- United States

- /

- IT

- /

- NasdaqCM:TSSI

Exploring Undiscovered Gems in the United States This December 2024

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet over the past 12 months, it has risen by an impressive 32%, with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

LINKBANCORP (NasdaqCM:LNKB)

Simply Wall St Value Rating: ★★★★★★

Overview: LINKBANCORP, Inc. is a bank holding company for The Gratz Bank, offering a range of banking products and services to individuals, families, nonprofits, and businesses in Pennsylvania with a market capitalization of $278.04 million.

Operations: The primary revenue stream for LINKBANCORP comes from its banking operations, generating $86.14 million. The company has a market capitalization of $278.04 million, reflecting its position in the financial sector within Pennsylvania.

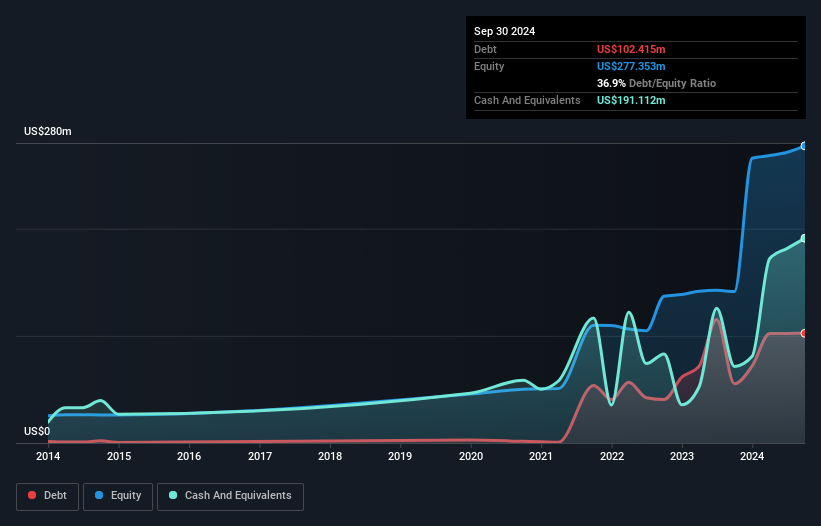

LINKBANCORP, with assets totaling US$2.9 billion and equity of US$277.4 million, is gaining traction thanks to its impressive earnings growth of 225.3% over the past year, outpacing the banks industry average significantly. The company manages a healthy balance sheet with total deposits at US$2.4 billion and loans at US$2.2 billion, while maintaining a net interest margin of 3.1%. Despite a one-off loss impacting recent results by US$10.4 million, LINKBANCORP has a sufficient bad loan allowance at 0.8% of total loans and primarily low-risk funding sources accounting for 91% of liabilities.

- Take a closer look at LINKBANCORP's potential here in our health report.

Examine LINKBANCORP's past performance report to understand how it has performed in the past.

TSS (NasdaqCM:TSSI)

Simply Wall St Value Rating: ★★★★★★

Overview: TSS, Inc. offers integration technology services focused on implementing, operating, and maintaining IT systems for enterprises in the United States and has a market cap of $267.23 million.

Operations: TSS generates revenue primarily from System Integration Services, contributing $114.68 million, and Facilities services, adding $7.85 million.

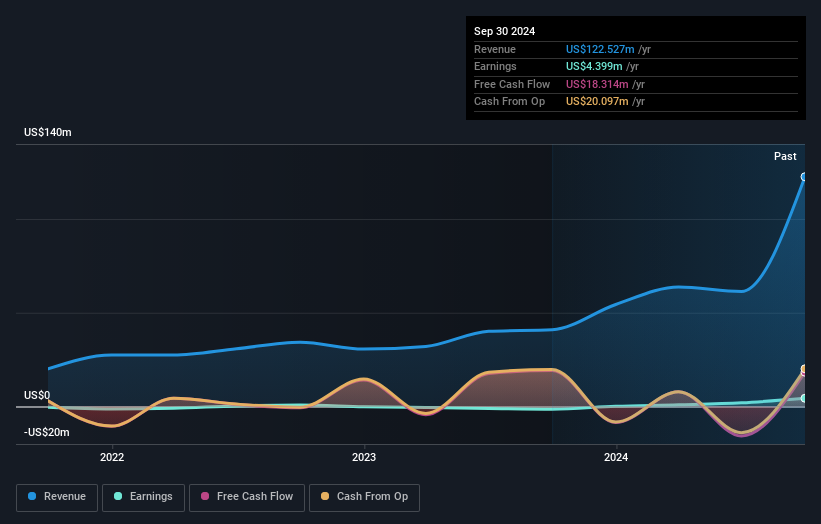

TSS, Inc. has made waves with its recent inclusion in the NASDAQ Composite Index, reflecting a robust performance trajectory. This company reported a significant leap in third-quarter revenue to US$70.07 million from US$8.88 million last year, alongside net income of US$2.65 million compared to just US$0.209 million previously. Despite shareholder dilution and volatile share prices recently, TSS stands out for trading 25% below its estimated fair value and maintaining high-quality earnings without debt concerns. The firm’s strategic relocation plans aim to bolster AI integration capabilities by expanding facility capacity over 60%, promising sustained growth momentum into 2025.

- Click to explore a detailed breakdown of our findings in TSS' health report.

Assess TSS' past performance with our detailed historical performance reports.

Gencor Industries (NYSEAM:GENC)

Simply Wall St Value Rating: ★★★★★★

Overview: Gencor Industries, Inc. designs, manufactures, and sells heavy machinery for highway construction materials and environmental control equipment, with a market cap of $322.47 million.

Operations: Gencor Industries generates revenue primarily from the sale of equipment for the highway construction industry, totaling $113.12 million.

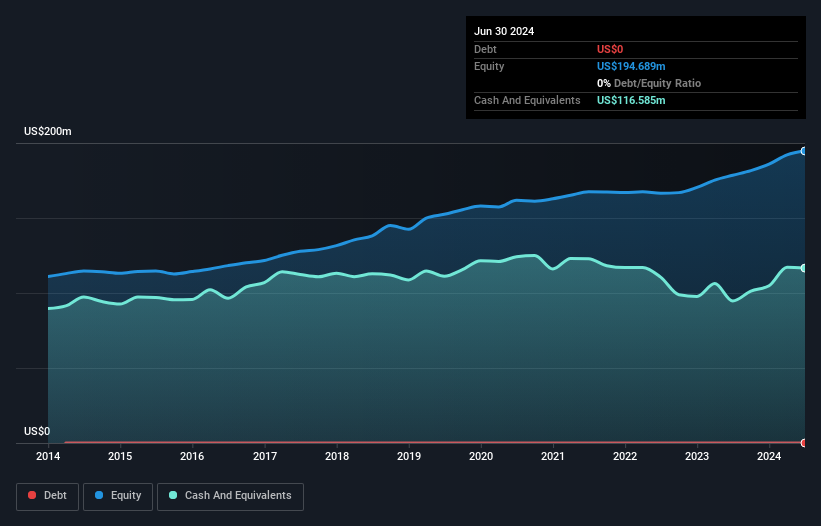

Gencor Industries, a nimble player in the machinery sector, has showcased impressive growth with earnings surging 34.7% over the past year, outpacing the industry average of 11.5%. This debt-free company trades at a significant discount, approximately 90.3% below its estimated fair value, indicating potential undervaluation in US$ terms. Gencor's financial health is bolstered by its positive free cash flow and high-quality earnings profile. Recently, they transitioned their auditing services to Forvis Mazars following an acquisition involving their previous firm MSL; this strategic move likely reflects a commitment to maintaining robust financial oversight.

Summing It All Up

- Dive into all 229 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TSSI

TSS

Provides integration technology services to implement, operate, and maintain information technology systems to enterprises and users in the United States.

Flawless balance sheet with proven track record.