- United States

- /

- Banks

- /

- NasdaqGS:IBOC

A Look at International Bancshares (IBOC) Valuation Following Strong Q3 Earnings and Loan Growth

Reviewed by Simply Wall St

International Bancshares (IBOC) posted third quarter results that topped expectations, with net income and revenue both coming in above forecast. The company reported growth across commercial, real estate, and consumer loan categories, which signals steady business momentum.

See our latest analysis for International Bancshares.

International Bancshares’ share price stands at $67.31, with momentum building over the past year as steady earnings and rising institutional ownership have caught investors’ attention. Despite a minor dip in 1-day trading, the stock has delivered a solid 36.6% total shareholder return over three years and an impressive 159.3% over five years. This highlights its resilience and long-term growth story.

If you’re looking for the next standout in the financial sector, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares nearing historic highs and a strong track record of growth, the key question is whether International Bancshares remains undervalued, or if the market has already accounted for the company’s future potential.

Price-to-Earnings of 10.2x: Is it justified?

International Bancshares trades at a price-to-earnings (P/E) ratio of 10.2x, which appears attractive next to its recent closing price of $67.31 and signals a potential discount relative to peers.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company's earnings. For banks, this is a critical gauge of investor confidence and expectations for future profitability, especially in a sector where earnings growth can be cyclical.

Currently, International Bancshares' P/E is not only lower than the peer group average of 31x but also below the US Banks industry average of 11.1x. This suggests the market is assigning a lower earnings multiple despite the bank’s strong track record and may be overlooking its sustained profit growth. Such a gap could narrow if the company continues to deliver on its fundamentals and sector sentiment improves.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.2x (UNDERVALUED)

However, uncertainty in broader economic trends or regulatory changes could affect International Bancshares’ growth story and challenge its undervalued status.

Find out about the key risks to this International Bancshares narrative.

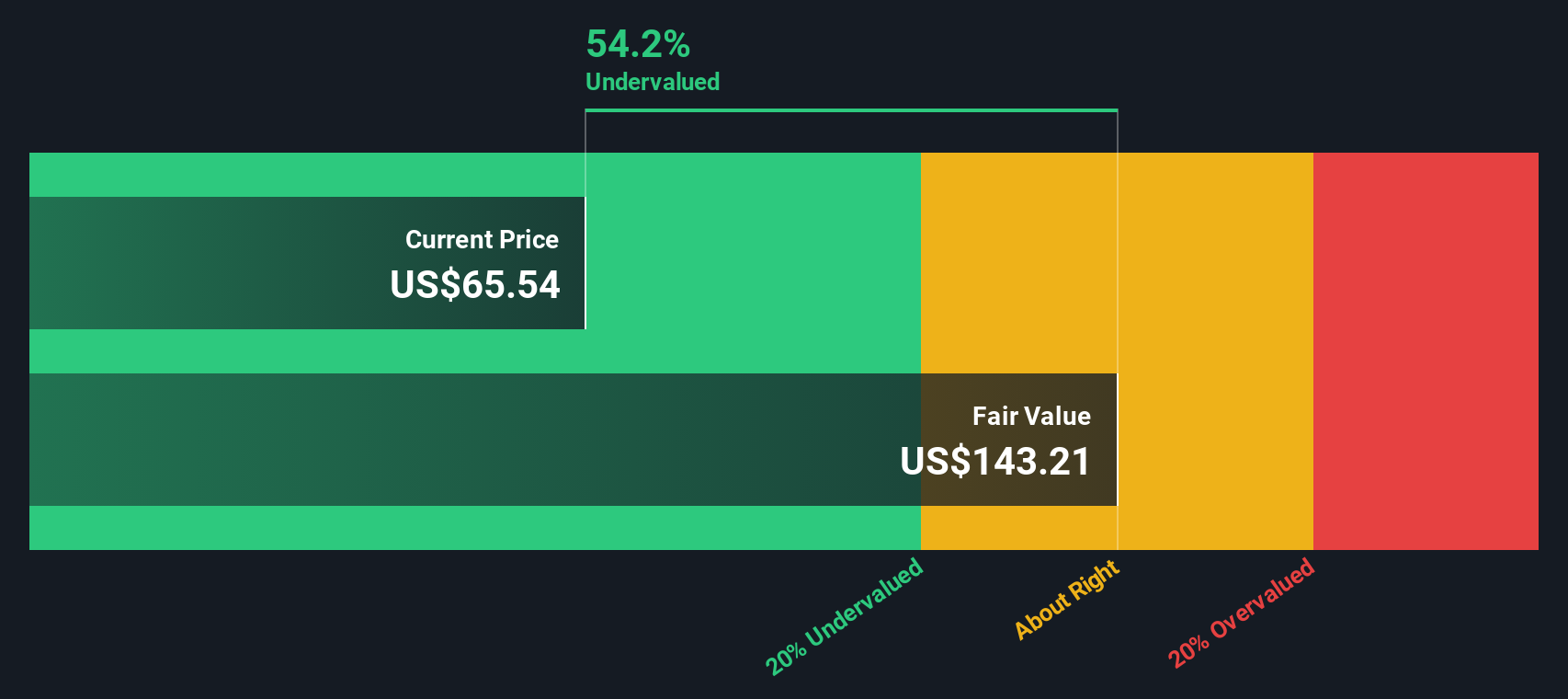

Another View: Discounted Cash Flow Suggests Even Deeper Value

Looking at International Bancshares through the lens of our DCF model adds a new dimension to the valuation story. The SWS DCF model estimates fair value at $141.29, which is dramatically above the current share price. This approach points toward substantial undervaluation, raising the question of whether the market is missing something significant.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out International Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own International Bancshares Narrative

If you want a different perspective or prefer to analyze the numbers on your own, it's quick and simple to develop your personal view. Do it your way

A great starting point for your International Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on fresh opportunities. Expand your watchlist and stay ahead. Make sure you don’t miss the stocks shaking up tomorrow’s markets.

- Signal your portfolio for bigger yields by reviewing these 17 dividend stocks with yields > 3% with solid payouts and proven income growth.

- Ride technology’s next wave by seeing what’s possible from innovation powerhouses through these 25 AI penny stocks.

- Find exceptional value opportunities by evaluating these 861 undervalued stocks based on cash flows that could be flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBOC

International Bancshares

A multibank financial holding company, provides a range of commercial and retail banking services in Texas and the State of Oklahoma.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives