Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:INBK

First Internet Bancorp (NASDAQ:INBK) Is Due To Pay A Dividend Of US$0.06

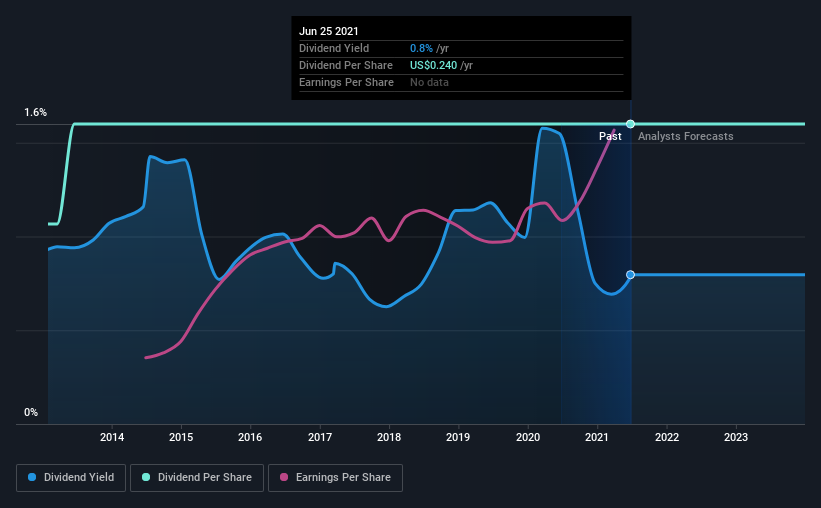

First Internet Bancorp (NASDAQ:INBK) has announced that it will pay a dividend of US$0.06 per share on the 15th of July. This means the annual payment will be 0.8% of the current stock price, which is lower than the industry average.

Check out our latest analysis for First Internet Bancorp

First Internet Bancorp's Earnings Easily Cover the Distributions

If it is predictable over a long period, even low dividend yields can be attractive. However, First Internet Bancorp's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to expand by 33.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 5.2%, which is in the range that makes us comfortable with the sustainability of the dividend.

First Internet Bancorp Doesn't Have A Long Payment History

The dividend's track record has been pretty solid, but with only 8 years of history we want to see a few more years of history before making any solid conclusions. The first annual payment during the last 8 years was US$0.16 in 2013, and the most recent fiscal year payment was US$0.24. This means that it has been growing its distributions at 5.2% per annum over that time. The dividend has been growing as a reasonable rate, which we like. However, investors will probably want to see a longer track record before they consider First Internet Bancorp to be a consistent dividend paying stock.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. We are encouraged to see that First Internet Bancorp has grown earnings per share at 11% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

First Internet Bancorp Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for First Internet Bancorp for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you decide to trade First Internet Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether First Internet Bancorp is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:INBK

First Internet Bancorp

Operates as the bank holding company for First Internet Bank of Indiana that provides commercial, small business, consumer, and municipal banking products and services to individuals and commercial customers in the United States.

Flawless balance sheet and undervalued.