This article will reflect on the compensation paid to Ron Haan who has served as CEO of Macatawa Bank Corporation (NASDAQ:MCBC) since 2009. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Macatawa Bank

Comparing Macatawa Bank Corporation's CEO Compensation With the industry

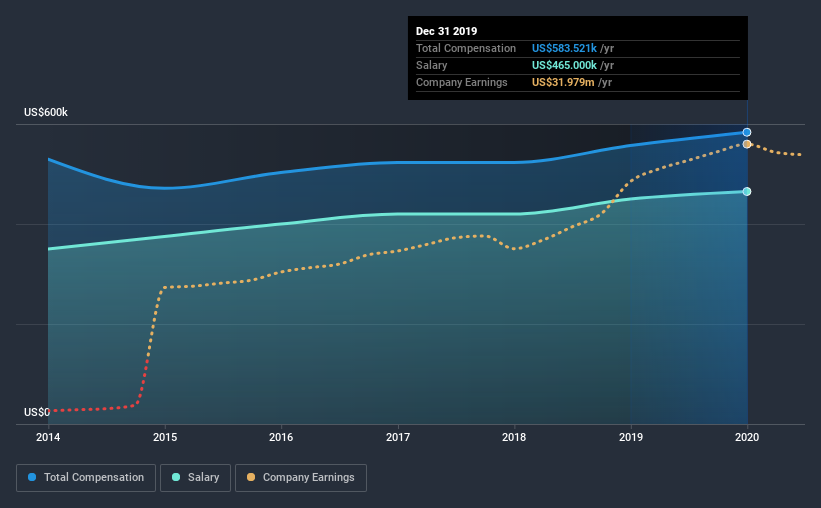

According to our data, Macatawa Bank Corporation has a market capitalization of US$217m, and paid its CEO total annual compensation worth US$584k over the year to December 2019. That's just a smallish increase of 4.8% on last year. Notably, the salary which is US$465.0k, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from US$100m to US$400m, we found that the median CEO total compensation was US$956k. That is to say, Ron Haan is paid under the industry median. Moreover, Ron Haan also holds US$1.8m worth of Macatawa Bank stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$465k | US$450k | 80% |

| Other | US$119k | US$107k | 20% |

| Total Compensation | US$584k | US$557k | 100% |

Talking in terms of the industry, salary represented approximately 43% of total compensation out of all the companies we analyzed, while other remuneration made up 57% of the pie. Macatawa Bank is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Macatawa Bank Corporation's Growth Numbers

Macatawa Bank Corporation's earnings per share (EPS) grew 19% per year over the last three years. In the last year, its revenue changed by just 0.7%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Macatawa Bank Corporation Been A Good Investment?

With a three year total loss of 34% for the shareholders, Macatawa Bank Corporation would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Ron is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. However, the EPS growth over three years is certainly impressive. Considering EPS are on the up, we would say Ron is compensated fairly. But we believe shareholders would want to see healthier returns before the CEO gets a raise.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Macatawa Bank (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Macatawa Bank, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Macatawa Bank, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:MCBC

Macatawa Bank

Operates as the bank holding company for Macatawa Bank that engages in the provision of commercial and consumer banking and trust services.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026