- United States

- /

- Banks

- /

- NasdaqGM:LARK

Landmark Bancorp (LARK) Margin Improvement Reinforces Defensive Narrative Despite Weak Long-Term Earnings Trend

Reviewed by Simply Wall St

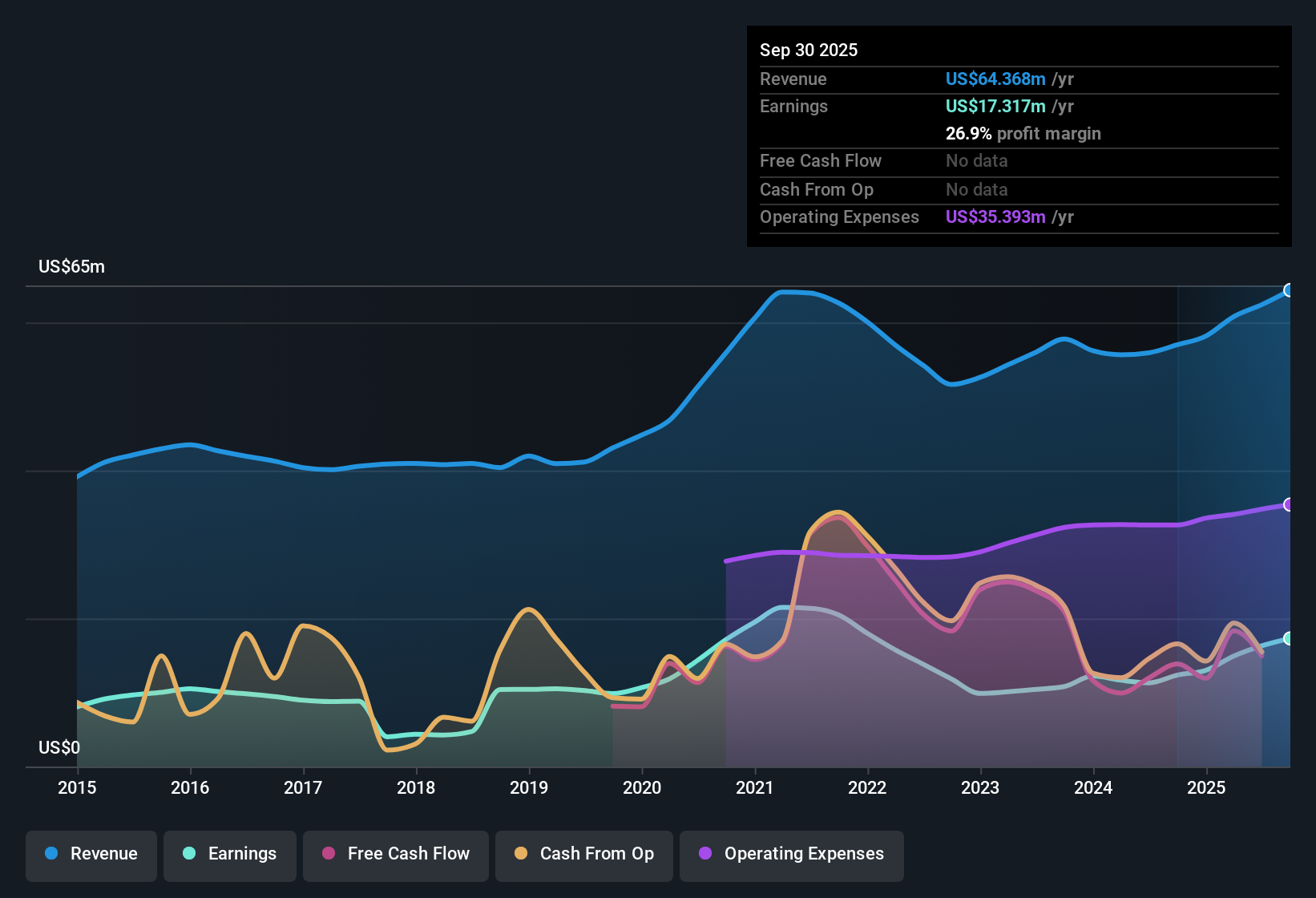

Landmark Bancorp (LARK) posted a notable jump in profitability this quarter, with net profit margins improving to 26.1% compared to 20.2% a year ago, and earnings growth reaching 44.3% year-on-year. Despite that recent surge, the five-year average shows a yearly decline of 11.1% in earnings, setting a backdrop of longer-term caution. Still, the market will be weighing this margin rebound and strong near-term growth against the company’s history of profit declines as investors assess the outlook ahead.

See our full analysis for Landmark Bancorp.Now, we're putting these headline results up against the most widely followed narratives around Landmark Bancorp, examining which market stories are supported by the data and where the latest numbers might start to shift the discussion.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Boosted by Higher Profit Quality

- Net profit margins improved to 26.1%, up from 20.2% a year ago. The quality of earnings was viewed as high relative to recent sector results and supports Landmark Bancorp’s reputation for reliability.

- Reliability of earnings and capital discipline are heavily cited by prevailing market narratives as supporting the case for Landmark as a stable, defensive pick.

- Consistent margin outperformance and a prudent management approach are highlighted as reasons investors seeking stability may be drawn in, despite the backdrop of declining long-term profits.

- The narrative also points out that Landmark typically trades at a valuation premium over weaker banks due to these safety and quality attributes. The company’s recent margin rebound offers fresh justification for that stance.

Dividend and Value Appeal Versus Sector Peers

- Landmark Bancorp’s price-to-earnings ratio stands at 9.2x, which is lower than both the US Banks industry average (11x) and its direct peer group (10x). The current share price of $25.92 trades below the DCF fair value of $28.10.

- The prevailing market view notes Landmark’s attractive valuation and steady dividend payout as key investor rewards.

- Being priced at a discount to sector peers is positioning the stock as a value opportunity. However, expectations for outsized returns remain modest because long-term growth trends have been negative.

- Prevailing sentiment points to the reliable dividend and relative safety as the main draw, even as the upside potential may be capped absent a material change to the earnings trajectory.

Growth Concerns Linger Despite Recent Gains

- While earnings surged 44.3% year-on-year, the five-year average reflects an annual earnings decline of 11.1%, underscoring that improvement is set against a much weaker long-term trend.

- Prevailing market analysis points to caution, as recent strength in earnings and margins may not be enough to reverse several years of steady declines.

- Investors and analysts remain watchful, since the lack of current forecasts for future growth means the jury is still out on whether the positive momentum is sustainable.

- This tension between near-term outperformance and longer-term weakness tempers expectations that the strong results are the start of a durable turnaround.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Landmark Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Landmark Bancorp’s latest results show short-term profit gains, its long-term trend of declining earnings raises real concerns about consistent future performance.

If reliable, steady growth is what you seek, check out stable growth stocks screener (2110 results) for companies consistently building earnings and revenue, so you can invest with greater confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LARK

Landmark Bancorp

Operates as the financial holding company for Landmark National Bank that provides various financial and banking services to its local communities.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives