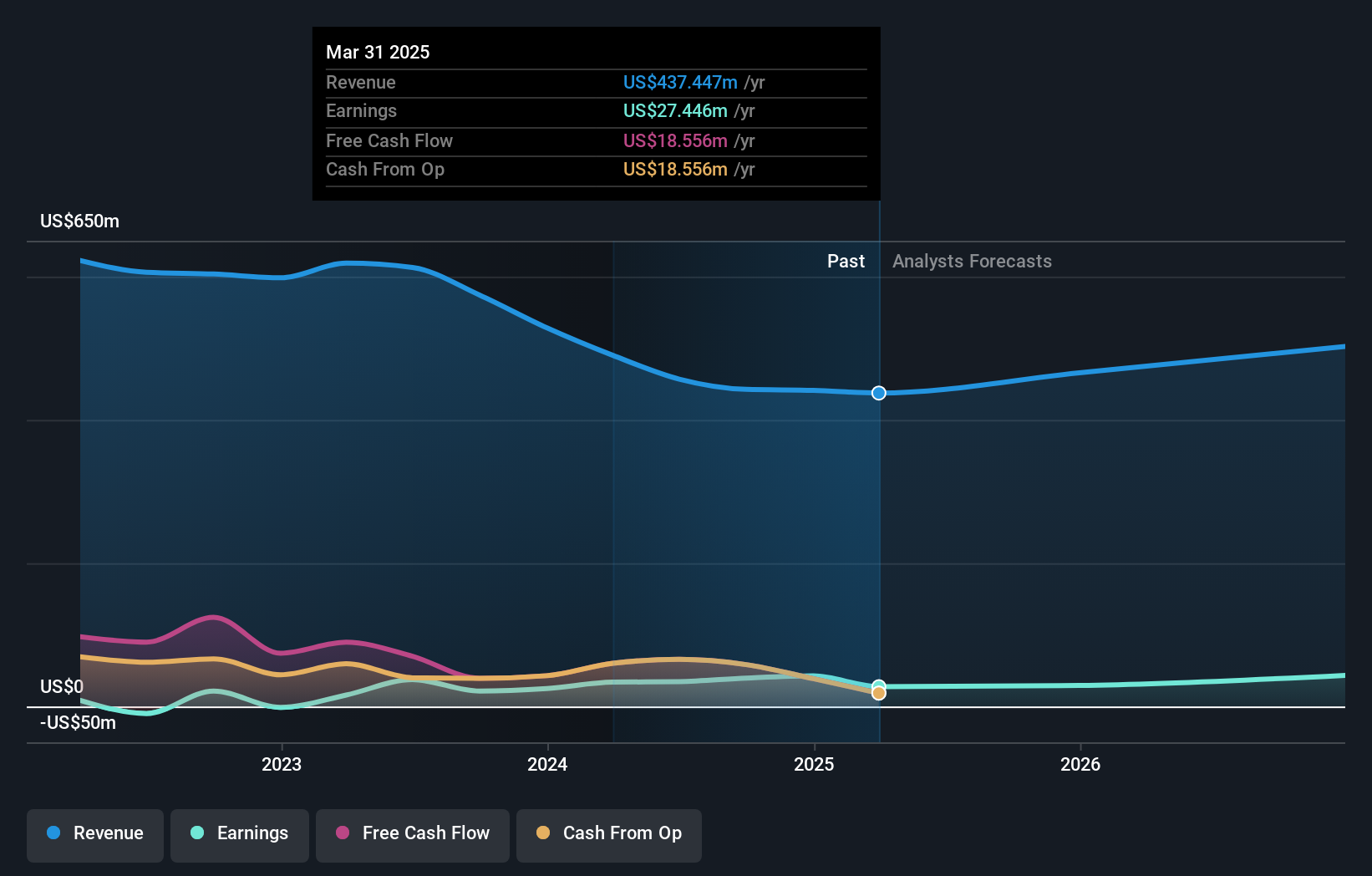

NVE Corporation, a lesser-known player in the semiconductor industry, presents intriguing financial and operational metrics. With a Price-to-Earnings ratio of 23.3x, it sits below the industry average of 28x, indicating potential undervaluation. Despite a challenging year with earnings growth down by 26.7%, NVE's debt-free status and positive free cash flow highlight its financial stability. Recently, NVE reported quarterly revenue of $6.78 million and net income of $4.1 million, alongside affirming a quarterly dividend of $1 per share, underscoring its commitment to shareholder returns despite market removals from several Russell indexes earlier this month.

- Delve into the full analysis health report here for a deeper understanding of NVE.

Gain insights into NVE's past trends and performance with our Past report.

Orange County Bancorp (NasdaqCM:OBT)

Simply Wall St Value Rating: ★★★★★★

Overview: Orange County Bancorp, Inc. operates as a financial services provider offering commercial and consumer banking, along with trust and wealth management services to a diverse clientele including small businesses, mid-sized companies, local governments, and individuals; it has a market capitalization of approximately $328.70 million.

Operations: The primary revenue streams for the company come from its banking operations, excluding wealth management, which generated $92.06 million, and wealth management services contributing $10.85 million. The business model showcases a robust net income margin trend, increasing significantly to 34.53% in the most recent period reported, reflecting effective operational management and possibly improved profitability strategies over time.

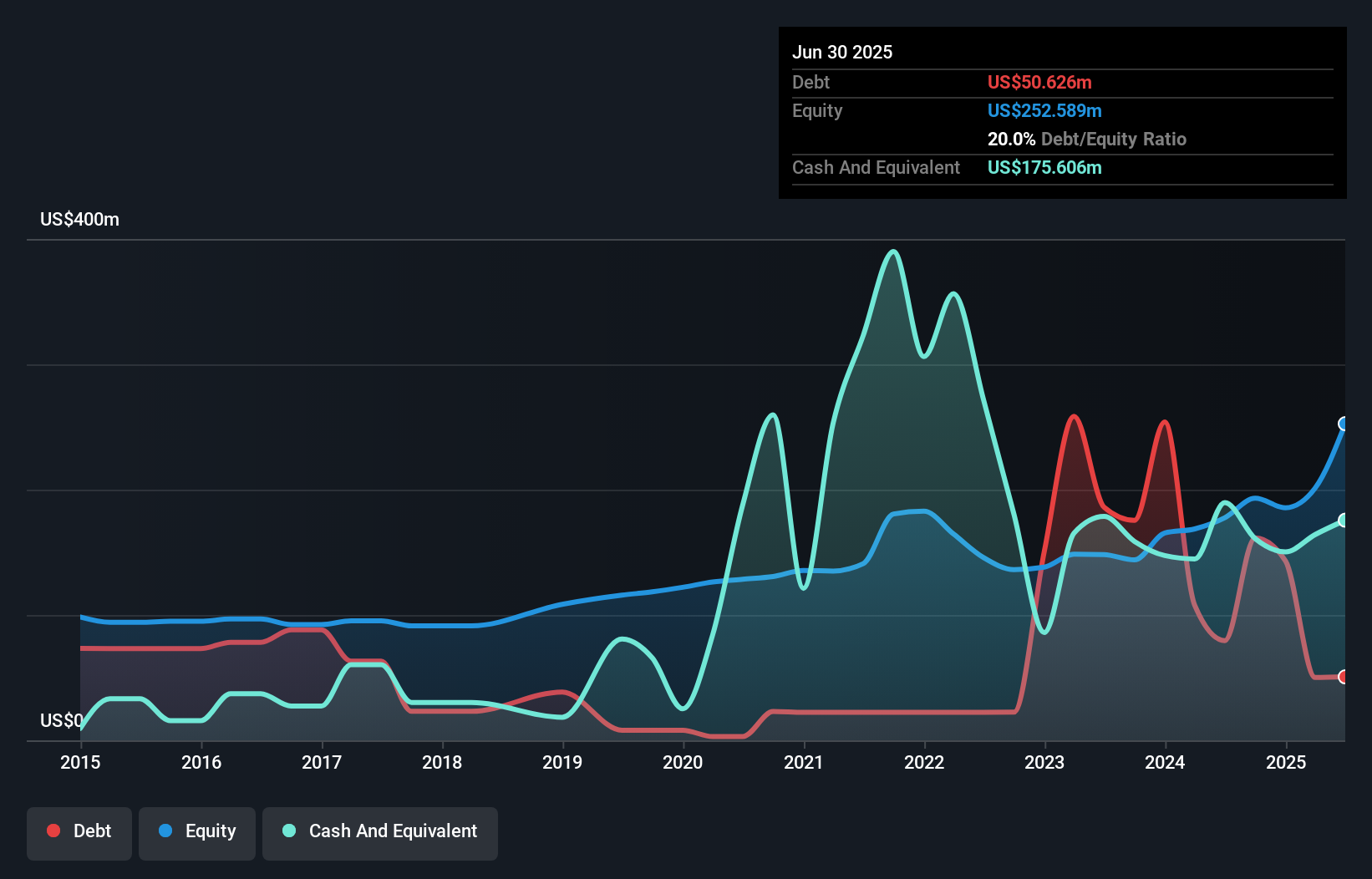

Orange County Bancorp, a lesser-known yet robust player in the banking sector, stands out with its impressive earnings growth of 59.6% over the past year, surpassing the industry's decline of 15.1%. With total assets of $2.5 billion and a strong bad loan allowance covering 441% of total loans, it demonstrates prudent risk management. Additionally, its recent shelf registration filing suggests strategic financial planning aimed at future growth opportunities.

- Navigate through the intricacies of Orange County Bancorp with our comprehensive health report here.

Evaluate Orange County Bancorp's historical performance by accessing our past performance report.

Global Indemnity Group (NYSE:GBLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Indemnity Group, LLC operates globally, offering specialty property and casualty insurance and reinsurance products through its subsidiaries, with a market capitalization of $428.54 million.

Operations: The company generates its revenue primarily through its Penn-America segment, which accounted for $354.37 million, and a smaller portion from non-core operations totaling $76.92 million. It operates with a gross profit margin of approximately 13.89% as of the latest quarter in 2024, indicating the percentage of revenue exceeding the cost of goods sold before deducting other operating expenses.

Global Indemindity Group, a lesser-known player in the insurance sector, stands out with its robust earnings growth of 112% over the past year, surpassing the industry average by nearly double. With a debt-free status and an attractive price-to-earnings ratio of 12.7x—below the US market average—the company shows strong financial health. Additionally, recent strategic maneuvers include pausing acquisition talks with James River Group and affirming dividends at $0.35 per share, signaling confidence in its operational stability and future prospects.

Next Steps

- Click here to access our complete index of 222 US Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether NVE is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NVEC

NVE

Develops and sells devices that use spintronics, a nanotechnology that relies on electron spin to acquire, store, and transmit information in the United States and internationally.

Flawless balance sheet with proven track record.