- United States

- /

- Banks

- /

- NasdaqGS:FIBK

Evaluating First Interstate BancSystem (FIBK) Valuation Following Strong Q3 Results and Shareholder Initiatives

Reviewed by Simply Wall St

First Interstate BancSystem (FIBK) just wrapped up a strong third quarter, reporting year-over-year growth in both net income and net interest income. The bank's improved credit quality and completion of its share repurchase program help round out the positive news for investors.

See our latest analysis for First Interstate BancSystem.

On the back of its upbeat earnings and shareholder-friendly moves, First Interstate BancSystem’s share price has gained 6.8% over the past month, contributing to a modest year-to-date rise. While recent results sparked more optimism, the company’s one-year total shareholder return stands at just 2.3%, highlighting steady but not spectacular momentum when viewed in a longer-term context.

If buybacks and growing returns have you thinking bigger picture, now could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up nearly 7% over the past month and recent fundamentals showing improvement, the key question now is whether First Interstate BancSystem remains undervalued or if the market is already factoring in all its future growth potential.

Most Popular Narrative: 8% Undervalued

First Interstate BancSystem’s most widely held narrative indicates the stock trades meaningfully below its fair value estimate of $35.25, with the last close at $32.42. Investors are weighing the upside potential against price targets, and recent improvements in performance may influence this outlook further.

Strong capital and liquidity levels, further enhanced by the Arizona and Kansas branch transaction, give the company multiple options for value creation. For example, share repurchases, organic investment, or future M&A can increase flexibility to support shareholder returns and earnings growth through 2026 and beyond.

Want to understand what's driving this bullish case? This narrative relies on a combination of ambitious profit margin expansion and optimistic earnings projections. Can these forecasts justify the aggressive valuation? Find out how optimistic assumptions about future earnings could reshape what investors consider “fair value.”

Result: Fair Value of $35.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in loan balances and rising asset quality concerns could quickly undermine the optimistic outlook. This is reflected in current price targets.

Find out about the key risks to this First Interstate BancSystem narrative.

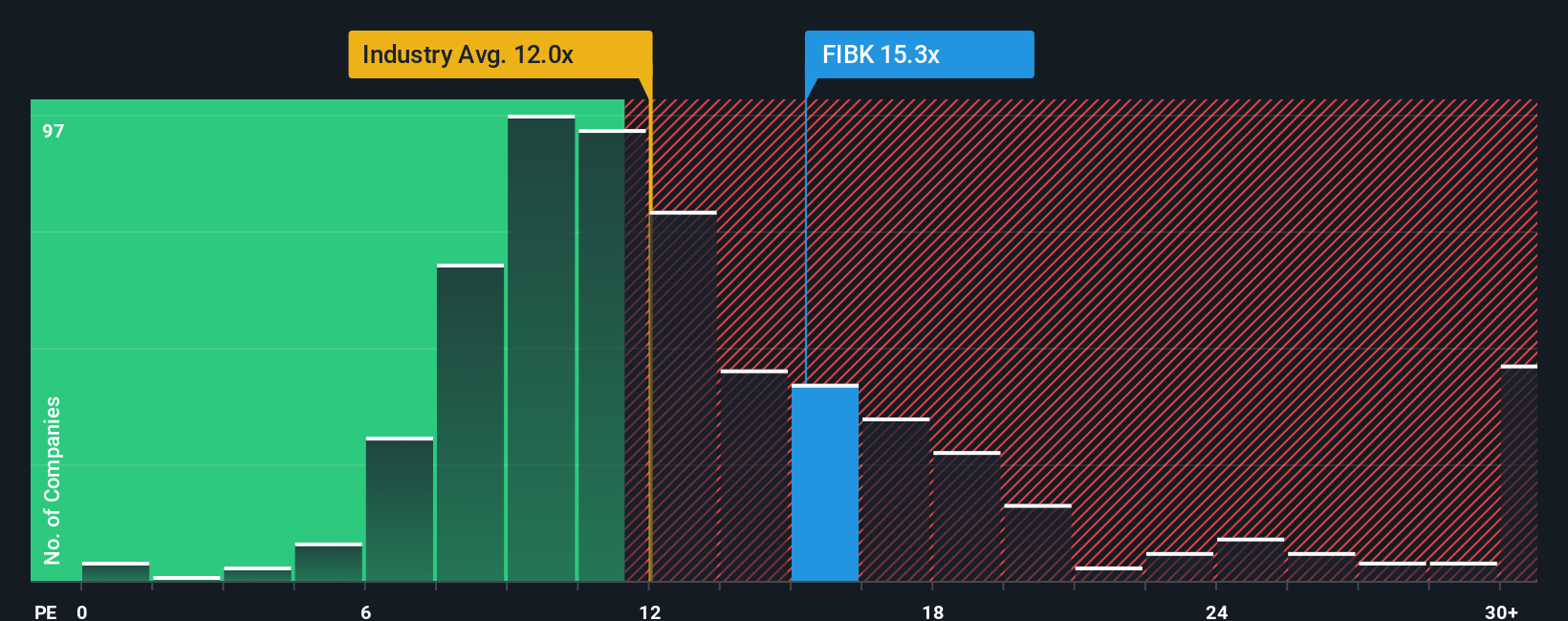

Another View: Multiple-Based Valuation

Looking at where First Interstate BancSystem trades versus similar banks, its price-to-earnings ratio of 13.6x is higher than both peer (12.8x) and US Banks industry (11.2x) averages. While it offers better value compared to its fair ratio of 14.8x, this gap hints at some downside risk if profitability expectations fall. Could the market be too optimistic, or is a re-rating possible?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Interstate BancSystem Narrative

If you think the story could unfold differently, or want to dive deeper into the numbers yourself, you can craft your own perspective in just a few minutes: Do it your way

A great starting point for your First Interstate BancSystem research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip by while others pounce on the next winning trend. Keep your portfolio one step ahead with these smart places to start:

- Spot tomorrow’s trends early by checking out these 25 AI penny stocks, built to shape the future with advances in automation and human-machine collaboration.

- Unlock high potential value with these 855 undervalued stocks based on cash flows, screened for robust cash flows and resilient business models that may be flying under Wall Street’s radar.

- Boost your passive income strategy and secure yields over 3% with these 15 dividend stocks with yields > 3%, focused on reliable payers delivering consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives