- United States

- /

- Banks

- /

- NasdaqGS:GABC

German American Bancorp (GABC): Assessing Valuation as Fundamentals Signal Strong Capital Growth and Market Share Potential

Reviewed by Simply Wall St

German American Bancorp (GABC) is drawing attention after recent commentary underscored its strong net interest income growth along with expectations for a pickup in tangible book value per share. These trends suggest the bank is effectively building capital and securing greater market share, sparking interest among market watchers.

See our latest analysis for German American Bancorp.

German American Bancorp’s share price has dipped slightly over the past month but remains resilient. Its 1-year total shareholder return highlights the bank’s underlying long-term strength even as short-term volatility persists.

If the solid foundation at German American Bancorp has you thinking more broadly about opportunity, now’s a good time to discover fast growing stocks with high insider ownership

The question now is whether German American Bancorp’s fundamentals indicate that the stock remains undervalued, or if the market has already accounted for this growth, leaving little room for further upside. Is there still a buying opportunity?

Price-to-Earnings of 16.8x: Is it justified?

German American Bancorp’s current price-to-earnings ratio stands at 16.8x, which signals the market values the stock higher than both the US Banks industry average and its peer group despite recent price weakness.

The price-to-earnings ratio (often called the P/E ratio) measures how much investors are willing to pay today for each dollar of earnings. For banks, this multiple reflects expectations of future profitability, growth, and the stability of earnings.

With GABC’s P/E ratio notably above the US Banks industry average of 11.3x and above the peer average of 12.5x, shares appear expensive. The multiple sits above the estimated fair P/E ratio of 14.3x, suggesting the share price could be pressured if market expectations realign closer to industry norms or to our calculated fair ratio.

Explore the SWS fair ratio for German American Bancorp

Result: Price-to-Earnings of 16.8x (OVERVALUED)

However, continued earnings volatility or a change in loan demand could challenge the optimistic outlook for German American Bancorp’s future growth trajectory.

Find out about the key risks to this German American Bancorp narrative.

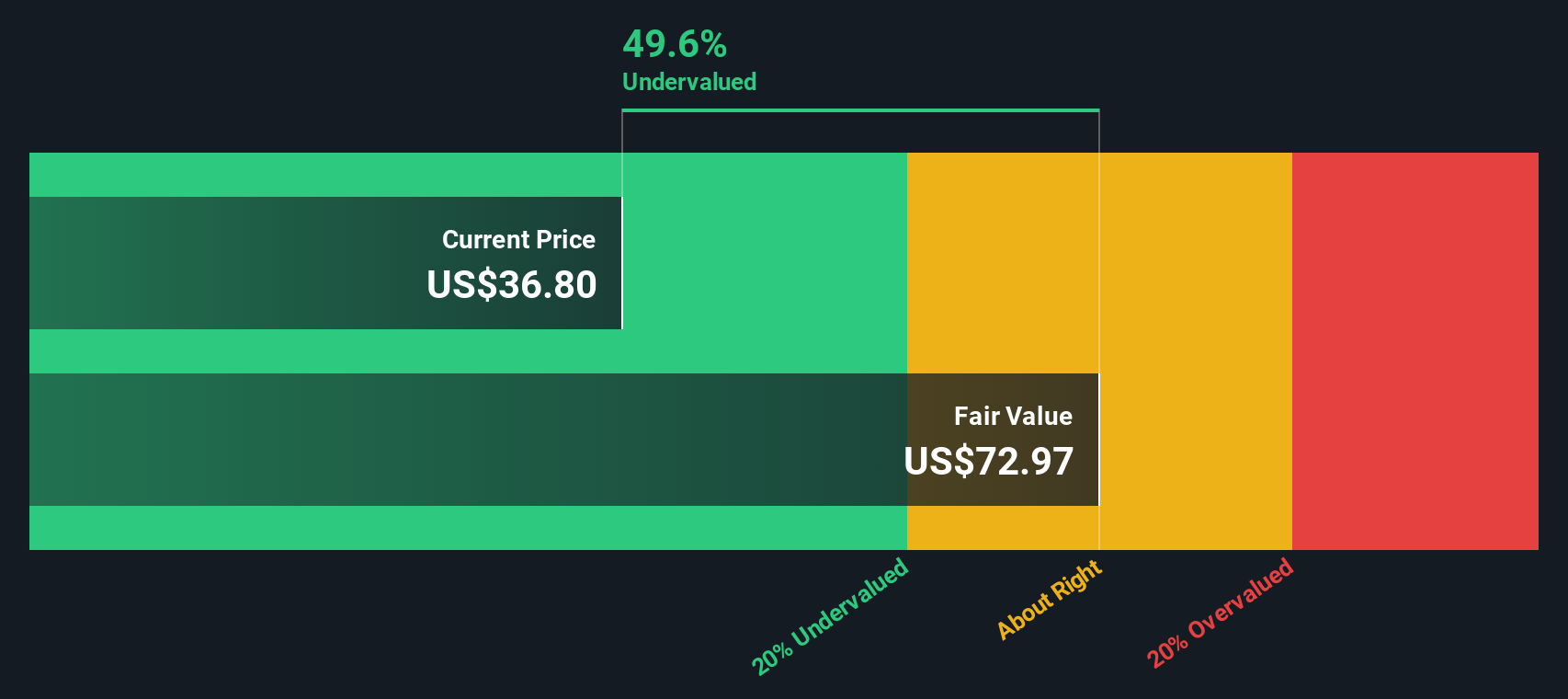

Another View: Discounted Cash Flow Analysis

While German American Bancorp appears expensive based on earnings multiples, the SWS DCF model presents a very different perspective. According to our DCF analysis, the stock is trading at a substantial 45.5% discount to its estimated fair value of $70.85. This suggests potential upside if those assumptions prove accurate. Which valuation should investors refer to when considering their next steps?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out German American Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own German American Bancorp Narrative

Exploring the numbers for yourself can reveal a new angle or help you shape a story that fits your analysis and outlook. Do it your way

A great starting point for your German American Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Next-level opportunities are waiting. Don’t miss your shot to find exceptional stocks that could boost your portfolio and match your investing style quickly.

- Tap into strong yield potential by checking out these 17 dividend stocks with yields > 3%, featuring reliable payouts exceeding 3% for steady income growth.

- Spot game-changing firms in artificial intelligence when you access these 27 AI penny stocks, transforming tomorrow’s industries with powerful technologies.

- Unlock future giants with these 3573 penny stocks with strong financials, offering surprising financial strength and significant upside in overlooked corners of the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GABC

German American Bancorp

Operates as a financial holding company for German American Bank that provides retail and commercial banking, and health management services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives