- United States

- /

- Banks

- /

- NasdaqGM:MLVF

Are Institutions Heavily Invested In Malvern Bancorp, Inc.'s (NASDAQ:MLVF) Shares?

Every investor in Malvern Bancorp, Inc. (NASDAQ:MLVF) should be aware of the most powerful shareholder groups. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Companies that used to be publicly owned tend to have lower insider ownership.

With a market capitalization of US$128m, Malvern Bancorp is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about Malvern Bancorp.

See our latest analysis for Malvern Bancorp

What Does The Institutional Ownership Tell Us About Malvern Bancorp?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

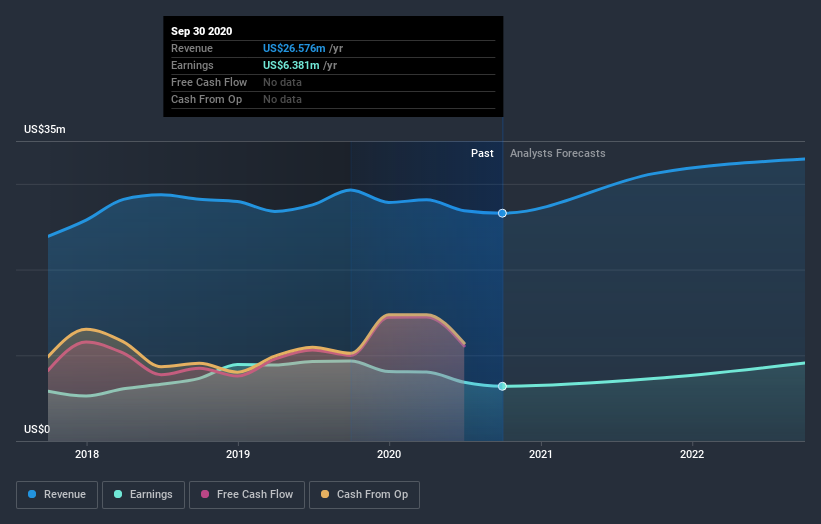

Malvern Bancorp already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Malvern Bancorp, (below). Of course, keep in mind that there are other factors to consider, too.

It would appear that 28% of Malvern Bancorp shares are controlled by hedge funds. That catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create near term value for shareholders. The company's largest shareholder is PL Capital Advisors, LLC, with ownership of 9.8%. Meanwhile, the second and third largest shareholders, hold 9.3% and 9.2%, of the shares outstanding, respectively. In addition, we found that Anthony Weagley, the CEO has 1.0% of the shares allocated to his name

We also observed that the top 9 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Malvern Bancorp

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would probably be interested to learn that insiders own shares in Malvern Bancorp, Inc.. It has a market capitalization of just US$128m, and insiders have US$6.4m worth of shares, in their own names. It is good to see some investment by insiders, but I usually like to see higher insider holdings. It might be worth checking if those insiders have been buying.

General Public Ownership

The general public holds a 36% stake in Malvern Bancorp. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

Private equity firms hold a 9.2% stake in Malvern Bancorp. This suggests they can be influential in key policy decisions. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Malvern Bancorp you should be aware of.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Malvern Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:MLVF

Malvern Bancorp

Malvern Bancorp, Inc. operates as the bank holding company for Malvern Bank that engages in the provision of various banking products and services to consumer and business customers in Pennsylvania.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives