- United States

- /

- Banks

- /

- NasdaqGS:GABC

German American Bancorp (GABC) Earnings Growth Surges 22%, Challenging Concerns Over Margin Compression

Reviewed by Simply Wall St

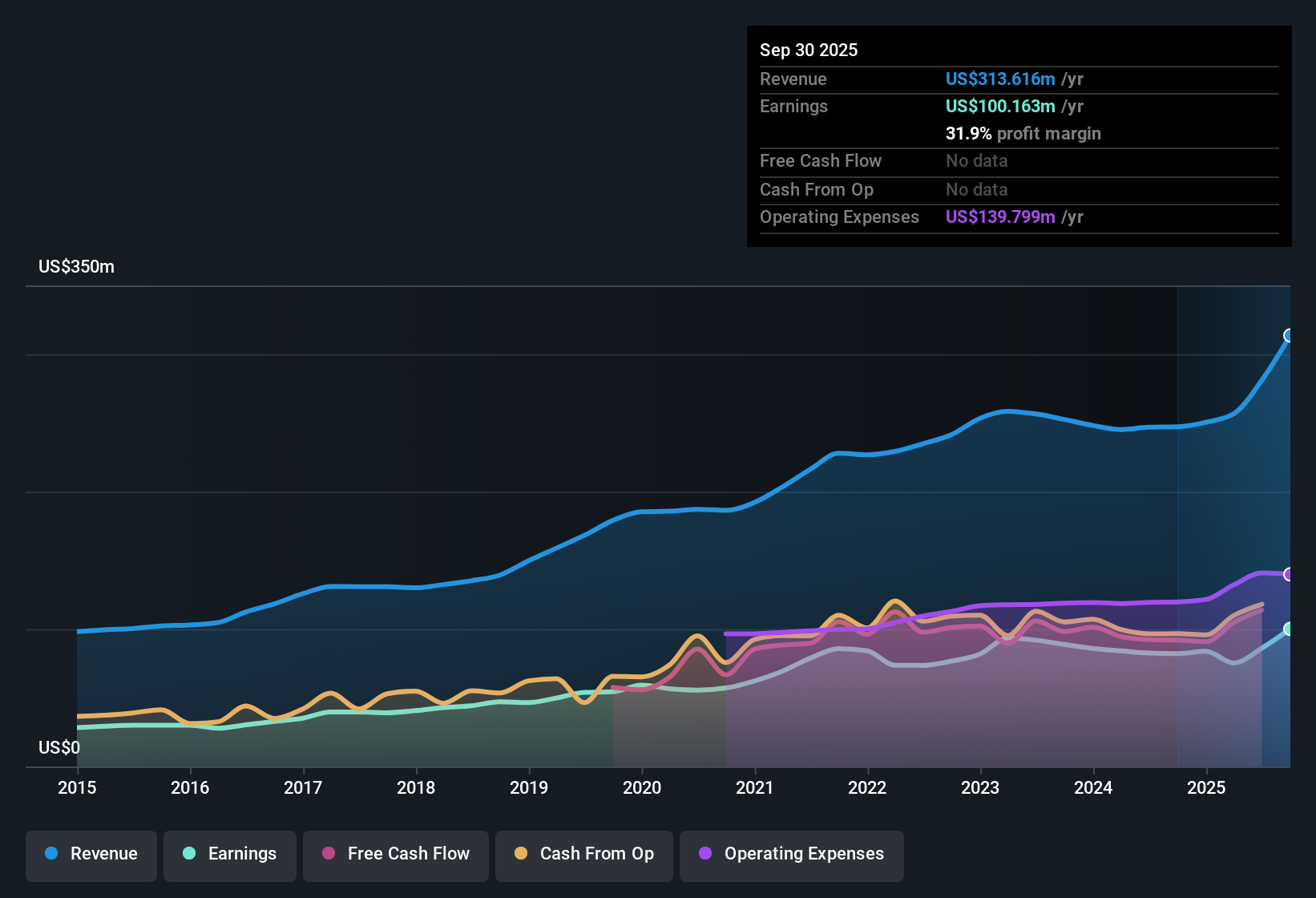

German American Bancorp (GABC) reported earnings growth of 22% over the past year, outpacing its five-year average of 5.2% per year. The company’s net profit margin edged lower to 32% from 33.2% last year, and analysts now expect annual earnings growth of 18.2% going forward, ahead of the broader US market’s forecast. With revenue projected to rise 10.8% per year and shares trading below estimated fair value despite a higher-than-average Price-to-Earnings ratio, investors are weighing whether this momentum can sustain a valuation premium as margins have slightly narrowed.

See our full analysis for German American Bancorp.Next up, we will see how these latest numbers compare to the dominant market narratives, putting the results in context and spotlighting where the consensus may get challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Compression Signals Cautious Optimism

- Net profit margin slipped to 32%, down from 33.2% the previous year. This marks a modest reduction in efficiency despite strong earnings growth.

- What is surprising is that, even as margins narrowed, the outlook sees GABC’s annual earnings growing at 18.2%. This rate outpaces the US market median of 15.6%.

- This margin dip has not shaken broader confidence, as guidance for both revenue and bottom-line growth still sits above industry averages.

- Investors debating the sustainability of premium valuation will find that margin compression has not slowed the company’s high-quality earnings record. This reinforces the view that fundamentals remain strong despite recent headwinds.

Equity Dilution Emerges as a Watch Item

- The main flagged risk from the period was equity dilution, which can put pressure on earnings per share even as absolute profits rise.

- Critics highlight that, while headline profits are up 22% for the year, past equity issuance introduces questions about long-term shareholder returns.

- When companies issue new shares, it can dilute ownership and make it harder for per-share figures to keep pace with profit gains.

- Bears argue this risk could weigh on future upside, particularly in a climate where net margins have already come under slight pressure.

DCF Fair Value Puts Shares at a Discount

- GABC’s current share price of $40.22 remains well below the DCF fair value estimate of $74.90. This suggests the stock trades at a notable discount even as its Price-to-Earnings ratio appears lofty compared to peers.

- Notably, while shares look expensive on backward-looking metrics, analysts and fundamentals both point to high-quality earnings and attractive dividends as reasons that could justify re-rating closer to fair value.

- With revenue projected to rise 10.8% per year and current valuation metrics already pricing in some premium, the gap to DCF fair value highlights ongoing tension between near-term concerns and longer-term growth potential.

- Investors watching for a catalyst might point to sustained outperformance versus the sector as a driver for closing the valuation gap.

See our latest analysis for German American Bancorp.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on German American Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While German American Bancorp continues to deliver impressive earnings growth, its modest margin compression and risk of equity dilution raise questions about the long-term consistency of shareholder returns.

If steady performance matters most to you, use stable growth stocks screener (2116 results) to focus on companies showing reliable revenue growth and consistent profitability through all types of market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GABC

German American Bancorp

Operates as a financial holding company for German American Bank that provides retail and commercial banking, and health management services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)