- United States

- /

- Banks

- /

- NasdaqGS:HOPE

Did Strong Q3 Results and Upbeat Guidance Just Shift Hope Bancorp's (HOPE) Investment Narrative?

Reviewed by Sasha Jovanovic

- Hope Bancorp reported strong third quarter 2025 results, including year-over-year improvements in net interest income and net income, a significant decline in net charge-offs, and affirmed guidance for high single-digit loan growth and approximately 10% net interest income growth for 2025.

- Management emphasized continued positive operating momentum, disciplined credit management, and ongoing integration of the Territorial acquisition, while also declaring a quarterly dividend of US$0.14 per share.

- We'll explore how Hope Bancorp's improved asset quality and positive earnings guidance could influence its investment narrative going forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Hope Bancorp Investment Narrative Recap

For shareholders of Hope Bancorp, the core investment idea centers on banking growth through disciplined lending, improved asset quality, and expanding into new geographic markets. The recent sharp reduction in net charge-offs for the third quarter reinforces confidence in credit management and supports current guidance for loan and net interest income growth. However, this development does not materially change the biggest short-term catalyst, which remains the successful integration and cost savings from the Territorial acquisition, nor does it eliminate the biggest risk, continued high exposure to commercial real estate during uncertain economic periods.

Among recent announcements, the continued payment of the US$0.14 per share quarterly dividend stands out for income-focused investors. It comes as management affirms confidence in both its growing deposit base and improving profitability, which are essential for supporting anticipated loan growth and providing a buffer against credit risk or regional downturns.

But even with improved loan performance, investors should not overlook the concentration risk in commercial real estate loans that could become more visible if regional economic conditions shift…

Read the full narrative on Hope Bancorp (it's free!)

Hope Bancorp's narrative projects $828.8 million in revenue and $392.4 million in earnings by 2028. This requires 26.2% yearly revenue growth and a $350.7 million earnings increase from current earnings of $41.7 million.

Uncover how Hope Bancorp's forecasts yield a $12.25 fair value, a 16% upside to its current price.

Exploring Other Perspectives

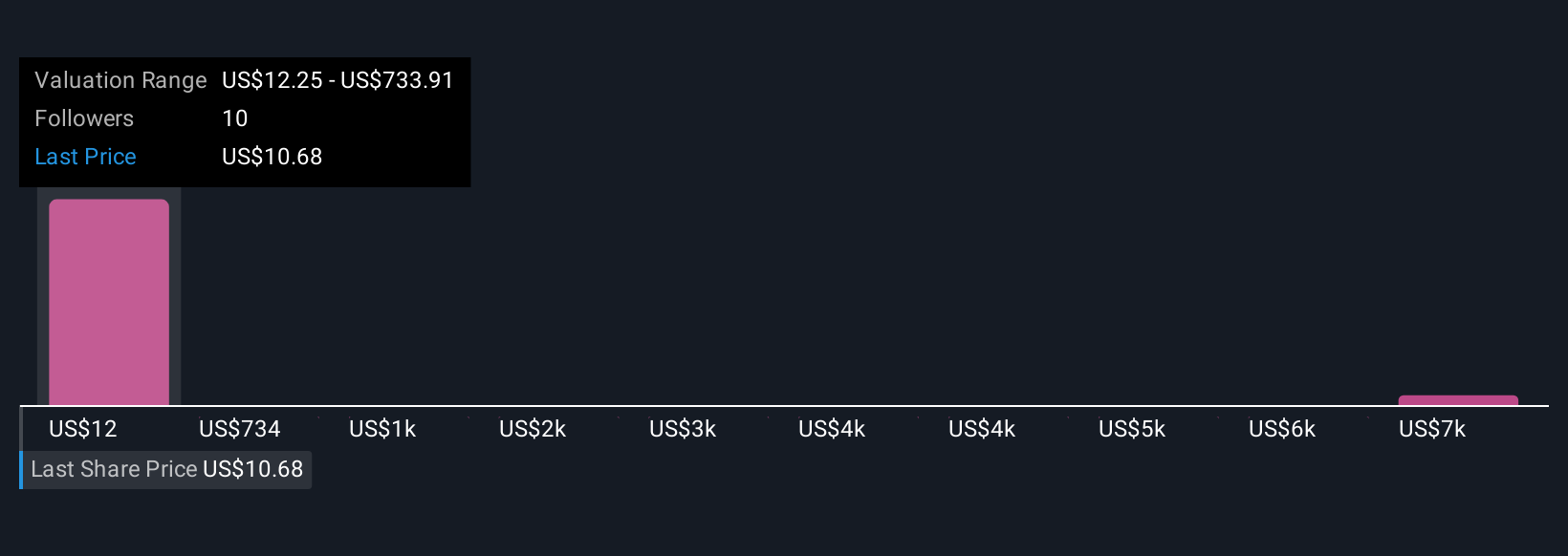

Four fair value estimates from the Simply Wall St Community span from US$12.25 to US$7,228.80 per share. Against these varied outlooks, recent progress in reducing charge-offs brings asset quality to the forefront as a key factor shaping future results.

Explore 4 other fair value estimates on Hope Bancorp - why the stock might be worth just $12.25!

Build Your Own Hope Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hope Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hope Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hope Bancorp's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hope Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOPE

Hope Bancorp

Operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives