- United States

- /

- Banks

- /

- NasdaqGS:MRBK

Meridian (MRBK) Profit Margin Rebound Reinforces Bullish Narratives in Earnings Season

Reviewed by Simply Wall St

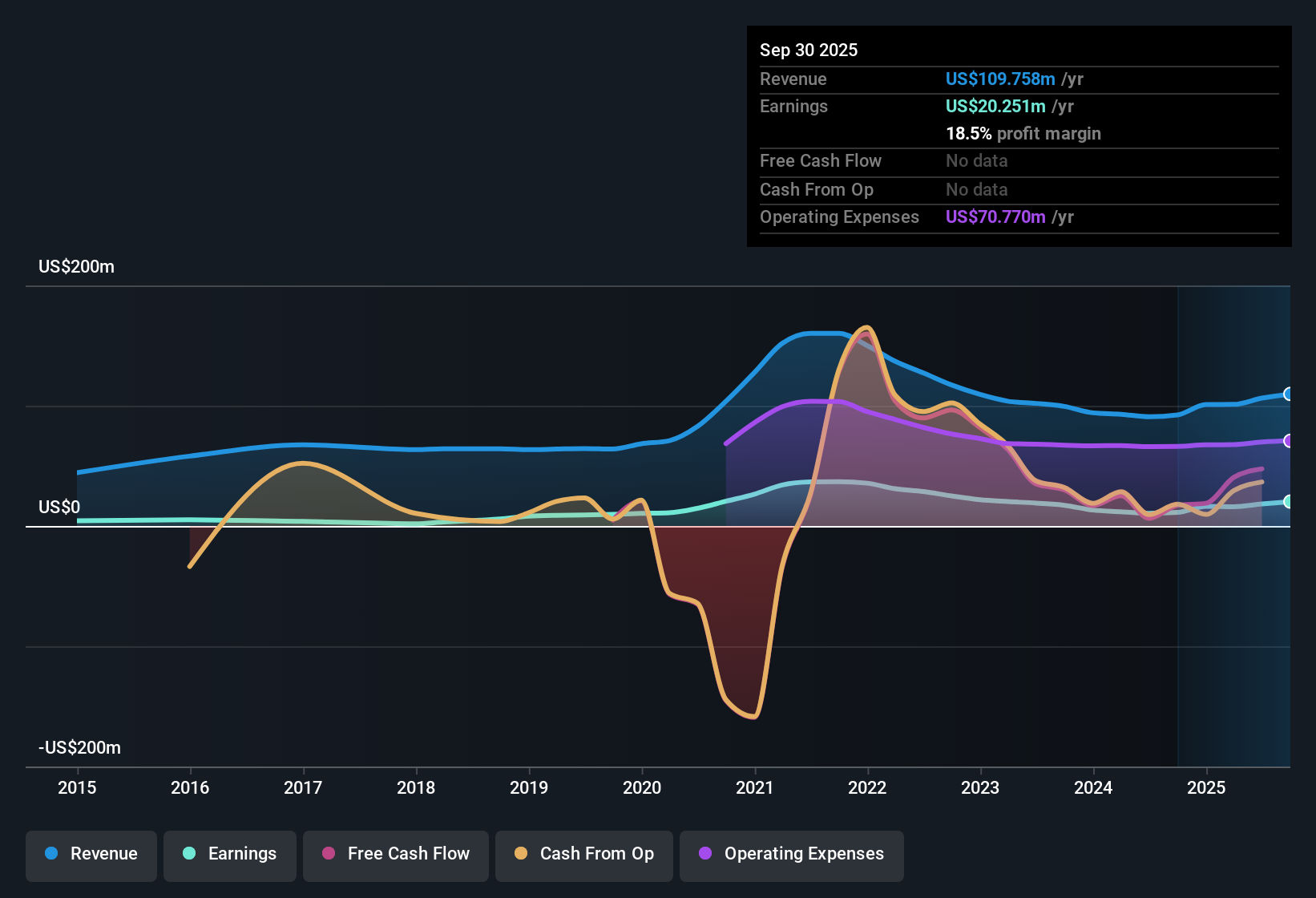

Meridian (MRBK) posted net profit margins of 18.5%, up from 12.3% the previous year, highlighting a solid step up in profitability. EPS growth soared 79% year-over-year, representing a dramatic turnaround from a 5-year average annual earnings decline of 18.1%. With margins running higher and quality earnings confirmed, investors are taking note, especially as the current share price of $15.34 trades well below the estimated fair value of $23.77 and the company's price-to-earnings ratio remains well under the industry average.

See our full analysis for Meridian.Now, let's see how these headline numbers match up to the major narratives followed by the Simply Wall St community. Some expectations might be confirmed, while others could face new challenges.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Reach Five-Year High

- Net profit margins climbed to 18.5%, compared to 12.3% in the prior year, marking Meridian’s highest margin level in at least five years.

- Recent momentum heavily supports the bullish case that operating improvements are sticking, as:

- This sharp margin advance follows a long-term pattern where earnings had been declining at an average annual rate of 18.1% over five years. This suggests the quality of this reversal stands out even more strongly against past underperformance.

- Bulls highlight that such a margin jump is rarely seen without significant operational changes. This trend is especially valuable for those looking for sustainable profitability gains.

Valuation Discount Widens Versus Industry

- At a Price-to-Earnings ratio of 8.4x, Meridian’s valuation not only sits below the peer average but is also well under the broader US Banks industry average of 11.2x.

- What's surprising is how the prevailing market view interprets this deep discount:

- Even after the recent sharp profit rebound, the share price of $15.34 still trails the DCF fair value estimate of $23.77, drawing attention from value-focused investors.

- Momentum from both the headline margin expansion and discounted valuation multiples could catalyze increased interest as earnings season unfolds, with many watching to see if further outperformance can close the valuation gap.

Recent Turnaround Defies Long-Term Averages

- Year-on-year EPS growth of 79% is a dramatic reversal compared with Meridian’s 5-year average annual decline of 18.1%.

- The prevailing market view focuses on whether this outsized profit rebound marks a lasting shift:

- Some investors may be cautious, as primary flagged risks still center around uncertainty in sustaining both top- and bottom-line growth over future periods, even after such a strong short-term result.

- Still, the scale of the improvement relative to the company’s multi-year trajectory makes this a notable case of a bank rapidly flipping from a negative trend to clear outperformance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Meridian's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although net profit margins have climbed and recent earnings rebounded sharply, Meridian’s long-term record still reveals years of inconsistent bottom-line performance and growth volatility.

If steady results matter more to you, use our stable growth stocks screener (2099 results) to pinpoint companies proving they can deliver reliable, cycle-tested growth without the wild swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRBK

Meridian

Operates as the bank holding company for Meridian Bank that provides commercial banking products and services in Pennsylvania, New Jersey, Delaware, Maryland, and Florida.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives