- United States

- /

- Banks

- /

- NasdaqGS:INTR

How Investors Are Reacting To Inter & Co (INTR) Expanding Digital Banking Services Into Argentina

Reviewed by Sasha Jovanovic

- Inter & Co recently announced the launch of its operations in Argentina, aiming to attract Argentine customers seeking to invest in the US as part of its broader international expansion beyond Brazil.

- This move reflects Inter & Co's commitment to positioning itself as a regional digital banking player by directly addressing demand from investors in key Latin American markets.

- We'll explore how Inter & Co's entry into Argentina could enhance its investment narrative by expanding its addressable market and international presence.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Inter & Co Investment Narrative Recap

To be a shareholder in Inter & Co, you need to believe in its vision of scaling as a leading digital financial platform across Latin America, with rapid user growth and ongoing international expansion fueling long-term value. The announcement of its Argentina launch likely supports the short-term catalyst of broadening its addressable market, but does not immediately address the high level of bad loans, which remains the most important short-term risk.

The recent equity offering of US$140.8 million stands out as particularly relevant, as it provides additional capital that could fund Inter & Co’s continued regional expansion, including the new Argentina initiative. This financial flexibility may support scaling efforts, but effective deployment will be watched closely by those focused on near-term risks to asset quality and profitability.

However, investors should keep in mind that with international expansion comes higher exposure to cross-border regulatory risks and...

Read the full narrative on Inter & Co (it's free!)

Inter & Co's narrative projects R$13.8 billion revenue and R$2.9 billion earnings by 2028. This requires 37.6% yearly revenue growth and an increase of R$1.8 billion in earnings from the current R$1.1 billion.

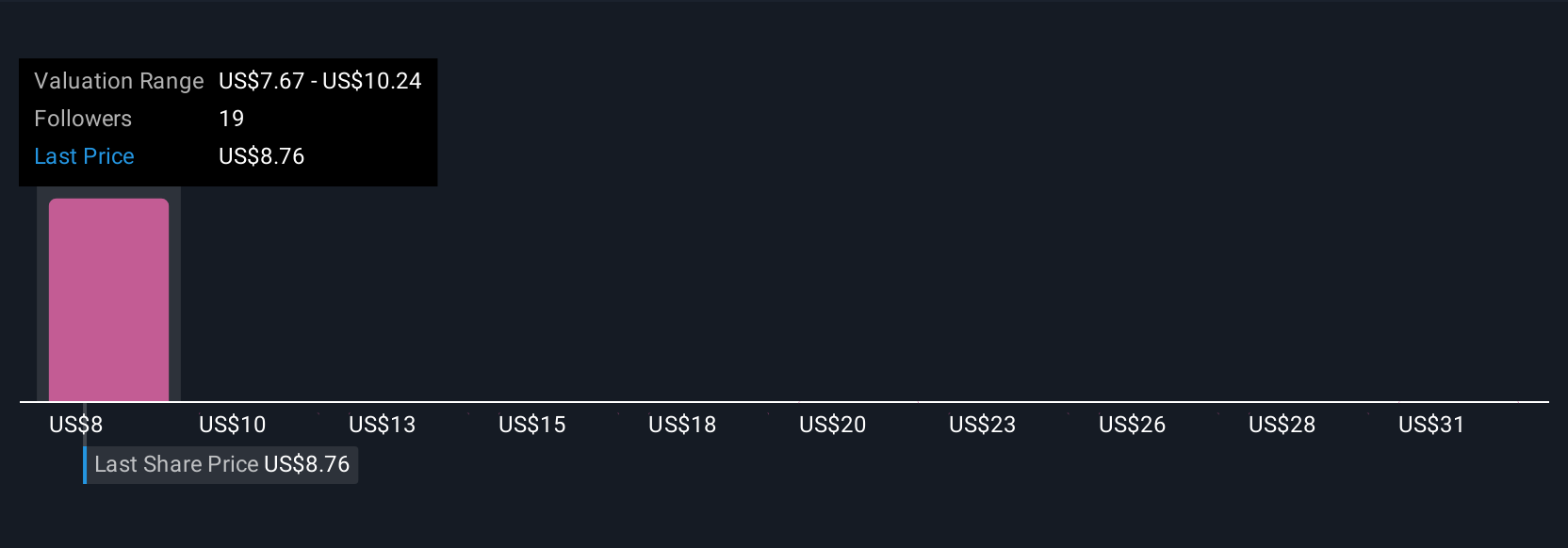

Uncover how Inter & Co's forecasts yield a $8.83 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Four participants from the Simply Wall St Community estimate Inter & Co’s fair value between US$8.00 and US$20.97 per share. While views vary widely, many are paying close attention to the company’s high bad loan ratio and what it could mean for future earnings, explore these perspectives to see what matters most to different investors.

Explore 4 other fair value estimates on Inter & Co - why the stock might be worth over 2x more than the current price!

Build Your Own Inter & Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inter & Co research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inter & Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inter & Co's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTR

Inter & Co

Through its subsidiaries, engages in the banking and spending, investments, insurance brokerage, and inter shop businesses in Brazil and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives