- United States

- /

- Banks

- /

- NasdaqGS:NBTB

Assessing NBT Bancorp (NBTB) Valuation After Interest Rate Cut Optimism Spurs Investor Gains

Reviewed by Simply Wall St

Following comments from New York Fed President John Williams suggesting a near-term interest rate adjustment, investors grew more optimistic about a possible rate cut. NBT Bancorp (NBTB) shares responded with a sharp price rally during the session.

See our latest analysis for NBT Bancorp.

This optimism around interest rates gave NBT Bancorp’s shares a boost, helping reverse some of the recent pressure on the stock. While the 7-day share price return stands at a healthy 3.8%, the stock is still playing catch-up, with year-to-date price return down 12.8% and a one-year total shareholder return of -16.8%. Over a longer period, five-year total shareholder returns remain impressive, suggesting the company’s advantages can shine through market cycles.

If you’re interested in what else is moving, now’s a great chance to broaden your search and discover fast growing stocks with high insider ownership

With these gains and a notable discount to analyst price targets, it begs the question: Is NBT Bancorp undervalued at current levels, or are investors already factoring in brighter prospects, leaving little room for upside?

Most Popular Narrative: 18% Undervalued

Compared to the last close price of $41.14, the most widely followed narrative calculates a fair value of $50.17, implying meaningful upside if projections hold. This estimate comes from a deep dive into NBT Bancorp’s growth initiatives and future profit drivers.

Expansion into the Western New York and Buffalo markets through the Evans Bancorp acquisition is likely to drive incremental loan and deposit growth and diversify the balance sheet. This could lead to higher top-line revenue and improved earnings stability. Ongoing investment in digital banking platforms and seamless integration of over 25,000 new digital banking and debit card users positions NBT to reach new customer segments, improve operating efficiencies, and support net margin expansion.

What’s fueling this ambitious fair value? The narrative is built on assumptions of accelerating earnings and margin expansion that could put NBT Bancorp in a much stronger league. Intrigued by the forward-looking calculations and the outlook that underpins this price? See what bold projections lie behind these numbers.

Result: Fair Value of $50.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow population growth in key regions and rising operating costs could quickly challenge these optimistic projections for NBT Bancorp's future performance.

Find out about the key risks to this NBT Bancorp narrative.

Another View: Market Multiples Tell a Different Story

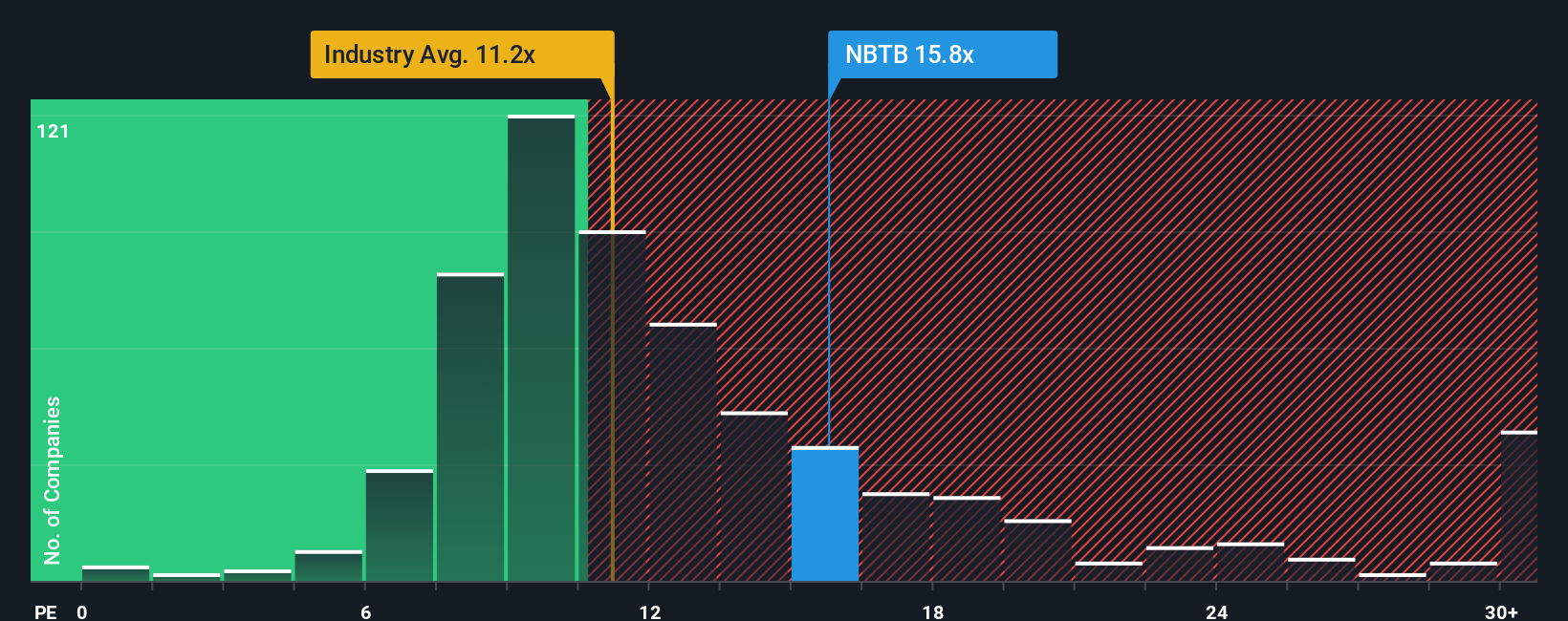

While the fair value narrative points to NBT Bancorp being undervalued, a closer look at its price-to-earnings ratio paints a more complex picture. The company trades at 14.4 times earnings, which is higher than the industry average of 11.2 and also exceeds its fair ratio of 13.5. This premium suggests there may be elevated valuation risk, even with growth expectations. Should investors look beyond optimistic projections and question if the stock’s strong track record is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NBT Bancorp Narrative

If you want to challenge these views or dive deeper yourself, you can build a personalized story around the numbers in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding NBT Bancorp.

Looking for More Investment Ideas?

Don’t settle for a single opportunity when the market is full of fresh possibilities. Use the Simply Wall Street Screener to uncover hidden gems and upgrade your investing game.

- Target higher yields and enjoy steady income by reviewing these 14 dividend stocks with yields > 3% with strong payout records and resilient cash flows.

- Invest in tomorrow’s breakthroughs now by checking out these 26 AI penny stocks that are pushing AI boundaries and transforming entire industries.

- Catch the upside potential with these 3580 penny stocks with strong financials featuring robust financials and exciting momentum that can put you ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success