- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Is Revenue Growth Amid Profit Pressure Changing the Long-Term Outlook for Northwest Bancshares (NWBI)?

Reviewed by Sasha Jovanovic

- Northwest Bancshares, Inc. recently reported third-quarter results showing revenue growth mainly from its Penns Woods Bancorp merger, but net income and earnings per share declined compared to the previous year, largely due to merger-related impacts.

- Despite increased net interest income and continued dividend payments, the company’s profitability for the quarter fell short of analyst expectations, highlighting pressures from integration costs and asset quality.

- We’ll assess how the combination of strong revenue growth and weaker profitability alters the outlook for Northwest Bancshares’s long-term growth story.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Northwest Bancshares Investment Narrative Recap

To own Northwest Bancshares shares today, you need to believe that the bank’s expanding market presence and ongoing acquisition efforts will deliver sustainable earnings growth and improved margins, even with the drag of recent integration costs. The latest quarterly update saw revenue jump on the Penns Woods Bancorp merger, but short-term profitability disappointed due to merger-related charges and asset quality concerns; for now, the impact to the near-term revenue growth catalyst appears limited, but execution risks around cost savings have become more pressing.

Among recent announcements, Northwest Bancshares’ board declared its 124th consecutive quarterly cash dividend, underlining management’s commitment to shareholder returns during a period of significant change. This consistency is an important signal for investors seeking stability amid evolving earnings and integration hurdles.

Yet, in contrast to the encouraging payout record, questions remain for investors about the cost and timing of merger integration savings if...

Read the full narrative on Northwest Bancshares (it's free!)

Northwest Bancshares' narrative projects $909.9 million revenue and $249.6 million earnings by 2028. This requires 17.4% yearly revenue growth and a $106.2 million earnings increase from the current $143.4 million.

Uncover how Northwest Bancshares' forecasts yield a $13.38 fair value, a 11% upside to its current price.

Exploring Other Perspectives

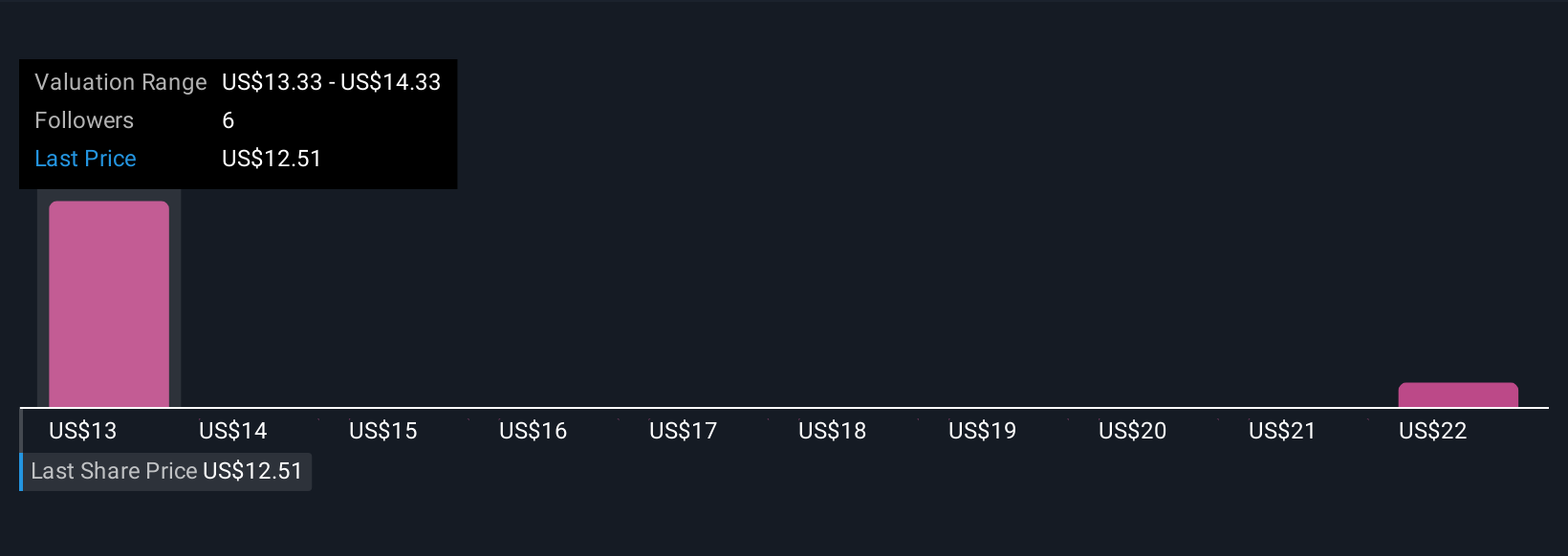

Three distinct Simply Wall St Community fair value estimates range from US$13.33 to US$22.85 per share, reflecting very different outlooks. While expanding into growth markets supports long-term potential, ongoing integration and asset quality issues remain crucial for performance, review several perspectives to inform your decision.

Explore 3 other fair value estimates on Northwest Bancshares - why the stock might be worth as much as 90% more than the current price!

Build Your Own Northwest Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northwest Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Bancshares' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives