Stock Analysis

- United States

- /

- Entertainment

- /

- NasdaqGM:GRVY

Exploring Undiscovered Gems In US Stocks July 2024

Reviewed by Simply Wall St

Amid a rebound in the broader U.S. stock market, with notable gains led by the tech sector and anticipation of key economic data releases, investors are showing renewed interest in equities as they navigate through economic indicators and earnings reports. In this context, exploring lesser-known stocks could provide interesting opportunities, especially when considering how current market dynamics might highlight potential in areas that are not yet fully recognized by the mainstream investment community.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| QDM International | NA | 123.47% | 83.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Northeast Community Bancorp (NasdaqCM:NECB)

Simply Wall St Value Rating: ★★★★★★

Overview: Northeast Community Bancorp, Inc. serves as the holding company for NorthEast Community Bank, offering a range of financial services to both individual and business clients, with a market capitalization of $263.99 million.

Operations: The institution primarily operates in the thrift and savings loan sector, generating revenue through financial services tailored to savings and loans. Over recent periods, it has demonstrated a significant increase in net income, reflecting an upward trend from $46.28 million in December 2023 to $46.41 million by July 2024, alongside consistent operational expenses growth aligned with revenue increases.

Northeast Community Bancorp, a lesser-known entity in the financial sector, presents a compelling narrative with its robust fundamentals. With total assets of $1.9B and an impressive bad loans ratio at just 0.3%, the bank demonstrates prudent risk management. Recent earnings surged by 43% year-on-year, outpacing the industry's average decline of 15%. Additionally, its Price-To-Earnings ratio stands attractively at 5.6x, well below the broader US market's 18x, signaling potential undervaluation relative to peers.

- Get an in-depth perspective on Northeast Community Bancorp's performance by reading our health report here.

Understand Northeast Community Bancorp's track record by examining our Past report.

Gravity (NasdaqGM:GRVY)

Simply Wall St Value Rating: ★★★★★★

Overview: Gravity Co., Ltd. is a global developer and publisher of online and mobile games, with a market capitalization of approximately $533.81 million.

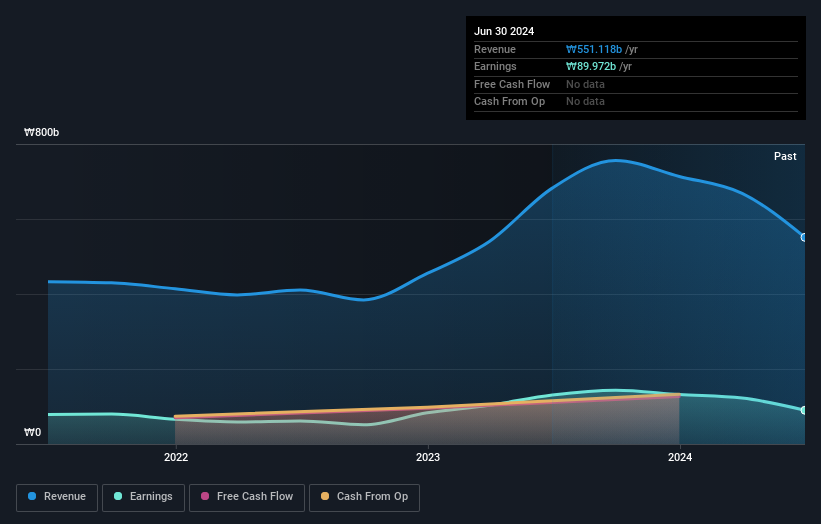

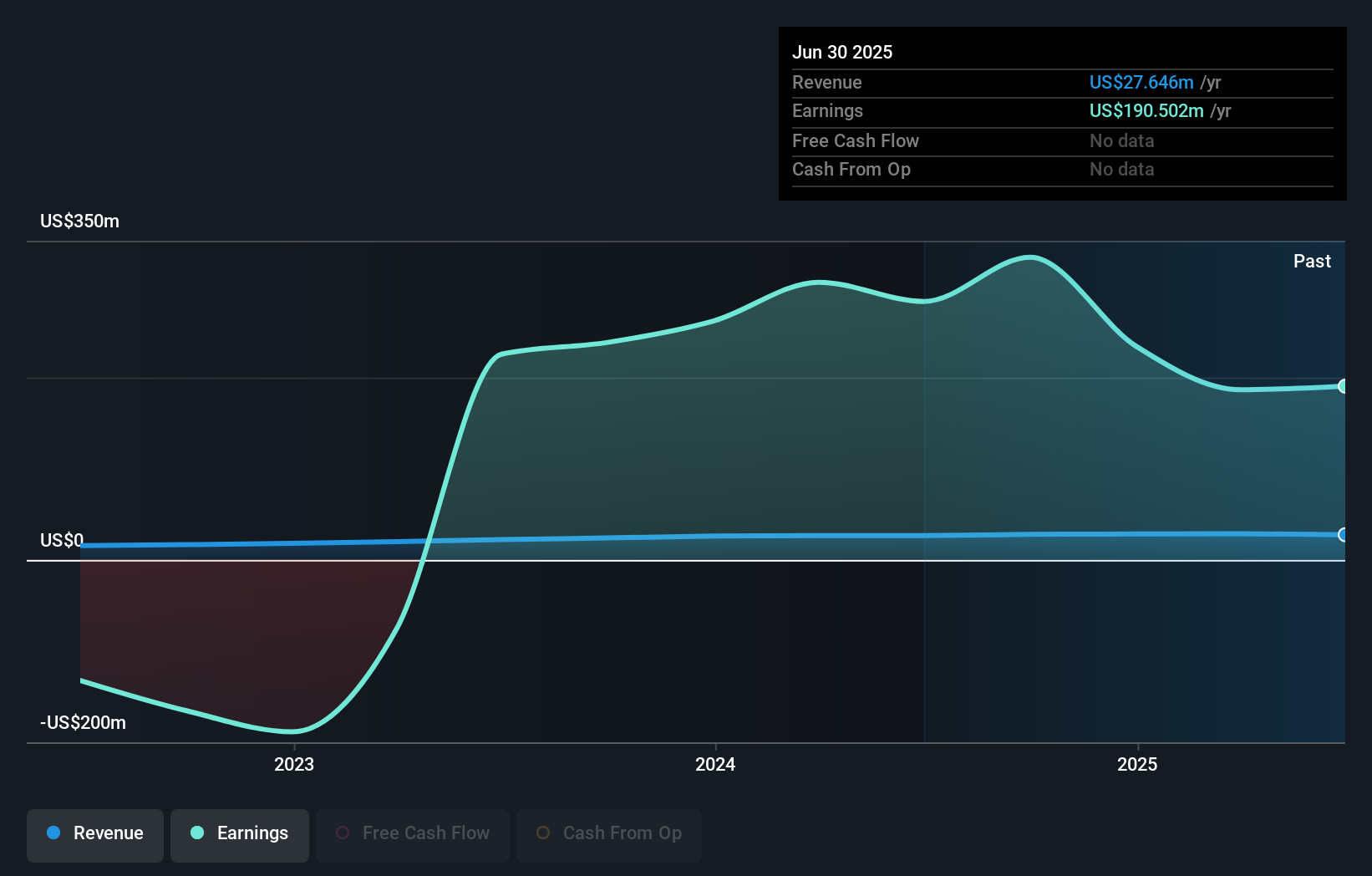

Operations: The company generates revenue primarily through the sale of goods and services, consistently incurring costs related to goods sold, operating expenses, and non-operating expenses. Over the years, it has experienced fluctuations in net income margins, reflecting varying levels of profitability and operational efficiency.

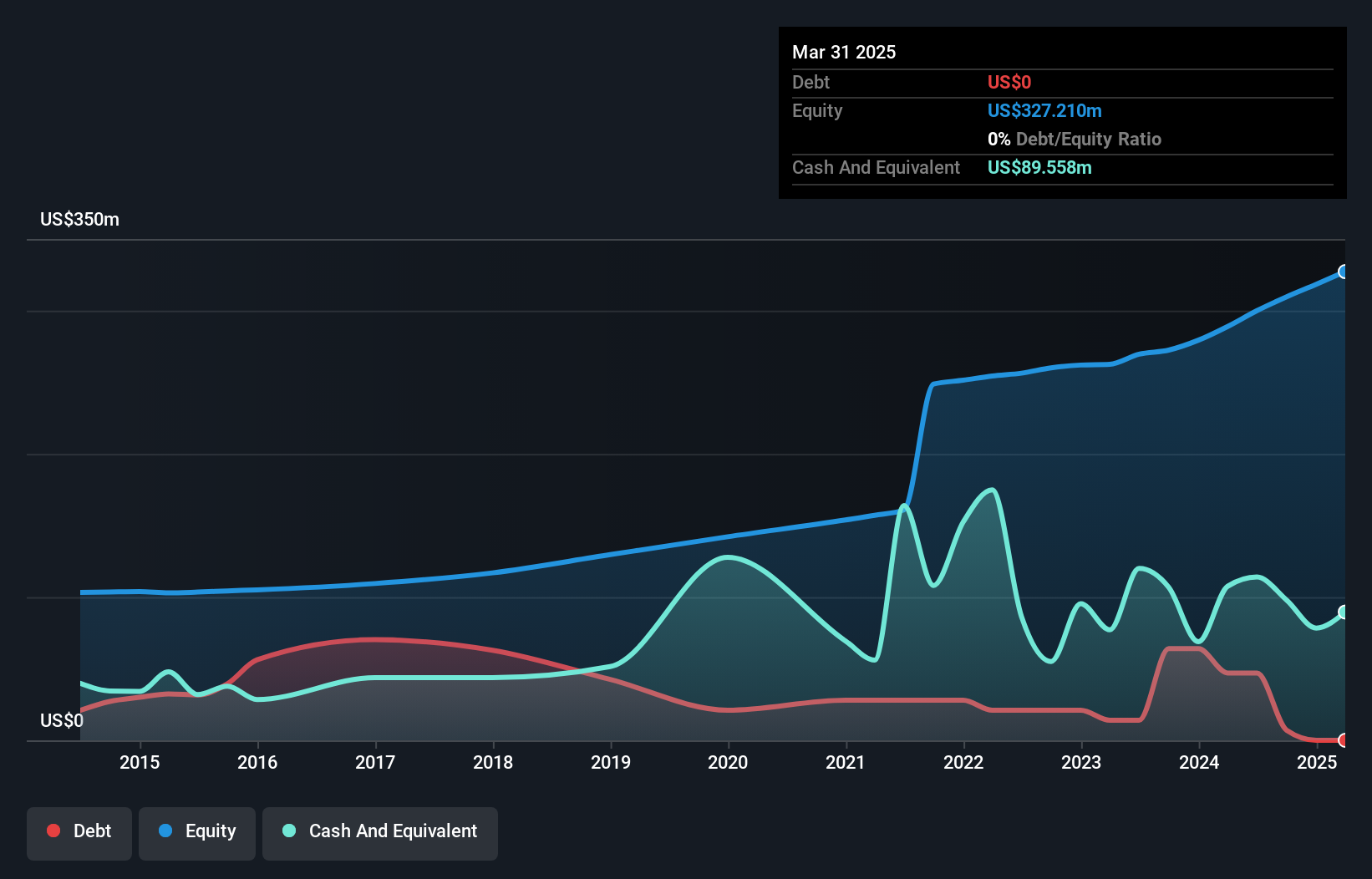

Gravity, a lesser-known yet promising entity in the entertainment sector, trades at 71.8% below its estimated fair value, signaling potential undervaluation. Over the past five years, its earnings have surged by 24.4% annually. Recently expanding its global footprint, Gravity launched new gaming titles in China and Taiwan and introduced 'ALTF42' globally on Steam, enhancing its market presence and product portfolio without bearing debt—an indicator of financial prudence and strategic growth focus.

- Navigate through the intricacies of Gravity with our comprehensive health report here.

Gain insights into Gravity's historical performance by reviewing our past performance report.

General American Investors Company (NYSE:GAM)

Simply Wall St Value Rating: ★★★★★☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market capitalization of approximately $1.22 billion.

Operations: The company operates in the financial services sector, specifically within closed-end funds, generating revenue through investments. It consistently reports a gross profit margin of 100%, indicating that it incurs no cost of goods sold and all revenue contributes directly to gross profit. However, net income has shown variability due to significant non-operating expenses and income impacting profitability across different periods.

General American Investors Company, Inc. (GAM) stands out as an undervalued opportunity, currently trading at 60.9% below its estimated fair value. The company's recent transition to profitability and a significant one-off gain of $308 million have bolstered its financial profile. Notably, GAM has maintained a debt-free status over the past five years, enhancing its financial stability. Additionally, the company actively repurchased shares worth $6.5 million in the first quarter of 2024, reflecting confidence in its growth trajectory and commitment to shareholder value.

Next Steps

- Discover the full array of 221 US Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GRVY

Flawless balance sheet and good value.