- United States

- /

- Banks

- /

- NasdaqCM:GBFH

Top Insider-Owned Growth Stocks For November 2025

Reviewed by Simply Wall St

In the current U.S. market landscape, major stock indexes have shown mixed results with the Dow Jones Industrial Average experiencing a slight decline while still posting weekly gains, and concerns about high valuations in big tech companies affecting investor sentiment. Amidst this backdrop, growth companies with high insider ownership can present unique opportunities as they often reflect confidence from those closest to the business; today we explore three such stocks that stand out for November 2025.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 51.6% |

| StubHub Holdings (STUB) | 21.9% | 73.4% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23% | 74.1% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 45.3% |

| Atour Lifestyle Holdings (ATAT) | 17.9% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 27.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Let's review some notable picks from our screened stocks.

GBank Financial Holdings (GBFH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GBank Financial Holdings Inc., with a market cap of $508.34 million, operates as a bank holding company for GBank, offering banking services to commercial and consumer customers in Nevada.

Operations: The company generates revenue of $67.42 million from its banking services to commercial and consumer clients in Nevada.

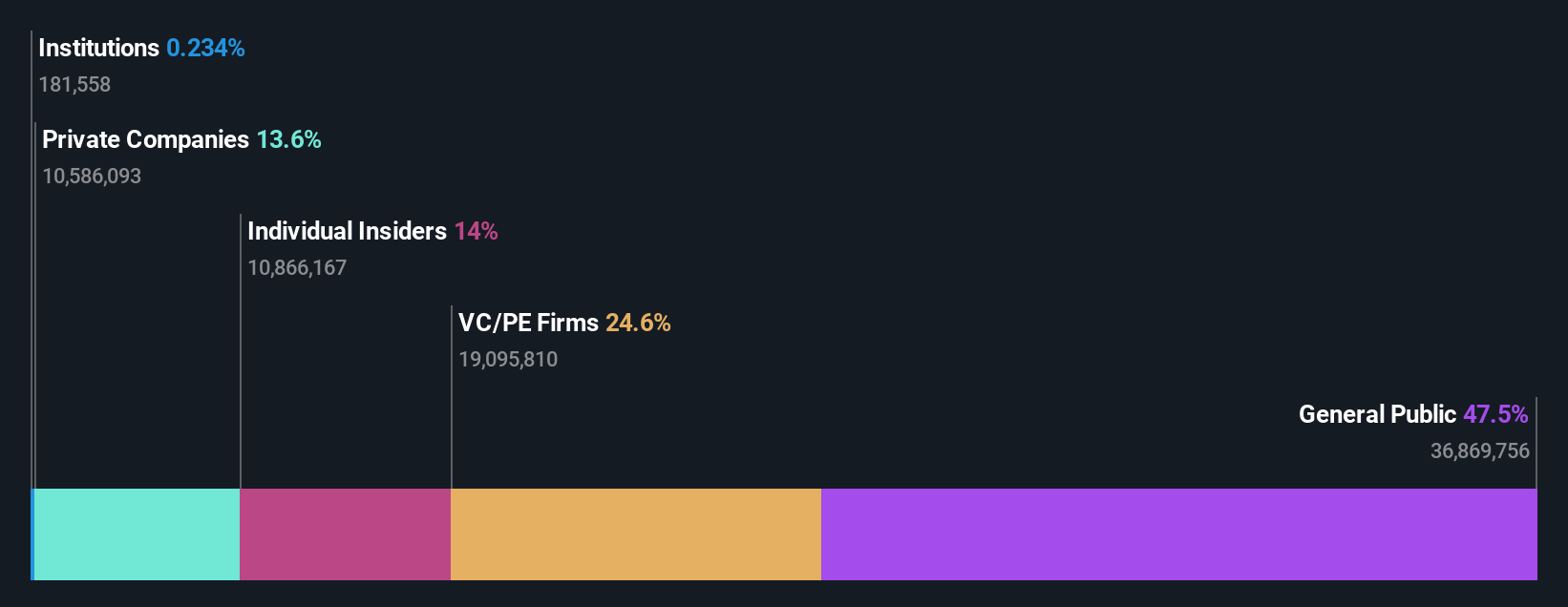

Insider Ownership: 31.9%

Return On Equity Forecast: 21% (2028 estimate)

GBank Financial Holdings is experiencing a leadership transition with the appointment of Hilary R. Sledge-Sarnor as Executive Vice President, enhancing its legal and regulatory framework. Despite recent executive changes, including CEO succession planning, the company maintains strong growth prospects with earnings forecasted to grow significantly above market rates. However, challenges persist with high levels of bad loans and no substantial insider buying recently noted. The company's revenue grew by 22.6% last year despite a decline in net income for the third quarter compared to last year.

- Delve into the full analysis future growth report here for a deeper understanding of GBank Financial Holdings.

- Our valuation report here indicates GBank Financial Holdings may be overvalued.

Aebi Schmidt Holding (AEBI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aebi Schmidt Holding AG develops and manufactures special-purpose vehicles and attachments, with a market cap of $840.56 million.

Operations: The company's revenue is derived from North America, contributing $781.05 million, and Europe and the rest of the world, generating $515.43 million.

Insider Ownership: 14.2%

Return On Equity Forecast: N/A (2028 estimate)

Aebi Schmidt Holding is trading significantly below its estimated fair value and has seen substantial insider buying in recent months, indicating confidence in its growth trajectory. Despite lower profit margins compared to last year, the company forecasts robust earnings and revenue growth well above market rates. Recent earnings showed a decline in net income due to large one-off items, yet sales increased notably. The company reaffirmed its full-year sales guidance between US$1.85 billion and US$2 billion.

- Dive into the specifics of Aebi Schmidt Holding here with our thorough growth forecast report.

- According our valuation report, there's an indication that Aebi Schmidt Holding's share price might be on the expensive side.

Liberty Latin America (LILA)

Simply Wall St Growth Rating: ★★★★☆☆

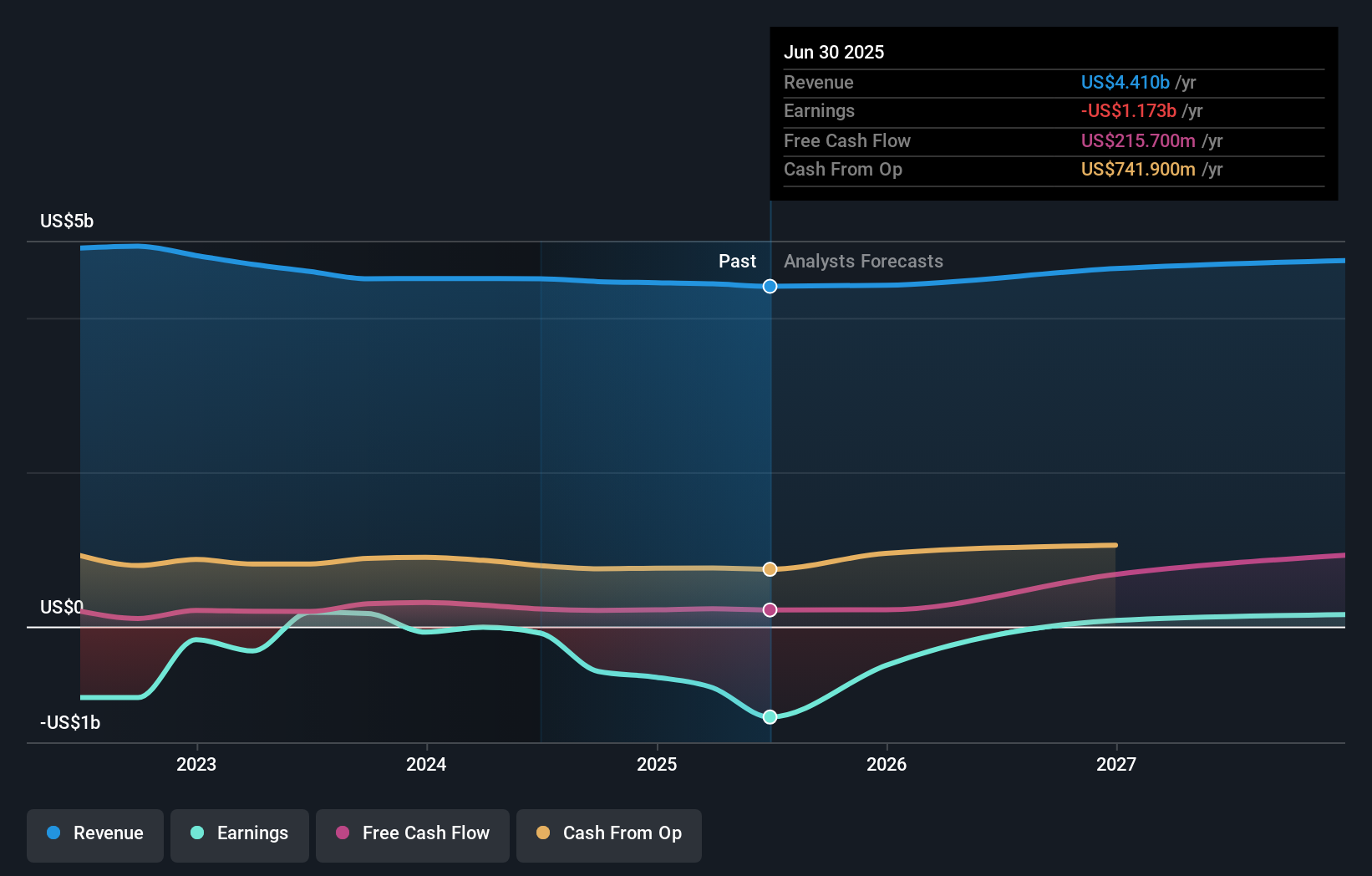

Overview: Liberty Latin America Ltd. provides fixed, mobile, and subsea telecommunications services across various regions including Puerto Rico, Panama, and the Caribbean with a market cap of approximately $1.65 billion.

Operations: The company's revenue segments consist of $762.20 million from C&W Panama, $451.70 million from Liberty Networks, $1.47 billion from Liberty Caribbean, $632.10 million from Liberty Costa Rica, and $1.21 billion from Liberty Puerto Rico.

Insider Ownership: 11.1%

Return On Equity Forecast: 25% (2028 estimate)

Liberty Latin America is trading well below its estimated fair value, suggesting potential upside. Despite slower revenue growth forecasts compared to the US market, it aims for profitability within three years with strong earnings growth projections. Recent collaborations, like with Starlink Direct to Cell for disaster connectivity solutions, and infrastructure investments such as the MAYA-1.2 subsea cable upgrade demonstrate strategic initiatives enhancing regional digital resilience and connectivity services across the Caribbean and Central America.

- Click here and access our complete growth analysis report to understand the dynamics of Liberty Latin America.

- The analysis detailed in our Liberty Latin America valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Get an in-depth perspective on all 193 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GBFH

GBank Financial Holdings

Operates as a bank holding company for GBank that provides banking services to commercial and consumer customers in Nevada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives