- United States

- /

- Banks

- /

- NasdaqGM:FMBH

First Mid Bancshares (FMBH) Profit Margins Surpass Expectations, Undercutting Skeptic Narratives on Regional Banks

Reviewed by Simply Wall St

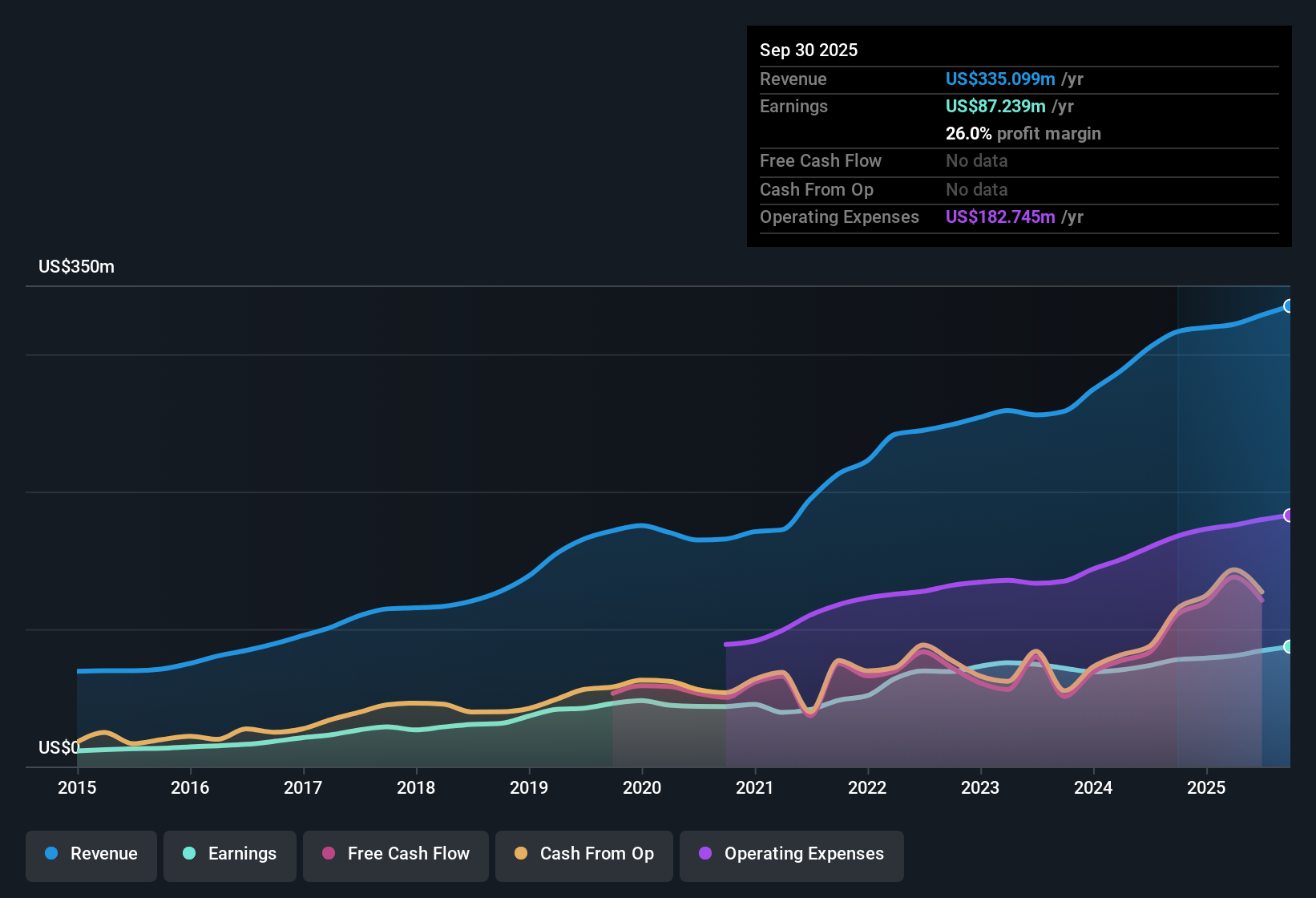

First Mid Bancshares (FMBH) delivered earnings growth of 14.7% over the past year, outpacing its five-year average of 13.6%. Net profit margins widened to 25.7%, up from 24.1% a year ago. Earnings are now forecast to grow at 16.8% annually, ahead of the expected 15.7% US market average. With shares trading at $35.2, below both peer price-to-earnings ratios and an estimated fair value of $76.85, these results point to improving profitability and a compelling value setup for investors.

See our full analysis for First Mid Bancshares.Now let’s see how the numbers measure up against the key market narratives. Some assumptions are bound to be reinforced, while others may be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Hit 25.7% High

- Net profit margins climbed to 25.7%, compared to last year's 24.1%, indicating that First Mid Bancshares is retaining a larger share of revenue as profit than before.

- Strong margin momentum strongly supports the argument that FMBH has become a more efficient operator, especially since this expansion occurs alongside consistent annual earnings growth of 14.7%.

- What is noteworthy is that this improved profitability comes at a time when the average US market earnings growth is lower at 15.7%, highlighting FMBH’s operating edge.

- Critics often expect margin erosion in challenging environments, but these results run counter to typical concerns about regional bank cost pressures.

Share Price Sits Far Below DCF Fair Value

- At $35.20 per share, FMBH trades well beneath its DCF fair value of $76.85 and also below analyst price targets at $45.29.

- The sizable valuation gap directly challenges the view that FMBH is already fully priced, with several data points reinforcing the idea of untapped upside.

- With price-to-earnings multiples at just 10x compared to peer averages of 12.2x and the broader US banks industry at 11x, bullish investors would argue the market is underappreciating the company’s profitability.

- Rather than suggesting the stock is overbought after its recent growth run, these valuation metrics point to continued room for re-rating if performance persists.

Dividend Sustainability the Only Named Risk

- Despite positive trends elsewhere, the main identified risk for FMBH focuses on dividend sustainability as highlighted in risk disclosures, but no additional major threats were flagged this cycle.

- This narrow risk profile suggests that for now, broader concerns such as credit losses or regulatory setbacks are not in play.

- The market appears to reward this stability, with share price and multiples remaining attractive despite investor caution around dividends.

- While sector-wide headwinds often spark more red flags for regional banks, FMBH’s limited risk commentary stands out as a potential advantage.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Mid Bancshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While First Mid Bancshares excels in growth and margins, its single biggest concern remains around dividend sustainability, with no clear assurances for income-focused investors.

If reliability matters to you, check out these 2003 dividend stocks with yields > 3% to discover companies offering more robust yields and a stronger track record of supporting their payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FMBH

First Mid Bancshares

A financial holding company, provides community banking products and services to commercial, retail, and agricultural customers in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives