- United States

- /

- Banks

- /

- NasdaqGS:HOPE

Hope Bancorp (HOPE): Assessing Valuation After Raised 2025 Guidance and Strengthened Quarterly Results

Reviewed by Simply Wall St

Hope Bancorp (HOPE) just reported third quarter results showing higher net interest income and net income compared to the same period last year. In addition, the bank affirmed its quarterly dividend and updated guidance for 2025.

See our latest analysis for Hope Bancorp.

With the share price of Hope Bancorp currently at $10.56, recent guidance for higher loan and net interest income in 2025 appears to have sparked interest, even as the 1-year total shareholder return remains at -9.24%. While quarterly fundamentals have shown improvement, the stock’s longer-term five-year total shareholder return is much brighter at 43.07%, reflecting momentum that has come in waves rather than a straight line.

If renewed confidence in banking stocks has you exploring the broader landscape, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets despite guidance pointing toward rising income, is there a real buying opportunity here? Or is the market already pricing in Hope Bancorp’s next phase of growth?

Most Popular Narrative: 13.8% Undervalued

Hope Bancorp's prevailing narrative values shares notably higher than the recent close of $10.56, focusing on potential upside that has caught market attention. This fair value is based on high expectations for business transformation and future earnings power, making the optimism hard to ignore.

Significant ongoing investment in digital platform enhancements and fintech partnerships is poised to improve operational efficiency and customer retention, which could translate into a sustainably lower cost-to-income ratio and improved net margins over time.

What is driving this optimistic narrative? Bold financial targets, a digital revamp, and a profit margin trajectory that is rarely seen in this sector. Curious about which key assumptions could change the outlook and whether the company can deliver on expectations? Get the inside story that is supporting this fair value.

Result: Fair Value of $12.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentration in commercial real estate loans or slower digital adoption could hinder Hope Bancorp’s progress. This may cast doubt over optimistic growth assumptions.

Find out about the key risks to this Hope Bancorp narrative.

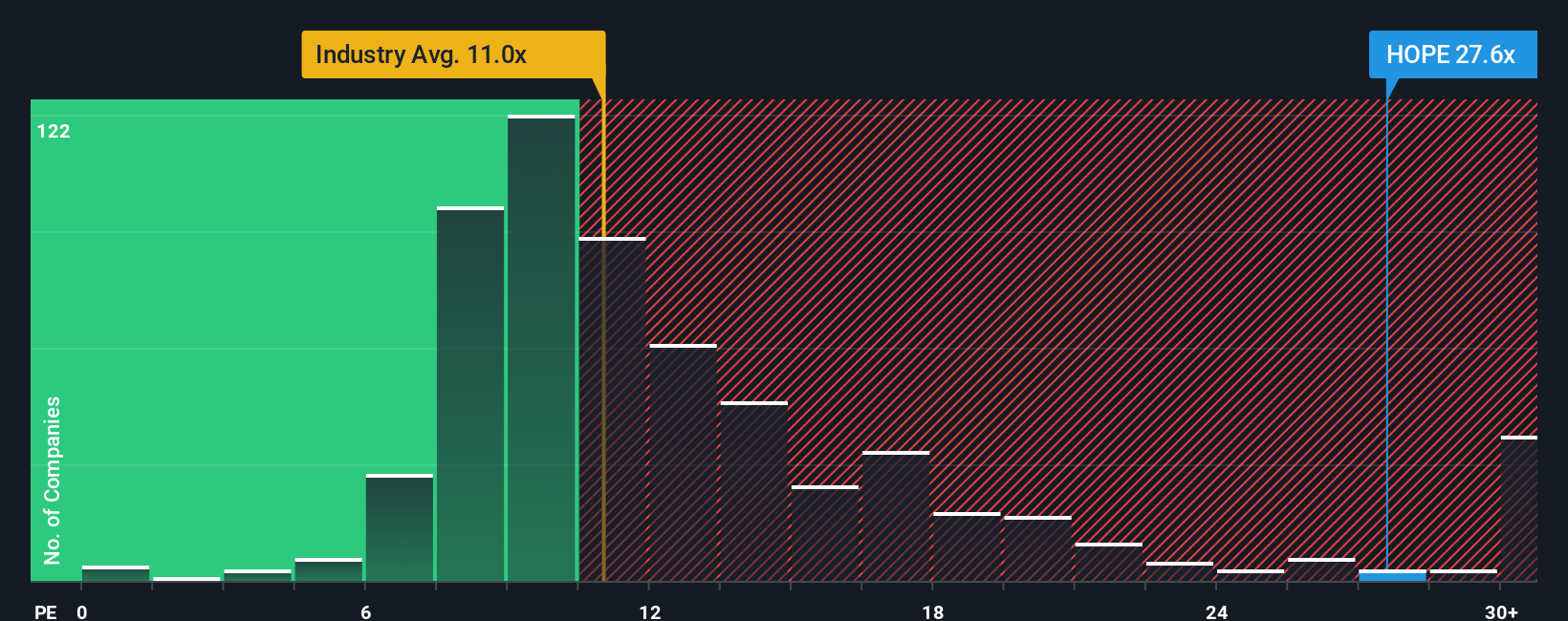

Another View: Price Compared to Peers

While the optimism around earnings potential suggests HOPE is undervalued, the current price-to-earnings ratio of 28x is much higher than the US Banks industry average of 11x and also exceeds the fair ratio of 24x. This could indicate valuation risk if future results do not align with expectations. Is momentum from digital upgrades sufficient to justify a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hope Bancorp Narrative

If you see things differently or want to take a closer look at the numbers, you can easily build your own narrative in just a few minutes: Do it your way

A great starting point for your Hope Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not let great opportunities slip by. Broaden your portfolio beyond just one stock and position yourself for the next wave of growth by checking out these exciting ideas:

- Uncover high-yield opportunities today by checking out these 18 dividend stocks with yields > 3% offering attractive payouts and dependable performance for income-focused investors.

- Jump ahead of market trends by exploring these 26 AI penny stocks, where pioneering firms are pushing the boundaries of artificial intelligence innovation and disruption.

- Tap into rapid growth potential with these 3598 penny stocks with strong financials, ideal for investors who thrive on spotting undervalued gems before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hope Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOPE

Hope Bancorp

Operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives