- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Clínica Baviera And 2 Other High-Quality Dividend Stocks

Reviewed by Simply Wall St

As global markets experience a mix of highs and lows, with U.S. indices reaching record levels amid the onset of earnings season, investors are navigating a landscape marked by modest inflation surprises and shifting central bank policies. Amidst this backdrop, dividend stocks remain an attractive option for those seeking consistent income streams; these stocks often demonstrate resilience through market fluctuations by providing regular payouts to shareholders.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.40% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.59% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.79% | ★★★★★★ |

Click here to see the full list of 2028 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics with a market cap of €630.90 million.

Operations: Clínica Baviera generates its revenue primarily from its ophthalmology clinics, with a total revenue of €243.31 million.

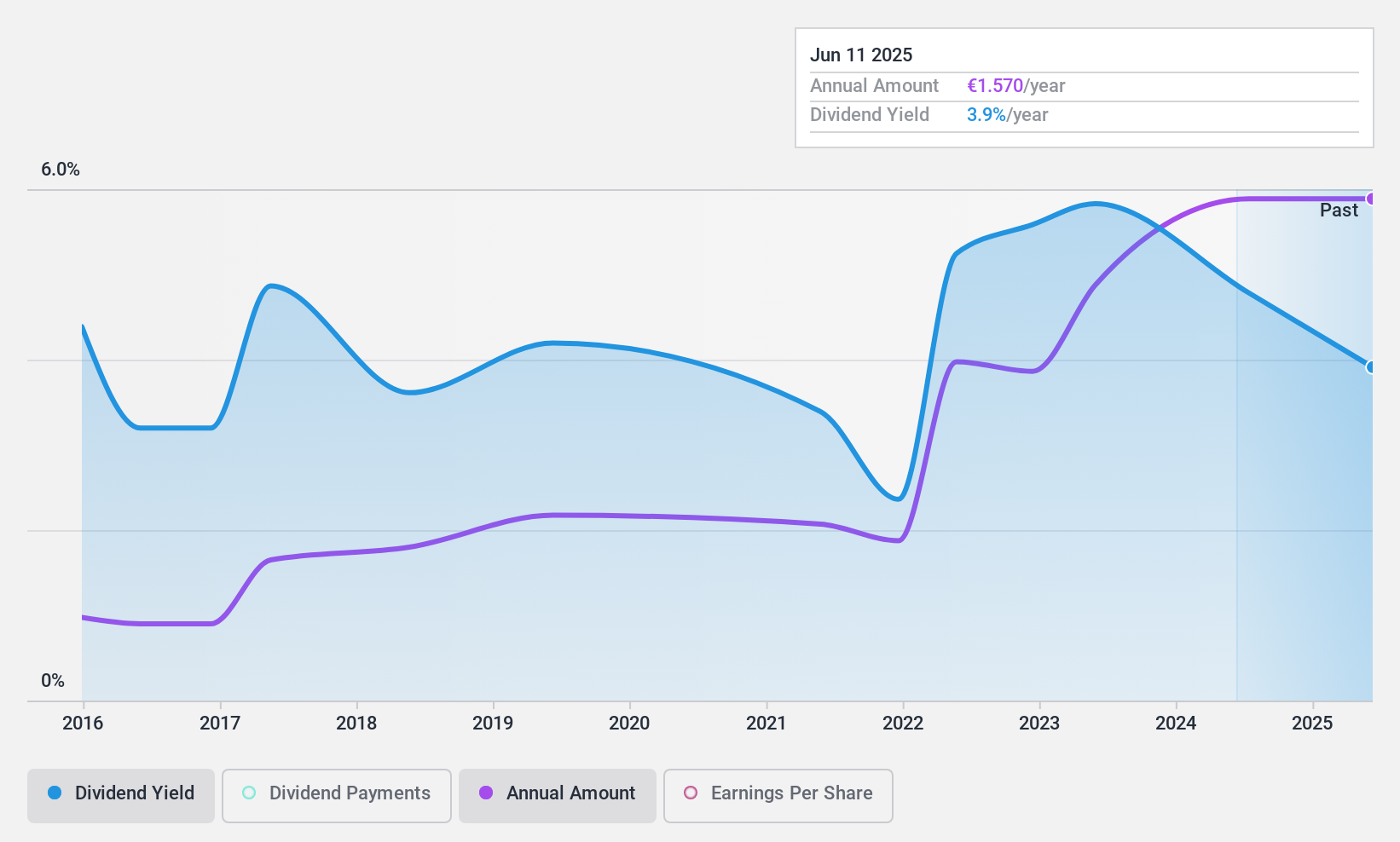

Dividend Yield: 4.1%

Clínica Baviera's dividend payments, though covered by earnings and cash flows with payout ratios of 66.6% and 65.5%, respectively, have been volatile over the past decade. Despite recent earnings growth of EUR 23.43 million for H1 2024, the dividend yield remains below top-tier levels in Spain at 4.06%. The stock trades significantly below its estimated fair value but has experienced high share price volatility recently, raising concerns about stability for income-focused investors.

- Get an in-depth perspective on Clínica Baviera's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Clínica Baviera is priced lower than what may be justified by its financials.

Carreras (JMSE:CAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carreras Limited markets and distributes cigarettes primarily in Jamaica, with a market cap of JMD55.58 billion.

Operations: Carreras Limited generates revenue of JMD17.94 billion from its cigarette marketing and distribution operations in Jamaica.

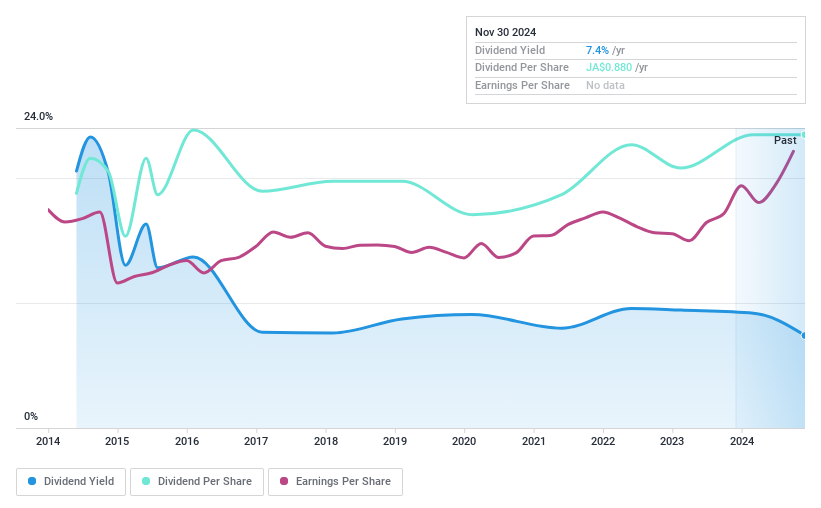

Dividend Yield: 7.7%

Carreras offers a high dividend yield, ranking in the top 25% of Jamaican payers, but sustainability is questionable due to a payout ratio of 162.3%, not covered by earnings. Despite recent earnings growth and stable cash flow coverage at an 89% cash payout ratio, dividends have been unreliable and volatile over the past decade. Recent financials show increased Q2 net income to J$1.41 billion from J$1.05 billion year-over-year, indicating some positive momentum.

- Click to explore a detailed breakdown of our findings in Carreras' dividend report.

- In light of our recent valuation report, it seems possible that Carreras is trading behind its estimated value.

First Interstate BancSystem (NasdaqGS:FIBK)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Interstate BancSystem, Inc. is a bank holding company for First Interstate Bank, offering a range of banking products and services in the United States with a market cap of $3.40 billion.

Operations: First Interstate BancSystem, Inc. generates revenue primarily through its Community Banking segment, which accounts for $974.90 million.

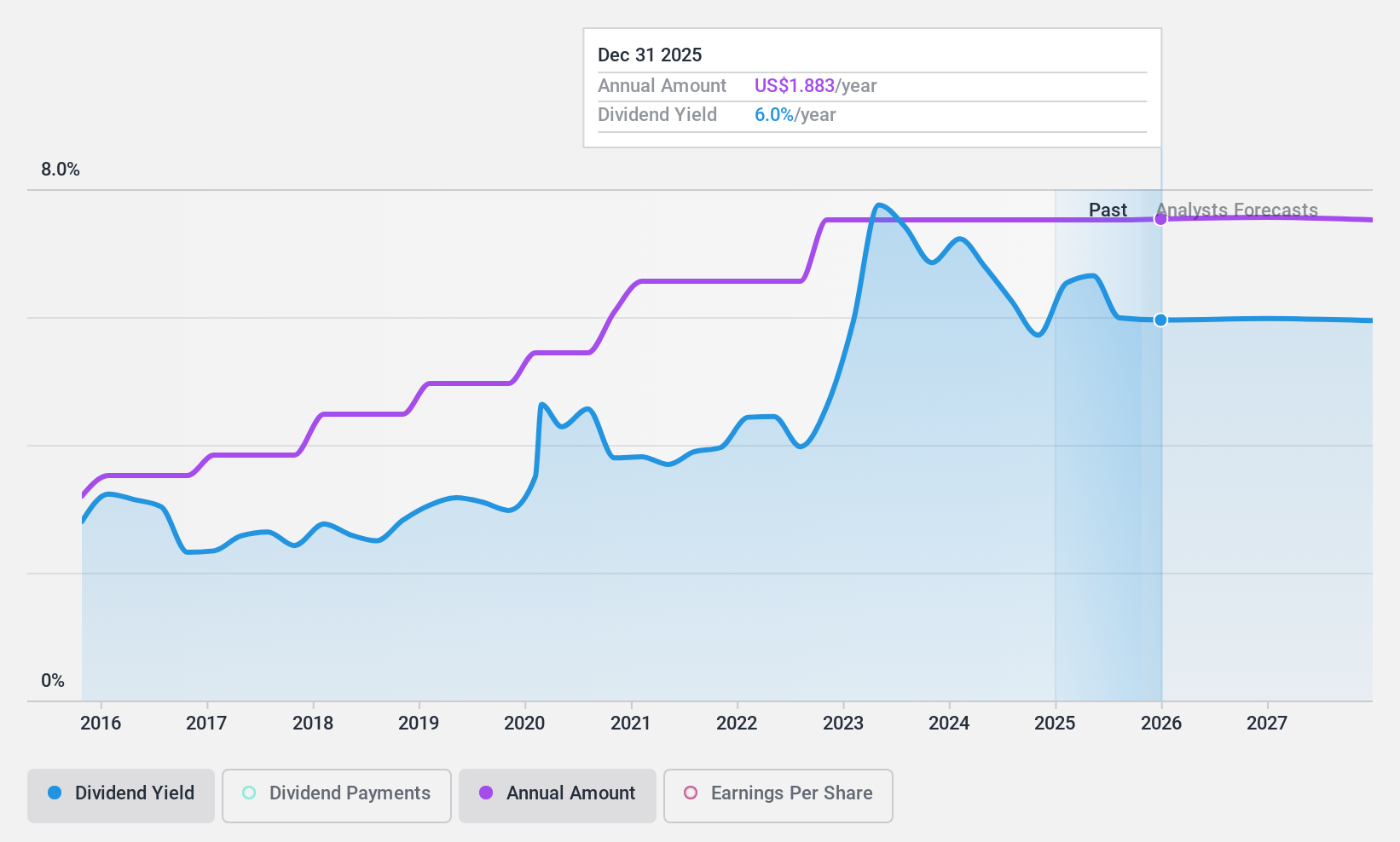

Dividend Yield: 5.7%

First Interstate BancSystem provides a high and stable dividend yield of 5.72%, placing it in the top 25% of US dividend payers. Its dividends are currently covered by earnings with a payout ratio of 76.9%, expected to remain sustainable at 74.9% in three years. Despite recent insider selling, dividends have been reliable over the past decade, supported by consistent payments and growth, although recent earnings showed a decline in net income to US$60 million from US$67 million year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of First Interstate BancSystem.

- Our comprehensive valuation report raises the possibility that First Interstate BancSystem is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Explore the 2028 names from our Top Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics.

Solid track record with excellent balance sheet and pays a dividend.