- United States

- /

- Banks

- /

- NasdaqCM:JMSB

John Marshall Bancorp's (NASDAQ:JMSB) Dividend Will Be Increased To $0.25

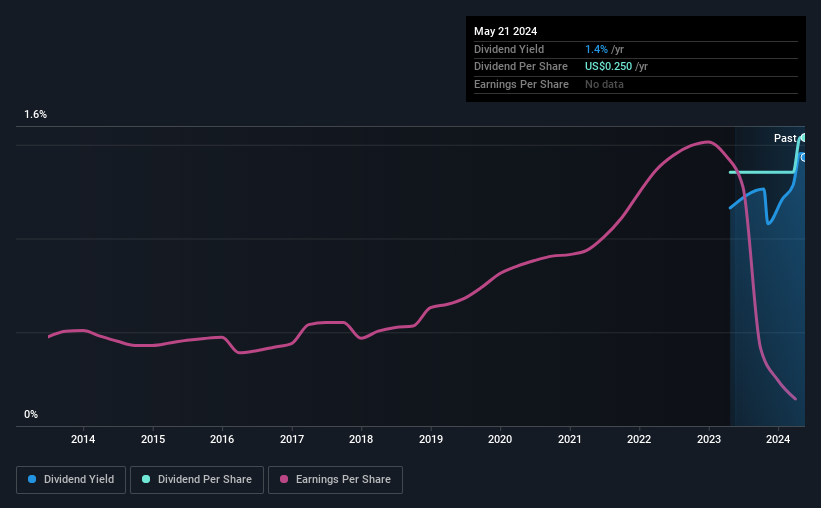

John Marshall Bancorp, Inc. (NASDAQ:JMSB) will increase its dividend from last year's comparable payment on the 8th of July to $0.25. Despite this raise, the dividend yield of 1.4% is only a modest boost to shareholder returns.

See our latest analysis for John Marshall Bancorp

John Marshall Bancorp Will Pay Out More Than It Is Earning

If it is predictable over a long period, even low dividend yields can be attractive.

Currently, John Marshall Bancorp does not yet have a history of paying dividends out, with this being its first year doing so. But while John Marshall Bancorp was able to finally pay out a dividend for the first time, its most recent earnings report shows the company's net income didn't cover its dividend distribution. This is worrying for investors as it points to John Marshall Bancorp's dividends being unsustainable in the long term.

Looking forward, EPS could fall by 26.1% if the company can't turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the future payout ratio could reach 157%, which could put the dividend under pressure if earnings don't start to improve.

John Marshall Bancorp Doesn't Have A Long Payment History

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. John Marshall Bancorp's earnings per share has shrunk at 26% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

John Marshall Bancorp's Dividend Doesn't Look Great

In conclusion, we have some concerns about this dividend, even though it being raised is good. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. We don't think that this is a great candidate to be an income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for John Marshall Bancorp that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JMSB

John Marshall Bancorp

Operates as the bank holding company for John Marshall Bank that provides banking products and financial services in the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026