- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Is Northwest Bancshares a Bargain After Recent Digital Banking and Branch Consolidation Moves?

Reviewed by Bailey Pemberton

- Ever wondered if Northwest Bancshares is truly a bargain or just looks cheap? Let’s cut through the noise and get straight to whether the stock offers real value for your portfolio.

- Stocks don’t exist in a vacuum. Northwest Bancshares has seen its share price slip 2.3% over the past month and drop 8.9% year-to-date, giving potential investors both pause and a dose of opportunity.

- Recent headlines have highlighted the bank’s ongoing efforts to streamline operations and strengthen its community banking presence, signaling strategic shifts. For example, their launch of new digital banking initiatives and a series of branch consolidations have caught the market’s attention and may explain some of that price volatility.

- On the numbers front, Northwest Bancshares checks only 2 out of 6 key boxes on our valuation score, so there is more to unpack. We will dig deeper into how valuations are really determined, and stick around for a smarter way to gauge what the stock is and is not worth.

Northwest Bancshares scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Northwest Bancshares Excess Returns Analysis

The Excess Returns valuation approach focuses on whether Northwest Bancshares is generating returns on its investors’ capital above the bare minimum required by its shareholders. In short, it measures how much value the company is adding by comparing actual returns to its cost of equity.

Here are some key details:

- Book Value: $12.73 per share

- Stable EPS: $1.25 per share (Source: Weighted future Return on Equity estimates from 5 analysts.)

- Cost of Equity: $0.93 per share

- Excess Return: $0.32 per share

- Average Return on Equity: 9.39%

- Stable Book Value: $13.32 per share (Source: Weighted future Book Value estimates from 4 analysts.)

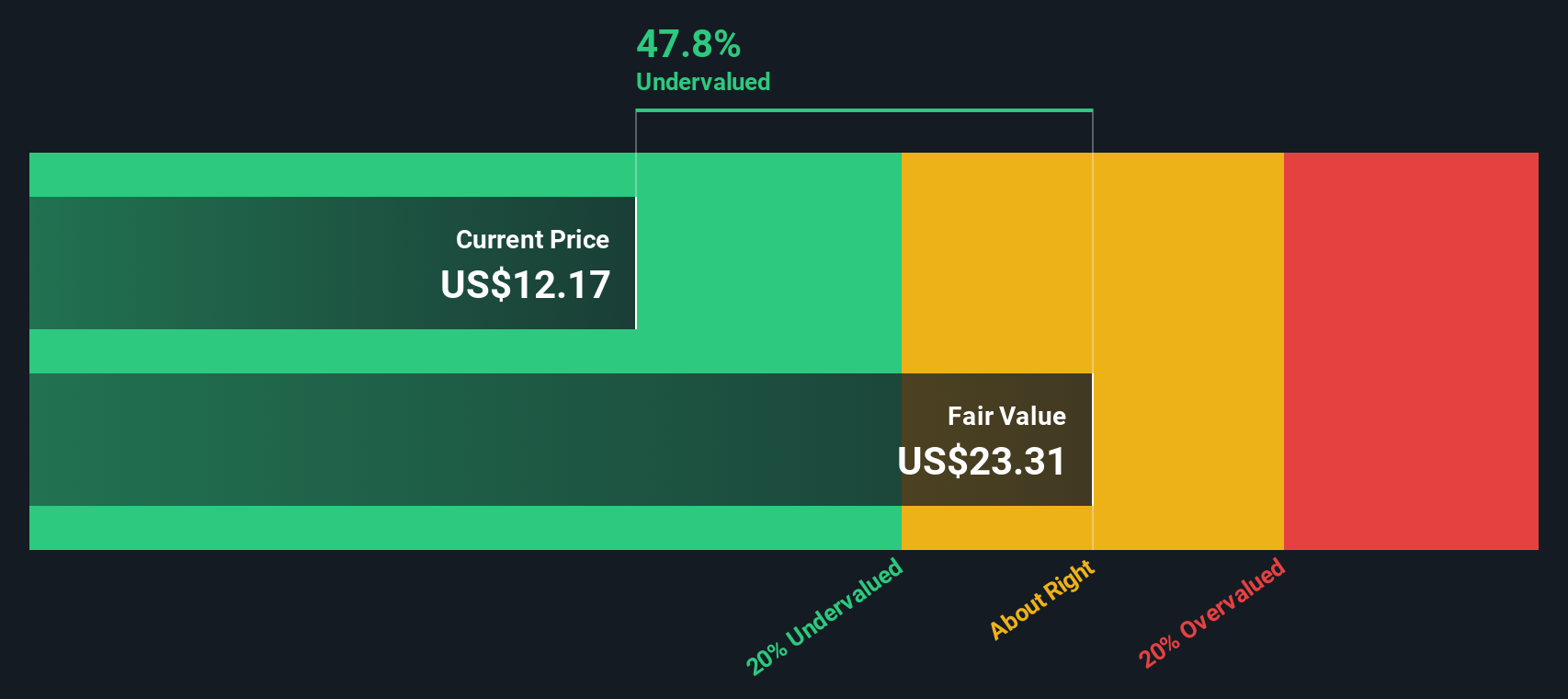

This model estimates an intrinsic value of $22.10 per share for Northwest Bancshares. When compared to the stock’s current trading price, this implies the shares are trading at a significant 46.6% discount to their modeled value. This suggests the market is overlooking the bank’s steady value creation through above-average returns on equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests Northwest Bancshares is undervalued by 46.6%. Track this in your watchlist or portfolio, or discover 855 more undervalued stocks based on cash flows.

Approach 2: Northwest Bancshares Price vs Earnings

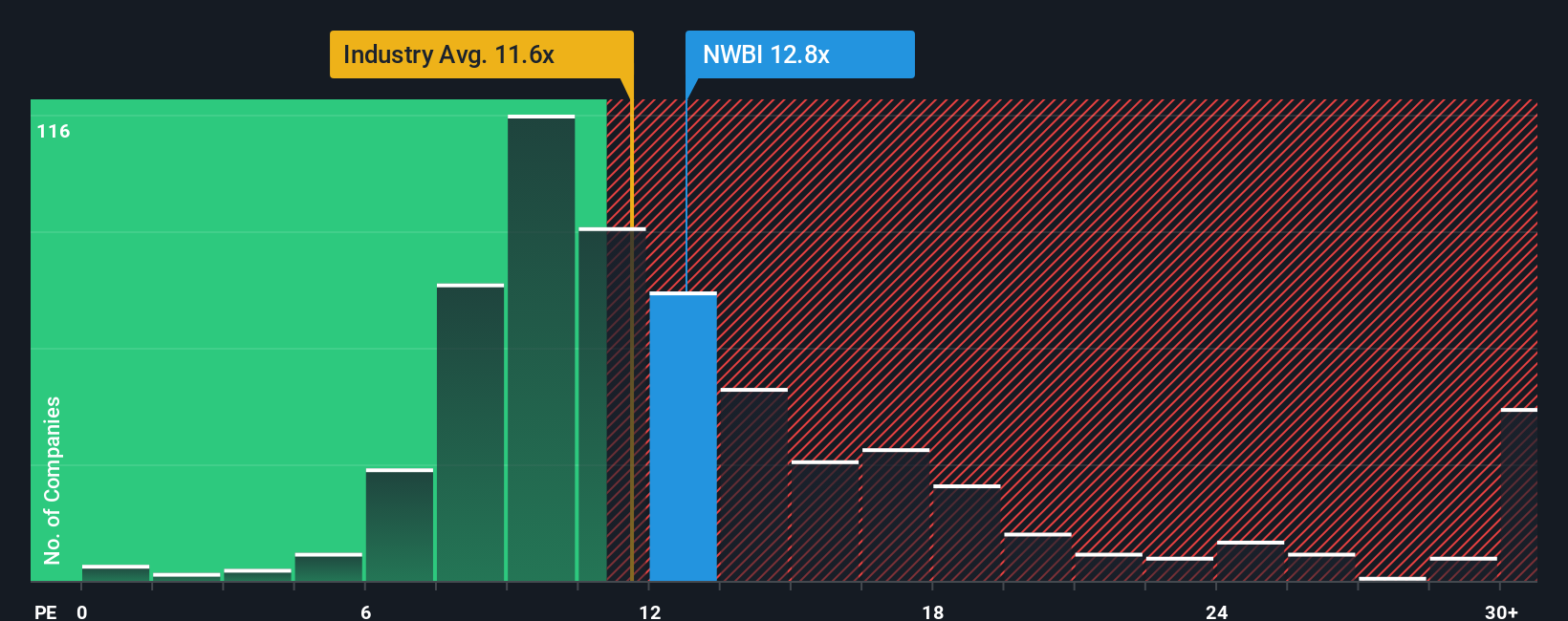

The Price-to-Earnings (PE) ratio is a go-to metric for evaluating profitable companies like Northwest Bancshares because it links a company’s share price directly to its earnings, making it straightforward to see what investors are paying for each dollar of profit. For businesses with stable profits, the PE ratio helps indicate whether those earnings are being valued highly or not by the market.

Growth prospects and risk profile play crucial roles in determining what a "normal" or "fair" PE ratio should be. Companies with higher expected earnings growth or lower risk often deserve a higher PE, while slower or riskier firms warrant a lower multiple.

Currently, Northwest Bancshares trades at a PE ratio of 15.28x. This sits just above the average for its industry (11.21x) and its peer group (11.42x). However, Simply Wall St’s proprietary “Fair Ratio” for Northwest Bancshares is 14.86x. The Fair Ratio is a more useful benchmark because it factors in not only industry comparisons, but also the company’s projected growth, profitability, and risk adjusted for its size and sector. This holistic approach can provide a more accurate read on what the multiple should be, instead of relying solely on blunt industry averages or potentially mismatched peers.

With the stock’s current PE ratio only slightly above its Fair Ratio by less than 0.10, the valuation appears well-aligned with its underlying fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1371 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Northwest Bancshares Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way to connect your own perspective—your story—about a company with your assumptions about its future numbers, like expected revenue, profit, and margins, to arrive at your personal Fair Value.

Narratives let you move beyond static ratios by linking the company's story (why it will succeed or face challenges) directly to a tailored forecast and valuation. This makes investing more personal and dynamic, rather than relying solely on one-size-fits-all metrics.

On the Simply Wall St platform, Narratives are easy to access and create through the Community page, and millions of investors use them to quickly test ideas and refine their decisions as new information emerges.

By comparing your own Fair Value with the current price, you can decide when the stock looks attractive to buy, or when it might be time to sell or hold back. These decisions are always based on your unique view and the latest data, since every Narrative updates automatically whenever news or earnings change the outlook.

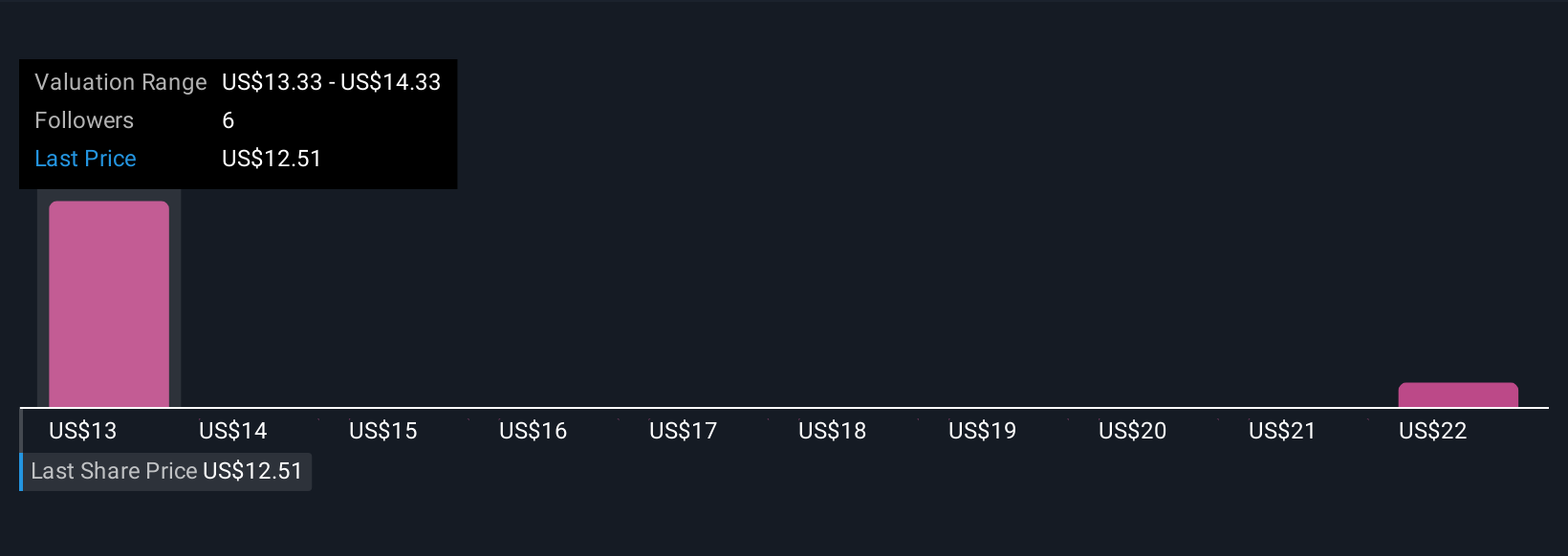

For example, some investors see Northwest Bancshares as worth over $15 if merger integration and digital expansion boost profits, while others think it's worth less than $12 citing slow-growth regions and rising credit risks. This shows how Narratives put the power of decision-making into your hands.

Do you think there's more to the story for Northwest Bancshares? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives