- United States

- /

- Banks

- /

- NasdaqGS:EWBC

East West Bancorp (EWBC): Valuation Insights Following Strong Q3 Earnings and Fresh Analyst Support

Reviewed by Simply Wall St

East West Bancorp (EWBC) recently posted third-quarter results that beat expectations on both earnings per share and revenue, which has sparked attention from investors. The upbeat performance and analyst support are fueling fresh interest in the stock.

See our latest analysis for East West Bancorp.

Strong third-quarter results have helped drive positive momentum for East West Bancorp, with the share price up over 11% year-to-date. The company’s three- and five-year total shareholder returns of 67% and 174% respectively stand out in the sector. This suggests both robust long-term growth potential and rising confidence among investors, even as some insider selling has emerged in recent months.

If this kind of performance has you looking for other high-conviction ideas beyond banks, now’s a perfect moment to explore fast growing stocks with high insider ownership.

With the shares trading at a noticeable discount to analyst price targets, despite standout quarterly growth, investors must consider whether East West Bancorp remains undervalued or if the market has already priced in its future gains.

Most Popular Narrative: 15.9% Undervalued

East West Bancorp’s most-followed narrative sees the fair value at $125.20, well above the recent close of $105.35, hinting at further upside if expectations are met. This fair value is built on detailed projections for growth and profitability, setting up an intriguing backdrop for the valuation case.

Sustained investments in digital banking, automation, and technology in areas such as mobile, cybersecurity, and operational efficiency allow for scalable growth and improve the efficiency ratio, supporting higher net margins and long-term cost containment.

Want to discover what makes this valuation tick? The narrative hints at aggressive assumptions about digital leadership and operational advances. Which forward-looking numbers propel the target price sky-high? Click to see the full playbook. These projections could be a real surprise.

Result: Fair Value of $125.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to commercial real estate and rising regulatory costs could present challenges for East West Bancorp’s profit trajectory if sector headwinds deepen.

Find out about the key risks to this East West Bancorp narrative.

Another View: What Do Market Multiples Suggest?

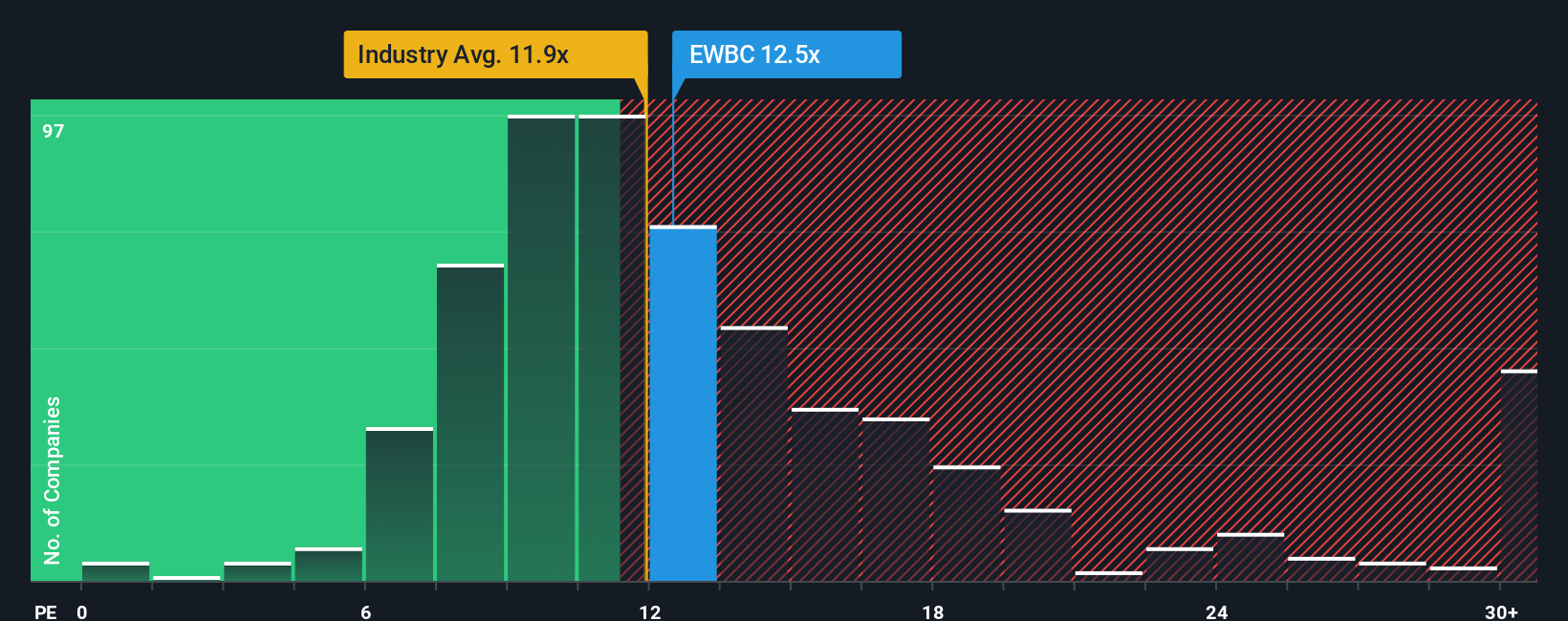

Looking through a different lens, East West Bancorp is trading at a price-to-earnings ratio of 11.5x, just a notch above the US Banks industry average (11.2x) and in line with peers (11.7x). However, it is still slightly below the fair ratio of 12.1x, suggesting some room for upside but also signaling that investors are not giving EWBC a large valuation premium. Does this muted reaction mean the market is still uncertain about the company's future trajectory?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own East West Bancorp Narrative

If you prefer to interpret the numbers differently or want to dig into the details yourself, you can build your own perspective in under three minutes, and Do it your way.

A great starting point for your East West Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Skip the guesswork and boost your investment game by targeting stocks with powerful growth stories, industry disruption, and future-ready fundamentals in just a few clicks.

- Unlock tomorrow’s potential by spotting game-changing tech with these 27 AI penny stocks, which is shaping everything from automation to artificial intelligence innovation.

- Start building a resilient income stream as you scan for reliable yields with these 14 dividend stocks with yields > 3%, featuring stocks offering more than 3% returns.

- Position yourself at the forefront of digital finance by tracking these 82 cryptocurrency and blockchain stocks, which stands out in cryptocurrency adoption and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if East West Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EWBC

East West Bancorp

Operates as the bank holding company for East West Bank that provides a range of personal and commercial banking services to businesses and individuals in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives