Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:LBC

A Rising Share Price Has Us Looking Closely At Luther Burbank Corporation's (NASDAQ:LBC) P/E Ratio

Luther Burbank (NASDAQ:LBC) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month alone, although it is still down 10.0% over the last quarter. While recent buyers might be laughing, long term holders might not be so pleased, since the recent gain only brings the full year return to evens.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

View our latest analysis for Luther Burbank

How Does Luther Burbank's P/E Ratio Compare To Its Peers?

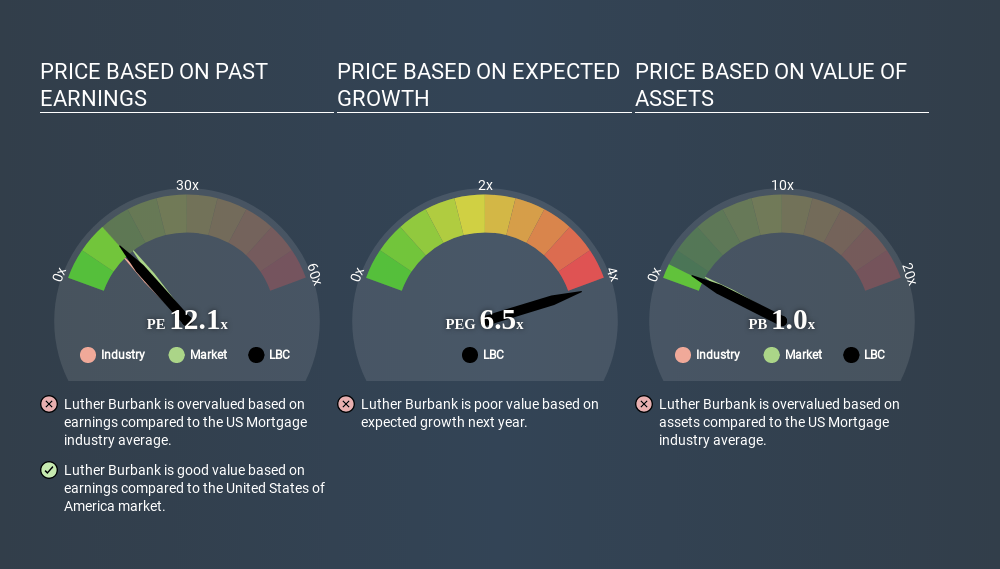

Luther Burbank's P/E of 12.06 indicates some degree of optimism towards the stock. As you can see below, Luther Burbank has a higher P/E than the average company (10.8) in the mortgage industry.

Its relatively high P/E ratio indicates that Luther Burbank shareholders think it will perform better than other companies in its industry classification. The market is optimistic about the future, but that doesn't guarantee future growth. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. That means even if the current P/E is low, it will increase over time if the share price stays flat. Then, a higher P/E might scare off shareholders, pushing the share price down.

Luther Burbank saw earnings per share improve by 8.9% last year. In contrast, EPS has decreased by 11%, annually, over 3 years.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

How Does Luther Burbank's Debt Impact Its P/E Ratio?

Net debt totals a substantial 180% of Luther Burbank's market cap. This level of debt justifies a relatively low P/E, so remain cognizant of the debt, if you're comparing it to other stocks.

The Verdict On Luther Burbank's P/E Ratio

Luther Burbank's P/E is 12.1 which is below average (14.0) in the US market. The meaningful debt load is probably contributing to low expectations, even though it has improved earnings recently. What we know for sure is that investors have become more excited about Luther Burbank recently, since they have pushed its P/E ratio from 9.2 to 12.1 over the last month. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Luther Burbank may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:LBC

Luther Burbank

Luther Burbank Corporation operates as the bank holding company for Luther Burbank Savings that provides various banking products and services for real estate investors, professionals, entrepreneurs, depositors, and commercial businesses.

Flawless balance sheet and fair value.